$ 10,000 $ 30,000 20,000 $ 50,000 Cash Accounts payable Notes payable to bank Receivables 50,000 Inventories 150,000 $210,000 90,000 $300,000 Total current liabilities Long-term debt Common equity Total liabilities and equity Total current assets 50,000 200,000 $300,000 Net fixed assets Total assets

Q: A firm wants to strengthen its financial position. Which of the following actions would increase its…

A: Here in this question, we are required to answer which of the option will increase current ratio.…

Q: You forecast that the company is going to reduce costs in the future, thus improve profit margin…

A: Here, Profit Margin Increases from 10% to 15% Asset Turnover Ratio is 0.5 Equity Multiplier is 1.5…

Q: A. Complete the Year 2 income statement data for Green Caterpillar, then answer the questions that…

A:

Q: Consider the following simplified financial statements for the Wims Corporation (assuming no income…

A: Pro forma Income Statement Sales ($25,000 * 112%) $28,000 Costs ($12,900 * 112%) $14,448 Net…

Q: Required information [The following information applies to the questions displayed below.] Shown…

A: In order to determine the net income earned during the year, the business entities prepare the…

Q: Increasing financial leverage increases both the cost of debt (rdebt) and the cost of equity…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Wayne, Inc., wishes to expand its facilities. The company currently has 6 million shares outstanding…

A: Calculation of New Book Value per share:

Q: Dubs & Co. has a debt ratio of 0.50, a total assets turnover of 0.25, and a profit margin of 10%.…

A: Current ROE= Profir Margin×Assets Turnover×Equity Multiplier10×0.25×2=5% Lets assets be 1so debt…

Q: Last year, K9 WebbWear, Inc. reported an ROE of 22 percent. The firm’s debt ratio was 50 percent,…

A: Total assets can be calculated as shown below.

Q: Revenue-based valuation for the valuation of an automotive company the reduced cash flow method will…

A: Risk free rate =10+2×0.1=10.2 Market return =18% Market risk premium =18-10.2=7.8% Market risk…

Q: Current and Quick Ratios The Nelson Company has $1,248,000 in current assets and $480,000 in…

A: Ratio analysis is the analysis of various financial figures in the financial statement of the…

Q: Lance Motors has current assets of $1.2 million. The company’s current ratio is 1.2, its quick ratio…

A: Compute the current Liabilities using the current ratio formula Curent ratio=Current AssetsCurrent…

Q: The Barnsdale Corporation has the following ratios: A0*/S0 = 1.6; L0*/S0 = 0.4; profit margin =…

A: Additional Funds needed (AFN): A company may need to raise funds needed for expansion when its…

Q: Profitability Ratios Meade Publications is a magazine publisher established in Southern California.…

A: Return on Equity Ratio: Return on Equity Ratio is a type of Profitability Ratio. It measures the…

Q: Pro forma balance sheet. Next year, California Cement Company will increase its plant, property,…

A: What is a balance sheet: It is the statement that shows the financial position of any company. It is…

Q: A firm has been experiencing low profitability in recent years. Perform an analysis of the firm's…

A: DuPont Analysis - It is a framework for analyzing fundamental performance originally popularized by…

Q: DuPONT ANALYSIS A firm has been experiencing low profitability in recent years. Perform an analysis…

A: Hi there, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Current Sales $18,900 $ 11,700 Debt $ 15,700 assets Costs 12,800 Fixed assets 26,500 Equity 22,500…

A: Internal growth rate = Retention ratio * Return on Equity Retention ratio = 1 - Dividend payout…

Q: Rowe and Company has a debt ratio of 0.50, a total assets turnover of 0.25, and a profit margin of…

A: Answer current ROE=profit margin×Asset turnover×Equity multiplier =10×0.25×2…

Q: Calculate Zumwalt’s net profit margin and debt ratio. Earth’s Best Company has sales of $200,000, a…

A: Given: The company sales is $200,000 The net income is $15,000 The data value is given below as,

Q: Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth…

A: Information in question: Sales last year = $ 1.6 millions Projected Sales this year =…

Q: For the most recent year, Robin Company reports operating income of $660,000. Robin's sales margin…

A: ROI = Sales margin x Capital turnover

Q: “Increasing financial leverage increases both the cost of debt (rdebt) and the cost of equity…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Du Pont Analysis. Keller Cosmetics maintains an operating profit margin of 5% and asset turnover…

A: Operating Profit Ratio = Operating Profit/ Net Sales*100It measures the income earned by operations…

Q: Problem 2. Last year Jullan Corp. had sales of P303,225, operating costs of P267,500, and year- end…

A: The return on equity(ROE) ratio provides insight to an investor about how efficiently the company is…

Q: Using the AFN formula approach, calculate the total assets of Harmon Photo Company given the…

A: Sales this year = $3,000 Increase in sales projected for next year = 20% Net income this year = $250…

Q: Net Income (NI) could be thought of as earnings available for dividends to equity shareholders,…

A: Sustainable growth rate is that rate at which a firm can expect to grow its operations in the long…

Q: The following is Firm Y's current statement of comprehensive income. If the firm is currently…

A: The question is multiple choice question Required Choose the Correct Option.

Q: Which of the following would occur

A: The mix of equity and debt in a business organization is known as the capital structure of the…

Q: JunJun & Co. has debt ratio of 0.50, a total asset turnover of 0.25 and a profit margin of 10%.…

A: Debt to Asset Ratio: Debt to asset ratio is the ratio that measures the relationship between total…

Q: RAEB Electronics produces stereo components that sell at P = $100 per unit. RAEB’s fixed costs are…

A: Break Even Point = Fixed Cost / Contribution per Unit Contribution per unit = Selling Price per -…

Q: A company begins with the following simple balance sheet: $10 million in real assets; $1 million…

A: leverage ratio is amount of debt company have more debt means more leverage ratios

Q: Tapley Dental Supply Company has the following data: Net income 240 Sales 10,000 Total assets 6,000…

A: Return on Equity would be considered as the net income incurred as part of the shareholders' equity.…

Q: RETURN ON EQUITY Central City Construction (CCC) needs $1 million of assets to get started, and it…

A: A company has several sources from where it can raise funds. It can issue equity shares and the…

Q: Current and Quick Ratios The Nelson Company has $1,125,000 in current assets and $450,000 in…

A: Current Ratio=Current AssetsCurrent Liabilities Given Current Assets=$1,125,000 Current…

Q: If higher debt forces the company’s managers to be more careful with shareholders’ money, what…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Profit margin = 9.1% Capital intensity ratio = .52 Debt-equity ratio = .67 Net income =…

A: Plow back ratio = 1 - Dividend / Net Income = 1- 50500 / 102000 =0.5049019608 = 50.49%

Q: (Financing decisions) Brussels Electronics, Inc, has total assets of $64 million and total debt of…

A: Brussels Electronic's debt ratio- = Total debt/ Total assets = $45/ $64 = 0.7031 or 70%

Q: Income Statement Balance Sheet Long-term debt 35,750 Fixed assets 68,550 Equity Current Sales…

A: In order to compute the sustainable growth rate, we first required to compute the ROE, which is:

Q: Beaker Company Income Statement Sales Less operating expenses Net operating income Less interest and…

A: Average operating assets: Average operating assets refer to those assets needed for the ongoing…

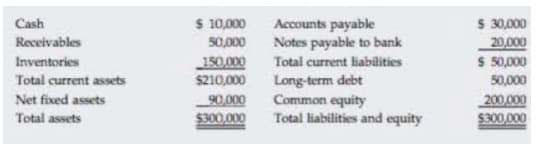

REFER IMAGE

The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 25×, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 25×); if the funds generated are used to reduce common equity (stock can be repurchased at book

value); and if no other changes occur, by how much will the ROE change? What will be the firm’s new quick ratio?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- What is CFF (Cash Flow Financing), given:Accounts Payable 100,000Accrued Expenses 50,000Increase in Bonds Payable 300,000Decrease in Equity 75,000Dividends Paid 80,000Accounts payable $509,000Notes payable $244,000Current liabilities $753,000Long-term debt $1,246,000Common equity $4,751,000Total liabilities and equity $6,750,000 What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm's new debt ratio?Accounts payable $466,000Notes payable $250,000Current liabilities $716,000Long-term debt $1,166,000Common equity $4,883,000Total liabilities and equity $6,765,000 a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.1 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? Question content area bottom Part 1 a. What percentage of the firm's assets does the firm finance using debt (liabilities)? The fraction of the firm's assets that the firm finances using debt is 27.827.8%. (Round to one decimal place.) Part 2 b. If Campbell were to purchase a new warehouse for $1.1 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? The new debt ratio will be enter your response here%. (Round to one decimal place.)

- The working capital of BT21 Co. on December 31, 2021 are presented below:· Cash on hand – 200,000· Cash in bank – 108,000· Notes receivable – 250,000· Trade receivable – 600,000· Inventory – 650,000· Prepaid expenses – 45,000· Trade payables – 325,000· Notes payable (due annually at 500,000 payable every March 31) – 1,000,000· Accrued expenses – 40,000How much total current liabilities should BT21 Co. present in its statement of financial position on December 31, 2021?The working capital of BT21 Co. on December 31, 2021 are presented below:· Cash on hand – 200,000· Cash in bank – 108,000· Notes receivable – 250,000· Trade receivable – 600,000· Inventory – 650,000· Prepaid expenses – 45,000· Trade payables – 325,000· Notes payable (due annually at 500,000 payable every March 31) – 1,000,000· Accrued expenses – 40,000How much total current assets should BT21 Co. present in its statement of financial position on December 31, 2021?BnB Construction Inc.Balance Sheet (Millions of Dollars) Assets 2021 Est 2020 2019 Liabilities 2021 Est 2020 2019 Cash and Cash Equivalents 15 10 15 Accounts payable 115 60 30 Short-Term Investments 10 0 65 Overdrafts 115 110 60 Accounts Receivable 420 375 315 Accruals 260 140 130 Inventories 700 615 415 Total Current Liabilities 490 310 220 Total Current Assets 1145 1000 810 Long -Term Bonds and New Loan 1300 754 580 Net Plant and Equipment 1884 1190 870 Total Debt 1790 1064 800 Preferred Stock 40 40 40 Common Stock 130 130 130 Retained Earnings 1069 956 710 Total Common Equity 1199 1086 840 Total Assets 3029 2190 1680 Total Liabilities and Equity 3,029 2,190 1,680 Included is the Income Statement. Requirements: 1. Calculate the EPS, DPS, and BVPS, and Cash…

- Consider the following bank balance sheet and the associated yields for earning assets and costs of liabilities. Assets Amount (000). Rate cash 400. 0% securitie 1600. 6.5% commercial loans 4000 9.0% credit card loans 3300. 10.0% loss reserves. 200 other assets 500 total assets. 10,000 Liabilities and equity Demand deposits. 1600 MMDAs. 3600 6.0% CDs. 2600 6.5% ST deposits. 1360. 5.0% Deferret tax credit. 200 Equity 640 total. 10000 Assume that net charge-offs $44,000 cash taxes paid $78,000 and allocated risk capital is $550,000 with a capital charge of 6 percent. determine : a) Calculate and show the bank income statement.SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…