Use the following information for the Exercises 3-7 below. (Algo) [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a periodic inventory system. For specific identification, ending inventory consists of 232 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 47 are from beginning inventory. Date Activities January 1 Beginning inventory January 10 Sales Purchase Sales Purchase Totals January 20 January 25 January 30 Units 156 units e Acquired at Cost $ 6.00 = 76 units e 180 units e 412 units $ 5.00 $ 4.50 = $ 936 380 810 $ 2,126 Units sold at Retail 84 units @ 96 units e 180 units $ 15.00 $ 15.00

Use the following information for the Exercises 3-7 below. (Algo) [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a periodic inventory system. For specific identification, ending inventory consists of 232 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 47 are from beginning inventory. Date Activities January 1 Beginning inventory January 10 Sales Purchase Sales Purchase Totals January 20 January 25 January 30 Units 156 units e Acquired at Cost $ 6.00 = 76 units e 180 units e 412 units $ 5.00 $ 4.50 = $ 936 380 810 $ 2,126 Units sold at Retail 84 units @ 96 units e 180 units $ 15.00 $ 15.00

Chapter4: Operating Activities: Sales And Cash Receipts

Section: Chapter Questions

Problem 1.3C

Related questions

Question

Can do the FIFO AND THE LIFO and also the weighted average for January 1

January 10

January 20

January 25

January 30 thank you

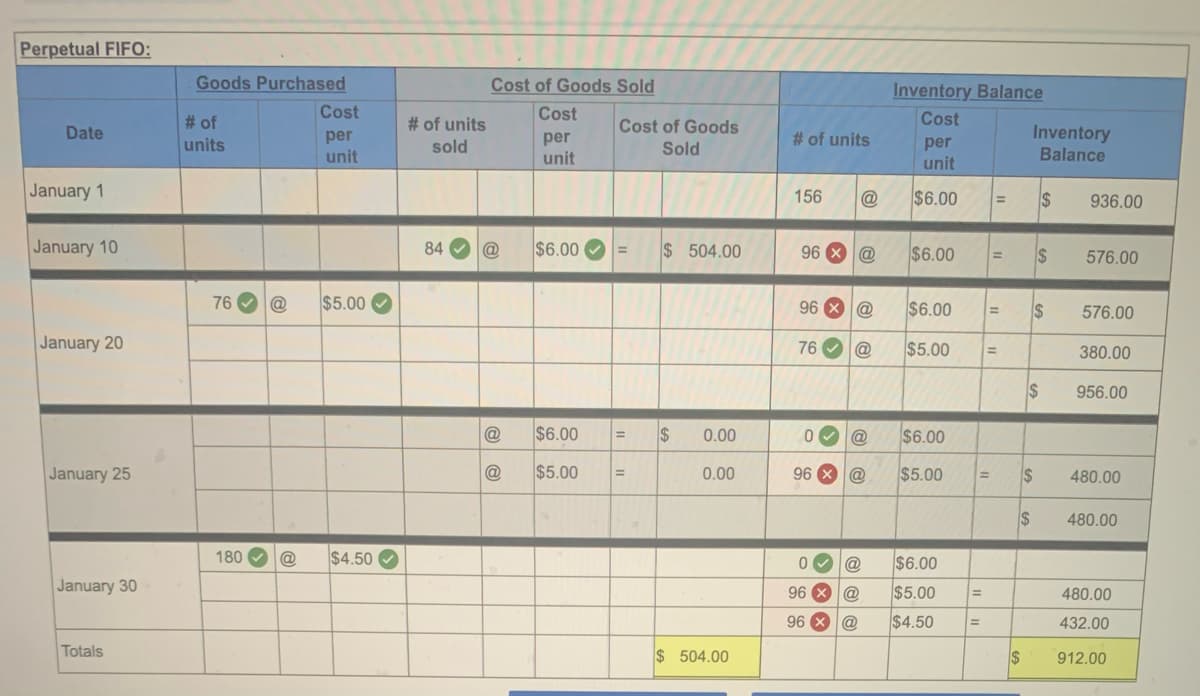

Transcribed Image Text:Perpetual FIFO:

Date

January 1

January 10

January 20

January 25

January 30

Totals

Goods Purchased

# of

units

76 @

Cost

per

unit

$5.00

180 @ $4.50

# of units

sold

Cost of Goods Sold

Cost

per

unit

84 @

@

$6.00

$6.00

$5.00

Cost of Goods

Sold

=

$ 504.00

= $ 0.00

=

0.00

$ 504.00

# of units

156 @

96 x @

96 X @

76

@

0✔ @

96 X @

0✓ @

96 x @

96 X @

Inventory Balance

Cost

per

unit

$6.00

$6.00 =

$6.00 =

$5.00 =

$6.00

$5.00

$6.00

$5.00

$4.50

=

=

=

=

$

Inventory

Balance

$

$

$

$

$

S

936.00

576.00

576.00

380.00

956.00

480.00

480.00

480.00

432.00

912.00

![Use the following information for the Exercises 3-7 below. (Algo)

[The following information applies to the questions displayed below.]

Laker Company reported the following January purchases and sales data for its only product. The Company uses a

periodic inventory system. For specific identification, ending inventory consists of 232 units, where 180 are from the

January 30 purchase, 5 are from the January 20 purchase, and 47 are from beginning inventory.

Date

Activities

January 1 Beginning inventory

January 10 Sales

January 20

Purchase

January 25

Sales

January 30

Purchase

Totals

Units Acquired at Cost

$6.00 =

156 units @

76 units e

180 units @

412 units

$ 5.00

$ 4.50

$ 936

380

810

$ 2,126

Units sold at Retail

84 units @

96 units

180 units

@

$ 15.00

$15.00](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F603fb863-551d-4e2c-baf1-38f56fb13d9e%2F9035d3d8-4473-4b49-92ad-d731cdf2191c%2F0ou4m8_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Use the following information for the Exercises 3-7 below. (Algo)

[The following information applies to the questions displayed below.]

Laker Company reported the following January purchases and sales data for its only product. The Company uses a

periodic inventory system. For specific identification, ending inventory consists of 232 units, where 180 are from the

January 30 purchase, 5 are from the January 20 purchase, and 47 are from beginning inventory.

Date

Activities

January 1 Beginning inventory

January 10 Sales

January 20

Purchase

January 25

Sales

January 30

Purchase

Totals

Units Acquired at Cost

$6.00 =

156 units @

76 units e

180 units @

412 units

$ 5.00

$ 4.50

$ 936

380

810

$ 2,126

Units sold at Retail

84 units @

96 units

180 units

@

$ 15.00

$15.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you