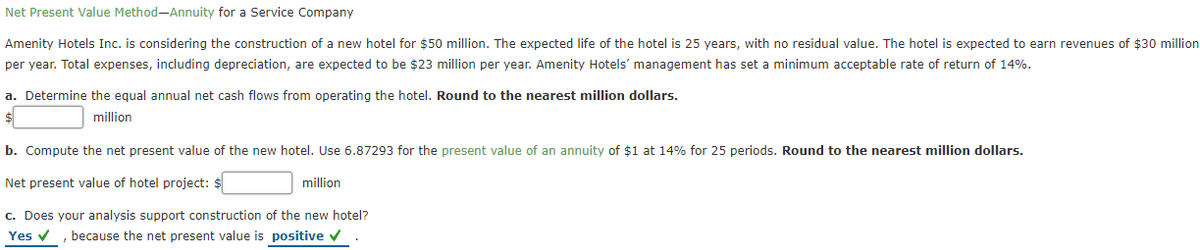

Net Present Value Method

Amenity Hotels Inc. is considering the construction of a new hotel for $50 million. The expected life of the hotel is 25 years, with no residual value. The hotel is expected to earn revenues of $30 million per year. Total expenses, including

a. Determine the equal annual net

$ ________ million

b. Compute the net present value of the new hotel. Use 6.87293 for the present value of an annuity of $1 at 14% for 25 periods. Round to the nearest million dollars.

Net present value of hotel project: $ _______ million

c. Does your analysis support construction of the new hotel?

Yes , because the net present value is positive .

Trending now

This is a popular solution!

Step by step

Solved in 5 steps