a. Assume Almoyed Corporation has no alternative use for the facilities that are now being used to produce of the B345 gaskets. If the outside supplier offers to sell the gaskets for $0.46 each, what would be the financial advantage (disadvantage) of buy 100,000 B345 gaskets from the outside supplier? b. should Almoyed Corporation accept the offer? Why? c. Assume that Almoyed Corporation could use the facilities that are now being used to produce the B345 gaskets to expand production of another product that would yield an additional contribution margin of S10,000 annually. Given this new assumption, what would the financial advantage (disadvantage) of buying 100,000 B345 gaskets from the outside supplier? d. Based on the new assumption in requirement (c), What is the maximum price Almoyed Corporation should be willing to pay the outside supplier for B345 gaskets? Fully support your answer with appropriate calculations.

a. Assume Almoyed Corporation has no alternative use for the facilities that are now being used to produce of the B345 gaskets. If the outside supplier offers to sell the gaskets for $0.46 each, what would be the financial advantage (disadvantage) of buy 100,000 B345 gaskets from the outside supplier? b. should Almoyed Corporation accept the offer? Why? c. Assume that Almoyed Corporation could use the facilities that are now being used to produce the B345 gaskets to expand production of another product that would yield an additional contribution margin of S10,000 annually. Given this new assumption, what would the financial advantage (disadvantage) of buying 100,000 B345 gaskets from the outside supplier? d. Based on the new assumption in requirement (c), What is the maximum price Almoyed Corporation should be willing to pay the outside supplier for B345 gaskets? Fully support your answer with appropriate calculations.

Chapter5: Process Costing

Section: Chapter Questions

Problem 2PB: The following product costs are available for Kellee Company on the production of eyeglass frames:...

Related questions

Question

100%

Transcribed Image Text:Remaining Time: 34 minutes, 25 seconds.

A Question Completion Status:

1

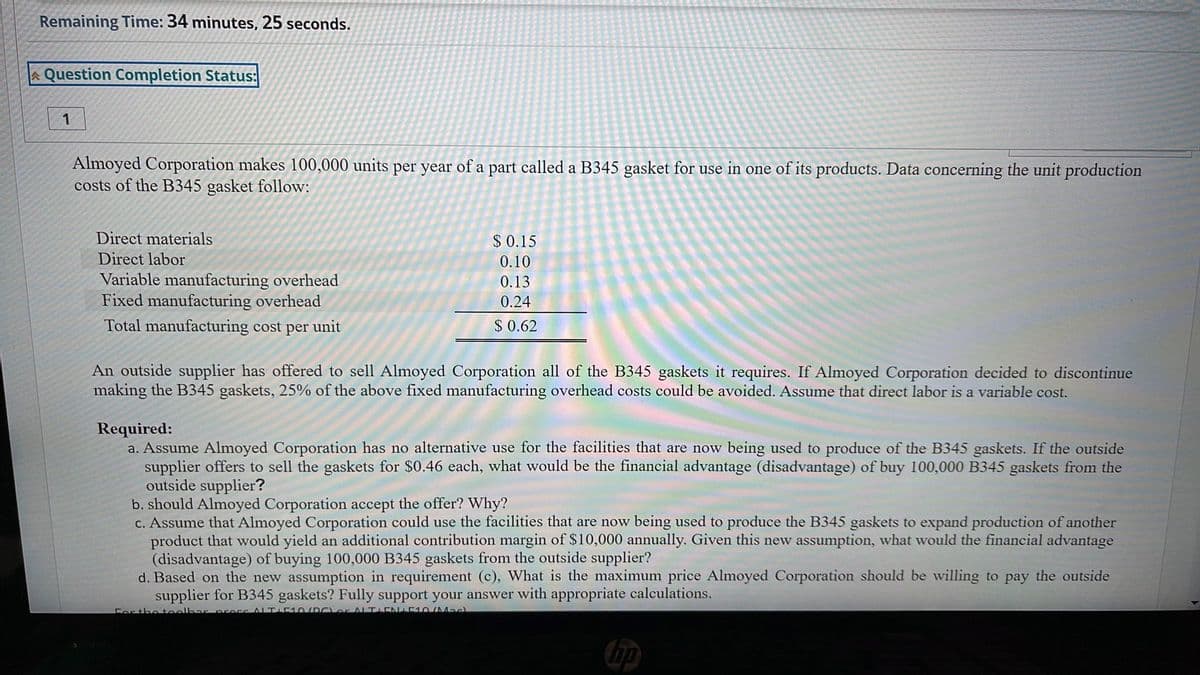

Almoyed Corporation makes 100,000 units per year of a part called a B345 gasket for use in one of its products. Data concerning the unit production

costs of the B345 gasket follow:

Direct materials

$ 0.15

Direct labor

0.10

Variable manufacturing overhead

Fixed manufacturing overhead

0.13

0.24

Total manufacturing cost per unit

$ 0.62

An outside supplier has offered to sell Almoyed Corporation all of the B345 gaskets it requires. If Almoyed Corporation decided to discontinue

making the B345 gaskets, 25% of the above fixed manufacturing overhead costs could be avoided. Assume that direct labor is a variable cost.

Required:

a. Assume Almoyed Corporation has no alternative use for the facilities that are now being used to produce of the B345 gaskets. If the outside

supplier offers to sell the gaskets for $0.46 each, what would be the financial advantage (disadvantage) of buy 100,000 B345 gaskets from the

outside supplier?

b. should Almoyed Corporation accept the offer? Why?

c. Assume that Almoyed Corporation could use the facilities that are now being used to produce the B345 gaskets to expand production of another

product that would yield an additional contribution margin of $10,000 annually. Given this new assumption, what would the financial advantage

(disadvantage) of buying 100,000 B345 gaskets from the outside supplier?

d. Based on the new assumption in requirement (c), What is the maximum price Almoyed Corporation should be willing to pay the outside

supplier for B345 gaskets? Fully support your answer with appropriate calculations.

For theteolha preccALTI510/RCLo ALTIENLE10/Mac

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub