On September 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $197,400. Holly also owns another residential apartment building that she purchased on November 15, 2020, with a cost basis of $214,000. a. Calculate Holly's total depreciation deduction for the apartments for 2020 using MACRS. b. Calculate Holly's total depreciation deduction for the apartments for 2021 using MACRS.

On September 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $197,400. Holly also owns another residential apartment building that she purchased on November 15, 2020, with a cost basis of $214,000. a. Calculate Holly's total depreciation deduction for the apartments for 2020 using MACRS. b. Calculate Holly's total depreciation deduction for the apartments for 2021 using MACRS.

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 7BCRQ

Related questions

Question

100%

On September 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $197,400. Holly also owns another residential apartment building that she purchased on November 15, 2020, with a cost basis of $214,000.

a. Calculate Holly's total

b. Calculate Holly's total depreciation deduction for the apartments for 2021 using MACRS.

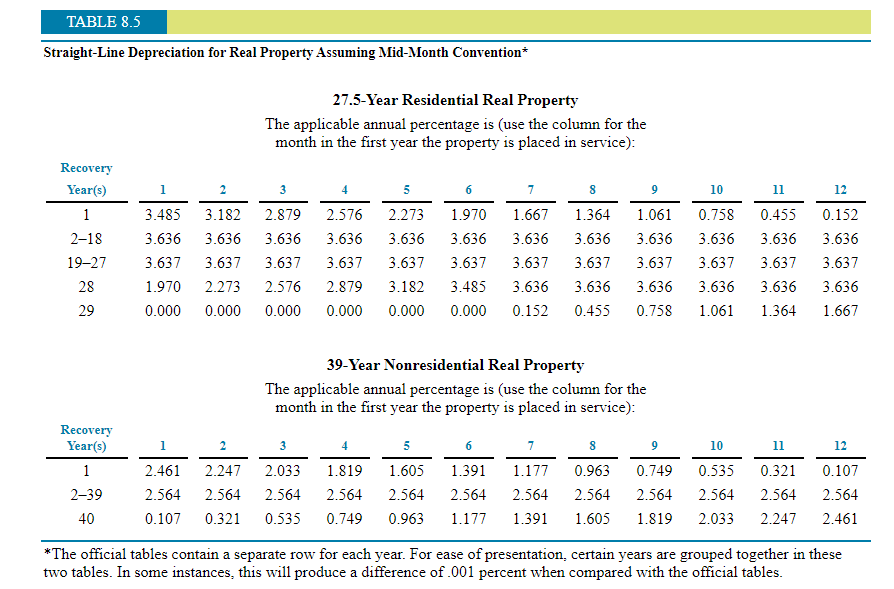

Transcribed Image Text:TABLE 8.5

Straight-Line Depreciation for Real Property Assuming Mid-Month Convention*

27.5-Year Residential Real Property

The applicable annual percentage is (use the column for the

month in the first year the property is placed in service):

Recovery

Year(s)

11

1.

2

3

4

6

7

9

10

12

1

3.485

3.182

2.879

2.576

2.273

1.970

1.667

1.364

1.061

0.758

0.455

0.152

2-18

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

19–27

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

28

1.970

2.273

2.576

2.879

3.182

3.485

3.636

3.636

3.636

3.636

3.636

3.636

29

0.000

0.000

0.000

0.000

0.000

0.000

0.152

0.455

0.758

1.061

1.364

1.667

39-Year Nonresidential Real Property

The applicable annual percentage is (use the column for the

month in the first year the property is placed in service):

Recovery

Year(s)

1

2

3

4

6

7

8

9

10

11

12

1

2.461

2.247

2.033

1.819

1.605

1.391

1.177

0.963

0.749

0.535

0.321

0.107

2-39

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

40

0.107

0.321

0.535

0.749

0.963

1.177

1.391

1.605

1.819

2.033

2.247

2.461

*The official tables contain a separate row for each year. For ease of presentation, certain years are grouped together in these

two tables. In some instances, this will produce a difference of .001 percent when compared with the official tables.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning