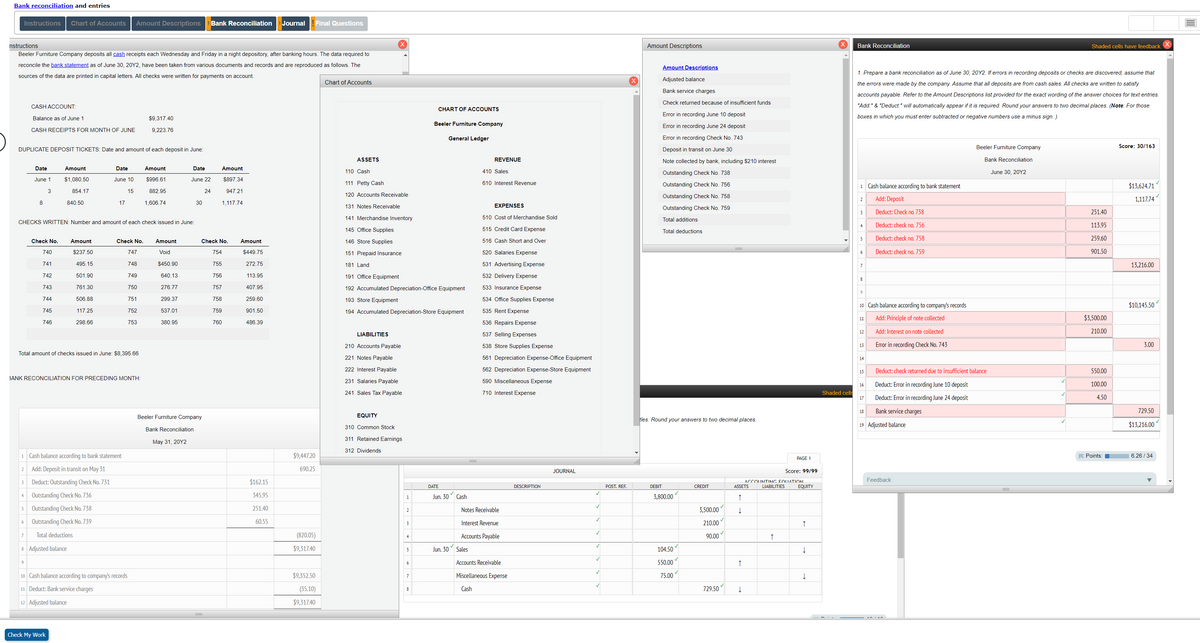

Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of June 30, 20Y2, have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account. Refer to the June Bank Statement (2nd attached image) Required: 1. Prepare a bank reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy accounts payable. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. "Add:" & "Deduct:" will automatically appear if it is required. Round your answers to two decimal places. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of June 30, 20Y2, have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account. Refer to the June Bank Statement (2nd attached image) Required: 1. Prepare a bank reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy accounts payable. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. "Add:" & "Deduct:" will automatically appear if it is required. Round your answers to two decimal places. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 5.4.3P

Related questions

Question

Bank Reconciliation

Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of June 30, 20Y2, have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account.

Refer to the June Bank Statement (2nd attached image)

Required:

1. Prepare a bank reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy accounts payable. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. "Add:" & "Deduct:" will automatically appear if it is required. Round your answers to two decimal places. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Transcribed Image Text:Bank reconciliation and entries

Instructions

Chart of Accounts

Amount Descriptions

Bank Reconciliation

Journal

!Final Questions

nstructions

Amount Descriptions

Bank Reconciliation

Shaded cells have feedback. X

Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to

reconcile the bank statement as of June 30, 20Y2, have been taken from various documents and records and are reproduced as follows. The

Amount Descriptions

1. Prepare a bank reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that

sources of the data are printed in capital letters. All checks were written for payments on account.

Adjusted balance

Chart of Accounts

the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy

Bank service charges

accounts payable. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.

Check returned because of insufficient funds

CASH ACCOUNT:

"Add:" & "Deduct:" will automatically appear if it is required. Round your answers to two decimal places. (Note: For those

CHART OF ACCOUNTS

Error in recording June 10 deposit

boxes in which you must enter subtracted or negative numbers use a minus sign. )

Balance as of June 1

$9,317.40

Beeler Furniture Company

Error in recording June 24 deposit

CASH RECEIPTS FOR MONTH OF JUNE

9,223.76

General Ledger

Error in recording Check No. 743

Beeler Furniture Company

Score: 30/163

DUPLICATE DEPOSIT TICKETS: Date and amount of each deposit in June:

Deposit in transit on June 30

ASSETS

REVENUE

Note collected by bank, including $210 interest

Bank Reconciliation

Date

Amount

Date

Amount

Date

Amount

110 Cash

410 Sales

Outstanding Check No. 738

June 30, 20Y2

June 1

$1,080.50

June 10

$996.61

June 22

$897.34

111 Petty Cash

610 Interest Revenue

Outstanding Check No. 756

1 Cash balance according to bank statement

$13,624.71

3

854.17

15

882.95

24

947.21

120 Accounts Receivable

Outstanding Check No. 758

Add: Deposit

1,117.74

2

8

840.50

17

1,606.74

30

1,117.74

131 Notes Receivable

EXPENSES

Outstanding Check No. 759

3

Deduct: Check no 738

251.40

141 Merchandise Inventory

510 Cost of Merchandise Sold

Total additions

CHECKS WRITTEN: Number and amount of each check issued in June:

4

Deduct: check no. 756

113.95

145 Office Supplies

515 Credit Card Expense

Total deductions

Deduct: check no. 758

259.60

Check No.

Amount

Check No.

Amount

Check No.

Amount

146 Store Supplies

516 Cash Short and Over

740

$237.50

747

Void

754

$449.75

520 Salaries Expense

Deduct: check no. 759

901.50

6

151 Prepaid Insurance

741

495.15

748

$450.90

755

272.75

181 Land

531 Advertising Expense

13,216.00

742

501.90

749

640.13

756

113.95

191 Office Equipment

532 Delivery Expense

8

743

761.30

750

276.77

757

407.95

192 Accumulated Depreciation-Office Equipment

533 Insurance Expense

9

744

506.88

751

299.37

758

259.60

193 Store Equipment

534 Office Supplies Expense

10 Cash balance according to company's records

$10,145.50

745

117.25

752

537.01

759

901.50

194 Accumulated Depreciation-Store Equipment

535 Rent Expense

Add: Principle of note collected

$3,500.00

11

746

298.66

753

380.95

760

486.39

536 Repairs Expense

12

Add: Interest on note collected

210.00

LIABILITIES

537 Selling Expenses

210 Accounts Payable

Error in recording Check No. 743

3.00

538 Store Supplies Expense

13

Total amount of checks issued in June: $8.395.66

221 Notes Payable

561 Depreciation Expense-Office Equipment

14

222 Interest Payable

562 Depreciation Expense-Store Equipment

Deduct: check returned due to insufficient balance

550.00

BANK RECONCILIATION FOR PRECEDING MONTH:

231 Salaries Payable

590 Miscellaneous Expense

Deduct: Error in recording June 10 deposit

100.00

16

241 Sales Tax Payable

710 Interest Expense

Shaded cells

Deduct: Error in recording June 24 deposit

4.50

17

Bank service charges

729.50

18

Beeler Furniture Company

EQUITY

tles. Round your answers to two decimal places.

19 Adjusted balance

$13,216.00

310 Common Stock

Bank Reconciliation

311 Retained Earnings

May 31, 20Y2

312 Dividends

Cash balance according to bank statement

$9,447.20

K Points:

6.26 / 34

PAGE 1

Add: Deposit in transit on May 31

690.25

JOURNAL

Score: 99/99

Deduct: Outstanding Check No. 731

$162.15

Feedback

3

ACCOUNTING FOUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

Outstanding Check No. 736

345.95

Jun. 30 Cash

4

3,800.00

↑

1

Outstanding Check No. 738

251.40

Notes Receivable

3,500.00

Outstanding Check No. 739

60.55

6

Interest Revenue

210.00

↑

3

Total deductions

(820.05)

Accounts Payable

90.00

4

8 Adjusted balance

$9,317.40

Jun. 30 Sales

104.50

5

Accounts Receivable

550.00

10 Cash balance according to company's records

$9,352.50

Miscellaneous Expense

75.00

11 Deduct: Bank service charges

(35.10)

Cash

729.50

| 12 Adjusted balance

$9,317.40

Check My Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College