Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Current Liabilities And Payroll

Section: Chapter Questions

Problem 10.23EX

Related questions

Question

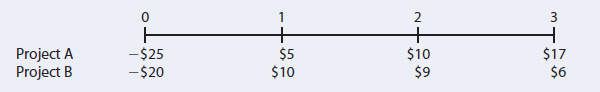

Your division is considering two projects with the following cash flows (in

millions):

a. What are the projects’ NPVs assuming the WACC is 5%? 10%? 15%?

b. What are the projects’

c. If the WACC was 5% and A and B were mutually exclusive, which project would you

choose? What if the WACC was 10%? 15%? (Hint: The crossover rate is 7.81%.)

Transcribed Image Text:2

3

Project A

Project B

+

$10

$9

-$25

$5

$10

$17

$6

-$20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning