Purchased merchandise from Haas Co., $43,250, terms FOB Mar. shipping point, 2/10, n/eom. Prepaid freight of $650 was added 1. to the invoice. Purchased merchandise from Whitman Co., $19,175, terms FOB 5. destination, n/30. 10. Paid Haas Co. for invoice of March 1. Purchased merchandise from Jost Co., $15,550, terms FOB 13. destination, 2/10, n/30. Issued debit memo to Jost Co. for $3,750 of merchandise 14. returned from purchase on March 13. Purchased merchandise from Fairhurst Company, $13,560, 18. terms FOB shipping point, n/com. Paid freight of $140 on March 18 purchase from Fairhurst 18. Company. Purchased merchandise from Bickle Co., $6,500, terms FOB 19. destination, 2/10, n/30. Paid Jost Co. for invoice of March 13 less debit memo of March 23. 14. 29. Paid Bickle Co. for invoice of March 19. 31. Paid Fairhurst Company for invoice of March 18. 31. Paid Whitman Co. for invoice of March 5.

Purchased merchandise from Haas Co., $43,250, terms FOB Mar. shipping point, 2/10, n/eom. Prepaid freight of $650 was added 1. to the invoice. Purchased merchandise from Whitman Co., $19,175, terms FOB 5. destination, n/30. 10. Paid Haas Co. for invoice of March 1. Purchased merchandise from Jost Co., $15,550, terms FOB 13. destination, 2/10, n/30. Issued debit memo to Jost Co. for $3,750 of merchandise 14. returned from purchase on March 13. Purchased merchandise from Fairhurst Company, $13,560, 18. terms FOB shipping point, n/com. Paid freight of $140 on March 18 purchase from Fairhurst 18. Company. Purchased merchandise from Bickle Co., $6,500, terms FOB 19. destination, 2/10, n/30. Paid Jost Co. for invoice of March 13 less debit memo of March 23. 14. 29. Paid Bickle Co. for invoice of March 19. 31. Paid Fairhurst Company for invoice of March 18. 31. Paid Whitman Co. for invoice of March 5.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter4: Accounting For Retail Operations

Section: Chapter Questions

Problem 4.1P: Purchase-related transactions The following selected transactions were completed by Epic Co. during...

Related questions

Topic Video

Question

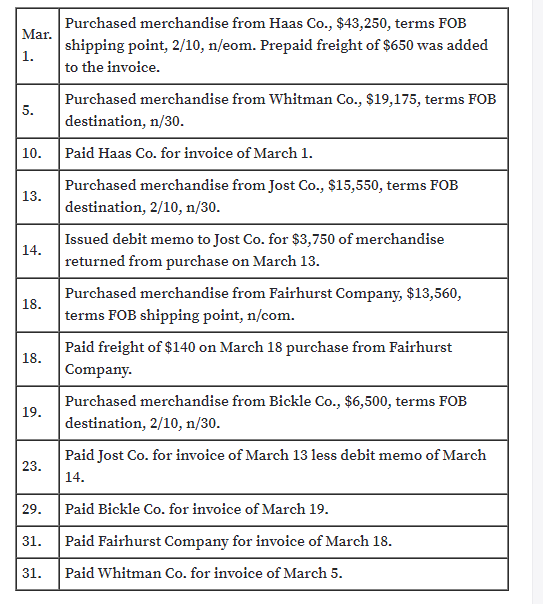

Purchase-related transactions using perpetual inventory system

The following selected transactions were completed by Niles Co. during

March of the current year:

Instructions

journalize the entries to record the transactions of Niles Co. for March

Transcribed Image Text:Purchased merchandise from Haas Co., $43,250, terms FOB

Mar.

shipping point, 2/10, n/eom. Prepaid freight of $650 was added

1.

to the invoice.

Purchased merchandise from Whitman Co., $19,175, terms FOB

5.

destination, n/30.

10.

Paid Haas Co. for invoice of March 1.

Purchased merchandise from Jost Co., $15,550, terms FOB

13.

destination, 2/10, n/30.

Issued debit memo to Jost Co. for $3,750 of merchandise

14.

returned from purchase on March 13.

Purchased merchandise from Fairhurst Company, $13,560,

18.

terms FOB shipping point, n/com.

Paid freight of $140 on March 18 purchase from Fairhurst

18.

Company.

Purchased merchandise from Bickle Co., $6,500, terms FOB

19.

destination, 2/10, n/30.

Paid Jost Co. for invoice of March 13 less debit memo of March

23.

14.

29.

Paid Bickle Co. for invoice of March 19.

31.

Paid Fairhurst Company for invoice of March 18.

31.

Paid Whitman Co. for invoice of March 5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning