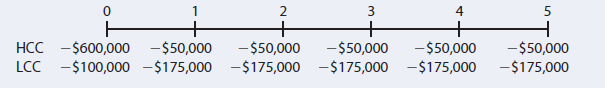

Kim Inc. must install

a new air conditioning unit in its main plant. Kim must install one or the other of the

units; otherwise, the highly profitable plant would have to shut down. Two units are

available, HCC and LCC (for high and low capital costs, respectively). HCC has a high

capital cost but relatively low operating costs, while LCC has a low capital cost but

higher operating costs because it uses more electricity. The costs of the units are shown

here. Kim’s WACC is 7%.

a. Which unit would you recommend? Explain.

b. If Kim’s controller wanted to know the IRRs of the two projects, what would you tell

him?

c. If the WACC rose to 15%, would this affect your recommendation? Explain your answer

and the reason this result occurred.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps