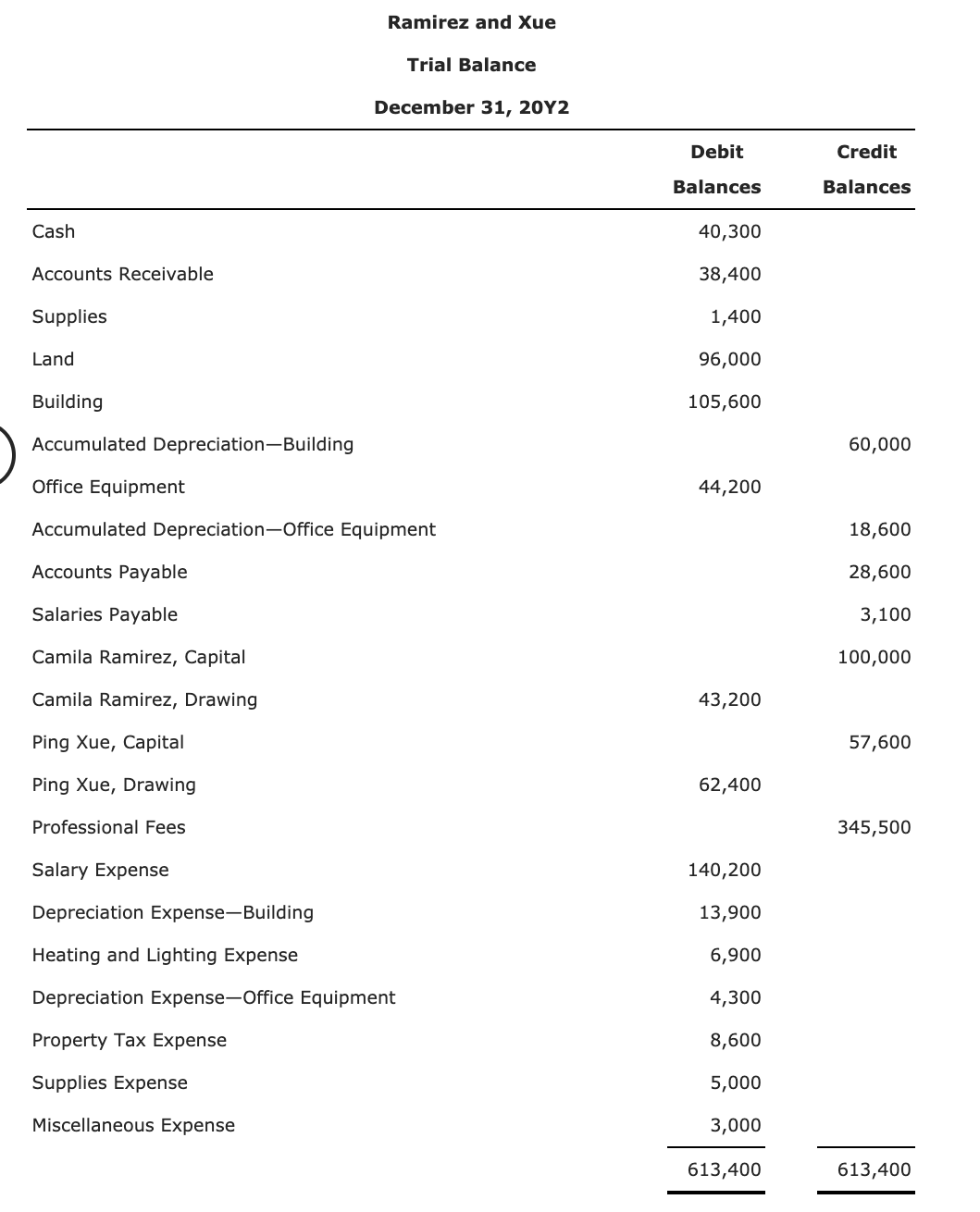

ccounts Receivable 38,400 upplies 1,400 and 96,000 uilding 105,600 ccumulated Depreciation-Building ffice Equipment 44,200 ccumulated Depreciation-Office Equipment ccounts Payable alaries Payable amila Ramirez, Capital amila Ramirez, Drawing 43,200 ing Xue, Capital ing Xue, Drawing 62,400 rofessional Fees alary Expense 140,200 epreciation Expense-Building 13,900 leating and Lighting Expense 6,900 epreciation Expense-Office Equipment 4,300 roperty Tax Expense 8,600

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

The balance in Xue's capital account includes an additional investment of $10,000 made on May 5, 20Y2.

Instructions:

1. Prepare an income statement for 20Y2, indicating the division of net income. The

2. prepare a statement of partnership equity for 20Y2.

3. Prepare a balance sheet as of the end of 20Y2.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps