Entries for Bonds Payable, including bond redemption The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year: Year 1 July 1. Issued $4,530,000 of five-year, 10% callable bonds dated July 1, Year 1, at a market (effective) rate of 11%, receiving cash of $4,359,272. Interest is payable semiannually on December 31 and June 30. Dec. 31. Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. Dec. 31. Closed the interest expense account. Year 2 June 30. Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. Dec. 31. Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. Dec. 31. Closed the interest expense account. Year 3 June 30. Recorded the redemption of the bonds, which were called at 98. The balance in the bond discount account is $102,436 after payment of interest and amortization of discount have been recorded. (Record the redemption only.)

Entries for Bonds Payable, including bond redemption The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year: Year 1 July 1. Issued $4,530,000 of five-year, 10% callable bonds dated July 1, Year 1, at a market (effective) rate of 11%, receiving cash of $4,359,272. Interest is payable semiannually on December 31 and June 30. Dec. 31. Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. Dec. 31. Closed the interest expense account. Year 2 June 30. Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. Dec. 31. Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. Dec. 31. Closed the interest expense account. Year 3 June 30. Recorded the redemption of the bonds, which were called at 98. The balance in the bond discount account is $102,436 after payment of interest and amortization of discount have been recorded. (Record the redemption only.)

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 11PB: Prepare journal entries to record the following transactions. Create a T-account for Unearned...

Related questions

Question

Entries for Bonds Payable, including bond redemption

The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year:

| Year 1 | |

| July 1. | Issued $4,530,000 of five-year, 10% callable bonds dated July 1, Year 1, at a market (effective) rate of 11%, receiving cash of $4,359,272. Interest is payable semiannually on December 31 and June 30. |

| Dec. 31. | Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. |

| Dec. 31. | Closed the interest expense account. |

| Year 2 | |

| June 30. | Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. |

| Dec. 31. | Paid the semiannual interest on the bonds. The bond discount amortization of $17,073 is combined with the semiannual interest payment. |

| Dec. 31. | Closed the interest expense account. |

| Year 3 | |

| June 30. | Recorded the redemption of the bonds, which were called at 98. The balance in the bond discount account is $102,436 after payment of interest and amortization of discount have been recorded. (Record the redemption only.) |

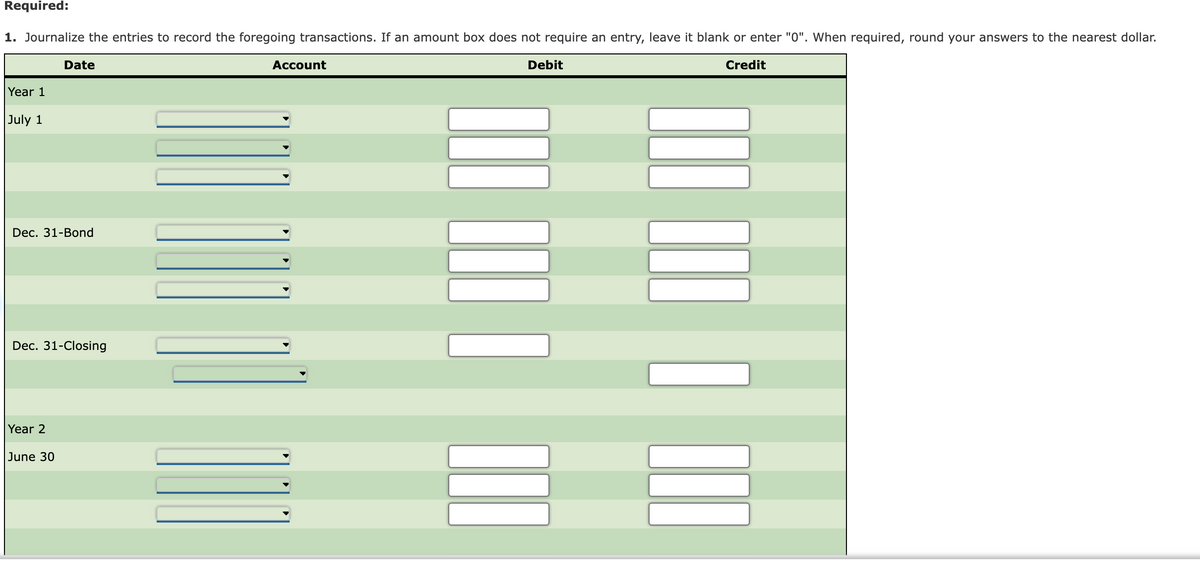

Transcribed Image Text:Required:

1. Journalize the entries to record the foregoing transactions. If an amount box does not require an entry, leave it blank or enter "0". When required, round your answers to the nearest dollar.

Date

Account

Debit

Credit

Year 1

July 1

Dec. 31-Bond

Dec. 31-Closing

Year 2

June 30

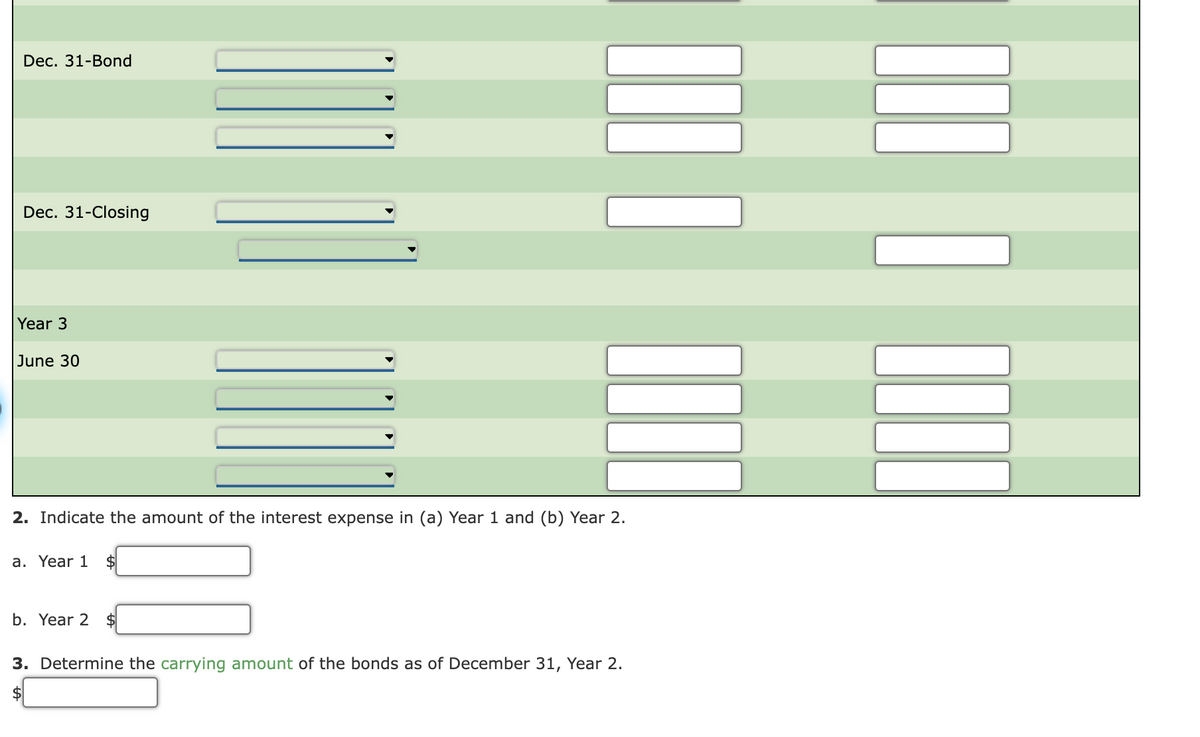

Transcribed Image Text:Dec. 31-Bond

Dec. 31-Closing

Year 3

June 30

2. Indicate the amount of the interest expense in (a) Year 1 and (b) Year 2.

a. Year 1

2$

b. Year 2

2$

3. Determine the carrying amount of the bonds as of December 31, Year 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning