Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method.Present data in columnar form, using the following headings: Model Quantity Unit Cost Total Cost If the inventory of a particular model comprises one entire purchase plus a portion of another r purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.

Periodic inventory by three methods

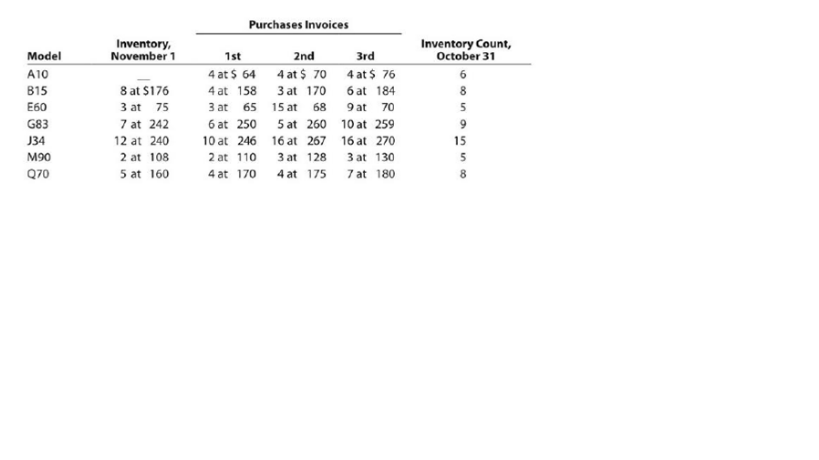

Dymac Appliances uses the periodic inventory system. Details regarding the inventory of

appliances at January 1, purchases invoices during the next 12 months, and the inventory

count at December 31 are summarized as follows:

Instructions

1. Determine the cost of the inventory on December 31 by the first-in, first-out method.Present data in columnar form, using the following headings:

Model Quantity Unit Cost Total Cost

If the inventory of a particular model comprises one entire purchase plus a portion of another r purchase acquired at a different unit cost, use a separate line for each purchase.

2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1).

3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1).

4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images