ACCOUNT Common Stock, 540 par ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 1 2 30,000 shares issued for cash 4,800,000 6,000,000 Jan. Balance, 120,000 shares Apr. 1,200,000 June 30 5% stock dividend 300,000 6,300,000 ACCOUNT Paid-in Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Balance 360,000 1,080,000 Jan. 2 30,000 shares issued for cash 30 Stock dividend Apr. 720,000 June 150,000 1,230,000 ACCOUNT Retained Earmings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. Balance 2,000,000 1,550,000 1,235,000 June 30 Stock dividend 450,000 315,000 Dec. 30 Cash dividend 31 Net income 1,000,000 2,235,000

ACCOUNT Common Stock, 540 par ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 1 2 30,000 shares issued for cash 4,800,000 6,000,000 Jan. Balance, 120,000 shares Apr. 1,200,000 June 30 5% stock dividend 300,000 6,300,000 ACCOUNT Paid-in Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Balance 360,000 1,080,000 Jan. 2 30,000 shares issued for cash 30 Stock dividend Apr. 720,000 June 150,000 1,230,000 ACCOUNT Retained Earmings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. Balance 2,000,000 1,550,000 1,235,000 June 30 Stock dividend 450,000 315,000 Dec. 30 Cash dividend 31 Net income 1,000,000 2,235,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 5MCQ

Related questions

Question

Reporting

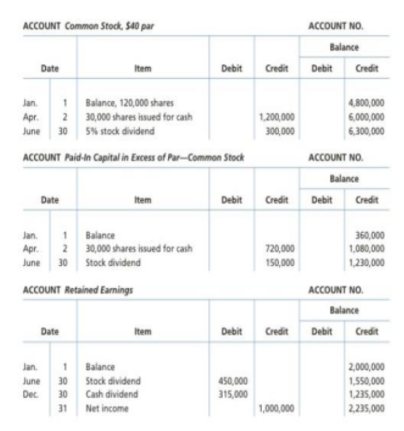

On the basis of the following stockholders' equity accounts, indicate the

items, exclusive of net income, to be reported on the statement of cash

flows. There were no unpaid dividends at either the beginning or the

end of the year.

Transcribed Image Text:ACCOUNT Common Stock, 540 par

ACCOUNT NO.

Balance

Date

Item

Debit Credit

Debit

Credit

1

2 30,000 shares issued for cash

4,800,000

6,000,000

Jan.

Balance, 120,000 shares

Apr.

1,200,000

June

30 5% stock dividend

300,000

6,300,000

ACCOUNT Paid-in Capital in Excess of Par-Common Stock

ACCOUNT NO.

Balance

Date

Item

Debit

Credit

Debit

Credit

Balance

360,000

1,080,000

Jan.

2 30,000 shares issued for cash

30 Stock dividend

Apr.

720,000

June

150,000

1,230,000

ACCOUNT Retained Earmings

ACCOUNT NO.

Balance

Date

Item

Debit Credit

Debit

Credit

Jan.

Balance

2,000,000

1,550,000

1,235,000

June

30

Stock dividend

450,000

315,000

Dec.

30

Cash dividend

31

Net income

1,000,000

2,235,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning