. 2022, Clark Co. received a P3,000,000, 10% note from a customer upon baid in six equal semi-annual installments, plus interest on the outstanding starting June 30, 2021. The effective rate on the note is 9%. h is the note upon initial recognition? h is the interest income recognized by Clark in 2022? Dagqmban 21 20222

. 2022, Clark Co. received a P3,000,000, 10% note from a customer upon baid in six equal semi-annual installments, plus interest on the outstanding starting June 30, 2021. The effective rate on the note is 9%. h is the note upon initial recognition? h is the interest income recognized by Clark in 2022? Dagqmban 21 20222

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 4E: Discounting of Notes Payable On October 30, 2019, Sanchez Company acquired a piece of machinery and...

Related questions

Question

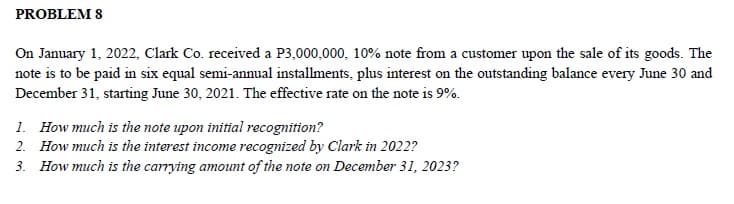

Transcribed Image Text:PROBLEM 8

On January 1, 2022, Clark Co. received a P3,000,000, 10% note from a customer upon the sale of its goods. The

note is to be paid in six equal semi-annual installments, plus interest on the outstanding balance every June 30 and

December 31, starting June 30, 2021. The effective rate on the note is 9%.

1. How much is the note upon initial recognition?

2. How much is the interest income recognized by Clark in 2022?

3. How much is the carrying amount of the note on December 31, 2023?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning