Juan’s marginal tax rate was 15% in 2019 and 35% in 2021. b. Juan’s marginal tax rate was 35% in 2019 and 12% in 2021.

Juan’s marginal tax rate was 15% in 2019 and 35% in 2021. b. Juan’s marginal tax rate was 35% in 2019 and 12% in 2021.

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 55P

Related questions

Question

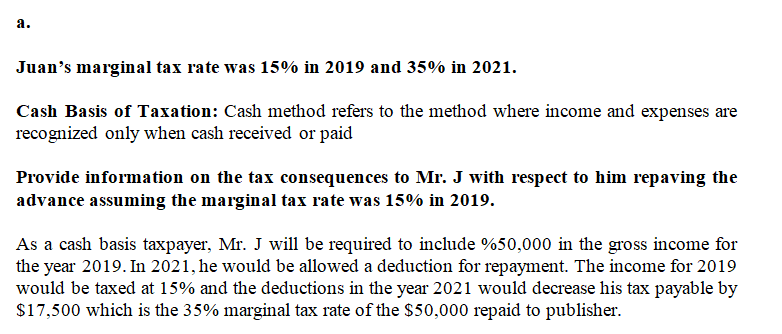

In 2019, Juan entered into a contract to write a book. The publisher advanced Juan $50,000, which was to be recovered out of future royalties. If the book was not completed by the end of 2020, however, Juan would be required to repay the publisher for the advance. Juan did not complete the book in 2020, and in accor- dance with the agreement, he repaid the $50,000 to the publisher in 2021. Juan is a cash basis taxpayer. What are the tax consequences to Juan of the repayment under the following assumptions?

a. Juan’s marginal tax rate was 15% in 2019 and 35% in 2021.

b. Juan’s marginal tax rate was 35% in 2019 and 12% in 2021.

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT