Water Closet Co. wholesales bathroom fodures. During the current year ending December 31, Water Closet received the folowing notes: 1. Determine for each note (a) tme due date and (D) the amount of CHART OF ACCOUNTS Date Face Amount Term Interest Rate interest due at maturity, identrying each note by number. Assume a Water Closet Co. 1. Mar. 6 $75.000 60 days 4% 360-day year Apr. 7 General Ledger 2. 40,000 45 days 6% Note Due Date Interest Due at Maturity 3. Aug. 12 36.000 120 days 5% 1. ASSETS REVENUE 4. Oct. 22 27,000 30 days 110 Cash 410 Sales 5. Nov. 19 48,000 90 days 3% 111 Petty Cash 610 Interest Revenue 6. Dec. 15 72.000 45 days 120 Accounts Receivable 129 Allowance for Doubtful Accounts EXPENSES Required: 131 Interest Receivable 510 Cost of Goods Sold 1. Determine for each note (a) the due date and (D) the amount of interest due at maturity, identitying each note by number. Assume a 360-day 132 Notes Receivable 141 Merchandise inventory 520 Sales Salaries Expense year 521 Advertising Expense 2. Journalize the entry to record the dishonor of Note (3) on its due date. Refer to the Chart of Accounts for exact wording of account tties 145 Office Supoles 146 Store Supplies 522 Depreciation Expense-Store 3. Journalize the adjusting entry to record the acorued interest on Notes (5) and (6) on December 31. Refer to the Chart of Accounts for exact Equipment wording of account tnes. Assume a 360day year. 4. Journalize the entries to record the receipt of the amounts due on Notes (5) and (6) in January and February Refer to the Chart of Accounts for 151 Prepaid Insurance 523 Delivery Expense 181 Land 524 Repairs Expense exact wording of account ttes 191 Store Equipment 529 Selling Expenses Journal 192 Accumulated Depreciation-Store 530 Ofice Salaries Expense Equipment 531 Rent Expense 2. Journalize the entry to record the dishonor of Nore (3) on its due date. Refer to the Chart of Accounts for exact wordng of account tes . 190 Ofice Equipment 532 Depreciation Expense-Omice 194 Accumulated Depreciation-office Equipment Equipment 533 Insurance Expense PAGE I 534 Ofice Supplies Expense JOURNAL ACCOUNTING EQUATION LIABILITIES 535 Store Supplies Expense DATE DESCRIPTION POST, REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 210 Accounts Payable 536 Credit Card Epense 211 Salaries Payable 537 Cash Short and Over 213 Sales Tax Payable 538 Bad Debt Expense 214 Interest Payable 539 Miscellaneous Expense 215 Notes Payable 710 Interest Expense 3. Journalize the adjusting entry to record the accrued interest on Notes (5) and (6) on December 31. Refer to tme Chart of Accounts for exact wording of account tes Assume a 360-day year. EQUITY 310 Common Stock PAGE I 311 Retained Eamings JOURNAL ACCOUNTING EQUATION 312 Dividends DATE DESCRIPTION POST. REF. DEIT CREDIT ASSETS UABILITIES EQUITY 4. Journalize the entries to record the recept of the amounts due on Notes (5) and (6) in January and February Refer to the Chart of Accounts for exact wording of account tdes. PAGE I JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY

Water Closet Co. wholesales bathroom fodures. During the current year ending December 31, Water Closet received the folowing notes: 1. Determine for each note (a) tme due date and (D) the amount of CHART OF ACCOUNTS Date Face Amount Term Interest Rate interest due at maturity, identrying each note by number. Assume a Water Closet Co. 1. Mar. 6 $75.000 60 days 4% 360-day year Apr. 7 General Ledger 2. 40,000 45 days 6% Note Due Date Interest Due at Maturity 3. Aug. 12 36.000 120 days 5% 1. ASSETS REVENUE 4. Oct. 22 27,000 30 days 110 Cash 410 Sales 5. Nov. 19 48,000 90 days 3% 111 Petty Cash 610 Interest Revenue 6. Dec. 15 72.000 45 days 120 Accounts Receivable 129 Allowance for Doubtful Accounts EXPENSES Required: 131 Interest Receivable 510 Cost of Goods Sold 1. Determine for each note (a) the due date and (D) the amount of interest due at maturity, identitying each note by number. Assume a 360-day 132 Notes Receivable 141 Merchandise inventory 520 Sales Salaries Expense year 521 Advertising Expense 2. Journalize the entry to record the dishonor of Note (3) on its due date. Refer to the Chart of Accounts for exact wording of account tties 145 Office Supoles 146 Store Supplies 522 Depreciation Expense-Store 3. Journalize the adjusting entry to record the acorued interest on Notes (5) and (6) on December 31. Refer to the Chart of Accounts for exact Equipment wording of account tnes. Assume a 360day year. 4. Journalize the entries to record the receipt of the amounts due on Notes (5) and (6) in January and February Refer to the Chart of Accounts for 151 Prepaid Insurance 523 Delivery Expense 181 Land 524 Repairs Expense exact wording of account ttes 191 Store Equipment 529 Selling Expenses Journal 192 Accumulated Depreciation-Store 530 Ofice Salaries Expense Equipment 531 Rent Expense 2. Journalize the entry to record the dishonor of Nore (3) on its due date. Refer to the Chart of Accounts for exact wordng of account tes . 190 Ofice Equipment 532 Depreciation Expense-Omice 194 Accumulated Depreciation-office Equipment Equipment 533 Insurance Expense PAGE I 534 Ofice Supplies Expense JOURNAL ACCOUNTING EQUATION LIABILITIES 535 Store Supplies Expense DATE DESCRIPTION POST, REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 210 Accounts Payable 536 Credit Card Epense 211 Salaries Payable 537 Cash Short and Over 213 Sales Tax Payable 538 Bad Debt Expense 214 Interest Payable 539 Miscellaneous Expense 215 Notes Payable 710 Interest Expense 3. Journalize the adjusting entry to record the accrued interest on Notes (5) and (6) on December 31. Refer to tme Chart of Accounts for exact wording of account tes Assume a 360-day year. EQUITY 310 Common Stock PAGE I 311 Retained Eamings JOURNAL ACCOUNTING EQUATION 312 Dividends DATE DESCRIPTION POST. REF. DEIT CREDIT ASSETS UABILITIES EQUITY 4. Journalize the entries to record the recept of the amounts due on Notes (5) and (6) in January and February Refer to the Chart of Accounts for exact wording of account tdes. PAGE I JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter8: Receivables

Section: Chapter Questions

Problem 4PB

Related questions

Question

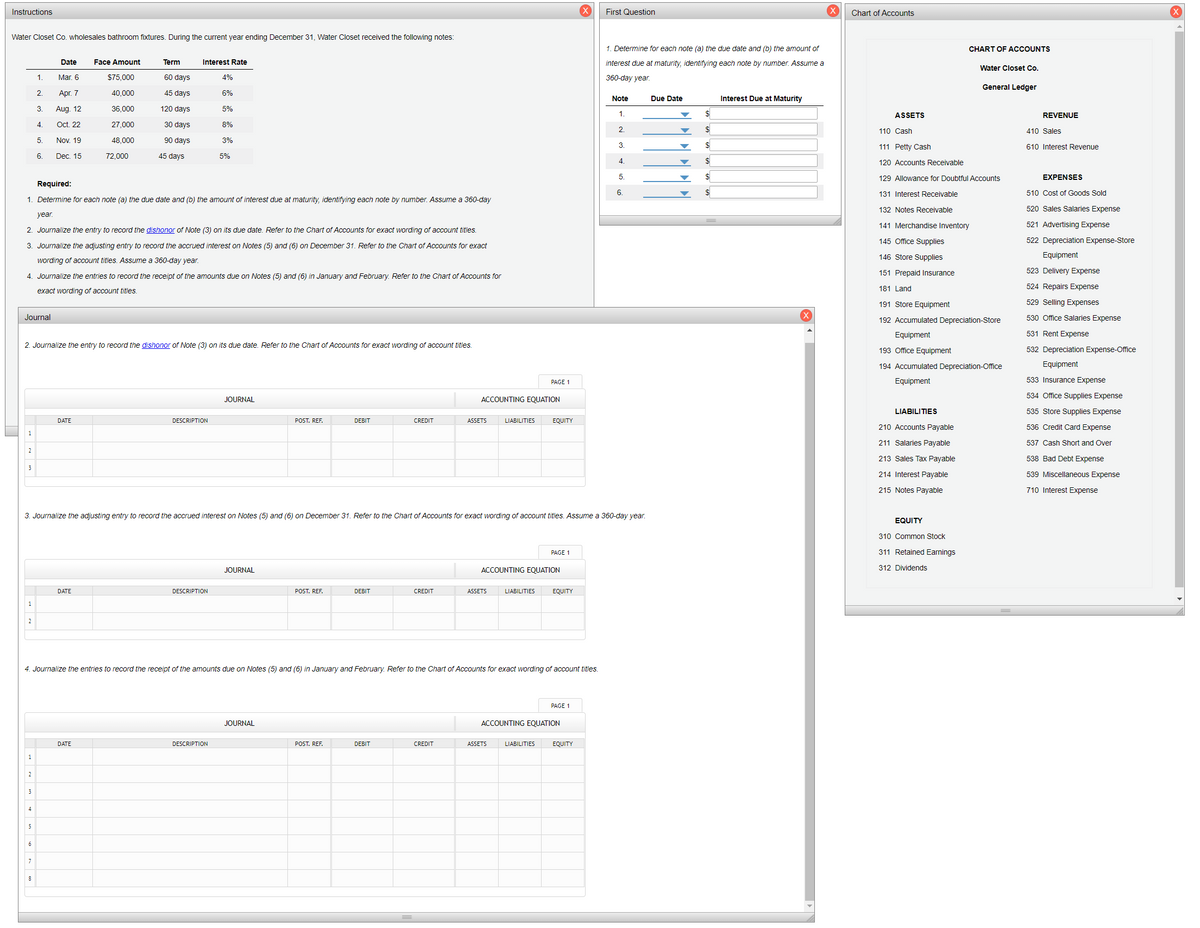

Water Closet Co. wholesales bathroom fixtures. During the current year ending December 31, Water Closet received the following notes:

Required: 1. Determine for each note (a) the due date and (b) the amount of interest due at maturity, identifying each note by number. Assume a 360-day year.

2. Journalize the entry to record the dishonor of Note (3) on its due date. Refer to the Chart of Accounts for exact wording of account titles.

3. Journalize the adjusting entry to record the accrued interest on Notes (5) and (6) on December 31. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year.

4. Journalize the entries to record the receipt of the amounts due on Notes (5) and (6) in January and February. Refer to the Chart of Accounts for exact wording of account titles.

Transcribed Image Text:Instructions

First Question

Chart of Accounts

Water Closet Co. wholesales bathroom fixtures. During the current year ending December 31, Water Closet received the following notes:

1. Determine for each note (a) the due date and (b) the amount of

CHART OF ACCOUNTS

Date

Face Amount

Term

Interest Rate

interest due at maturity, identifying each note by number. Assume a

Water Closet Co.

1.

Mar. 6

S75,000

60 days

4%

360-day year.

General Ledger

2.

Apr. 7

40,000

45 days

6%

Note

Due Date

Interest Due at Maturity

3.

Aug. 12

36,000

120 days

5%

1

ASSETS

REVENUE

4.

Oct. 22

27,000

30 days

8%

2.

$

110 Cash

410 Sales

5.

Nov. 19

48,000

90 days

3%

3.

$

111 Petty Cash

610 Interest Revenue

6.

Dec. 15

72,000

45 days

5%

4.

120 Accounts Receivable

5.

129 Allowance for Doubtful Accounts

EXPENSES

Required:

6.

131 Interest Receivable

510 Cost of Goods Sold

1. Determine for each note (a) the due date and (b) the amount of interest due at maturity, identifying each note by number. Assume a 360-day

132 Notes Receivable

520 Sales Salaries Expense

year.

141 Merchandise Inventory

521 Advertising Expense

2. Journalize the entry to record the dishonor of Note (3) on its due date. Refer to the Chart of Accounts for exact wording of account titles.

3. Journalize the adjusting entry to record the accrued interest on Notes (5) and (6) on December 31. Refer to the Chart of Accounts for exact

145 Office Supplies

522 Depreciation Expense-Store

146 Store Supplies

Equipment

wording of account titles. Assume a 360-day year.

4. Journalize the entries to record the receipt of the amounts due on Notes (5) and (6) in January and February. Refer to the Chart of Accounts for

151 Prepaid Insurance

523 Delivery Expense

181 Land

524 Repairs Expense

exact wording of account titles.

191 Store Equipment

529 Selling Expenses

Journal

192 Accumulated Depreciation-Store

530 Office Salaries Expense

Equipment

531 Rent Expense

2. Journalize the entry to record the dishonor of Note (3) on its due date. Refer to the Chart of Accounts for exact wording of account titles.

193 Office Equipment

532 Depreciation Expense-Office

194 Accumulated Depreciation-Office

Equipment

Equipment

533 Insurance Expense

PAGE 1

534 Office Supplies Expense

JOURNAL

ACCOUNTING EQUATION

LIABILITIES

535 Store Supplies Expense

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

210 Accounts Payable

536 Credit Card Expense

1

211 Salaries Payable

537 Cash Short and Over

2

213 Sales Tax Payable

538 Bad Debt Expense

3

214 Interest Payable

539 Miscellaneous Expense

215 Notes Payable

710 Interest Expense

3. Journalize the adjusting entry to record the accrued interest on Notes (5) and (6) on December 31. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year.

EQUITY

310 Common Stock

PAGE 1

311 Retained Earnings

JOURNAL

ACCOUNTING EQUATION

312 Dividends

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

2

4. Journalize the entries to record the receipt of the amounts due on Notes (5) and (6) in January and February. Refer to the Chart of Accounts for exact wording of account titles.

PAGE 1

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

2

4

5

6

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT