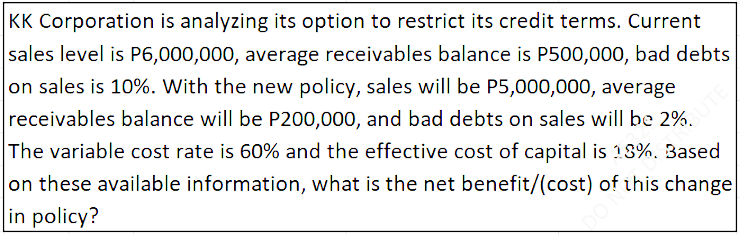

KK Corporation is analyzing its option to restrict its credit terms. Current sales level is P6,000,000, average receivables balance is P500,000, bad debts on sales is 10%. With the new policy, sales will be P5,000,000, average receivables balance will be P200,000, and bad debts on sales will be 2%. The variable cost rate is 60% and the effective cost of capital is 18%. Based on these available information, what is the net benefit/(cost) of this change in policy?

Q: Company a Ex return 12% Company b Ex return 8% SD company a 30% SD company b 25% Returns are perf ne...

A: For zero beta, variance of portfolio should be zero. Company A standard deviation (Sa) = 30% Company...

Q: Suppose you invest $5,000 into a mutual fund that is expected to earn a rate of return of 7%. The am...

A: Mutual Fund is an investment option where large number of investors put their investment amount coll...

Q: Blunderbluss Manufacturing’s balance sheets report $200 million in total debt, $70 million in short-...

A: Data given:: Total debt = $200 million Short-term investments = $7...

Q: uys a koi fishpond (and fish to put in it) for his wife on their anniversary. He pays $8000 for the ...

A: In the add on interest method we calculate the total interest for given period and add to the loan a...

Q: Use the Black-Scholes formula to find the value of the following call option. (Do not round intermed...

A: Stock Price $ 62.00 Exercise Price $ 62.00 Standard Deviation 40% Risk Free Rate 4% ...

Q: What are the two sources of value in an investment? Given an example of each.

A: An investment is a process where the investors gives or outlays his or her capital in return of gene...

Q: What are some feasible and stable investment activities during pandemic?

A: An Inestment is a form of acquring assets for a long run or short run to have good rate of return.It...

Q: I met Mr. Talagitok a year ago and he told me that he had invested a hundred thousand dollars in a b...

A: The question is based on the application of the time value of money, the value of money increases wi...

Q: purposes. The following proposals and ascertained profitability indexes have Question.8. Parth Ltd. ...

A:

Q: Please select the risk that affect only a single company? market risks. specific risks. systematic r...

A: Systematic risk is also known as non-diversifiable risk, and it exist for entire market. It arises d...

Q: A working capital financing policy that finances almost all assets with long-term capital a. Res...

A: Working capital is the difference between current assets and current liabilities. ------------------...

Q: Find the amount to which semi-annual deposits of $200.00 will grow in four years at 6.6% p.a. compou...

A: Semi annual deposit (PMT) = $200 Interest rate = 6.6% Semi annual interest rate (i) = 6.6%/2 = 3.3% ...

Q: A bond with a face value of $5,000 pays quarterly interest of 3.5 percent each period. Thirty-four i...

A: The price of the bond is calculated by calculating the present value of all the future payments that...

Q: Find the periodic payment which will amount to a sum of $16000 if an interest rate 8% is compounded ...

A: Present value (P) = $16000 Interest rate (r) = 8% Period (n) = 19 Years

Q: companies that use fiscal yea

A: Introduction : The fiscal year is the time period that a country or a company chooses as their busin...

Q: When a country's currency depreciates against the currencies of major trading partners: O a. The cou...

A: The exchange rate is the rate at which one currency is exchanged for another. When one currency beco...

Q: Find the value after 20 years in pesos of an annuity of P20,000 payable annually for 8 years, with t...

A: An annuity is a set of payments that are all the same size and are made at regular intervals over a ...

Q: Ashely's CFO wants to use P/E ratio to value the stock's terminal value in year 4. The CFO forecasts...

A: The price-to-earnings ratio (P/E ratio) is a valuation ratio that compares a company's current share...

Q: The consulting company Maggi has been hired to value the company Bolli AS, Bolli expects one operati...

A: The process of assessing the worth of a company entity is known as corporate valuation.It's a crucia...

Q: Ultravision Inc. anticipates sales of $460,000 from January through April. Materials will represent ...

A: Cashflows means movement of cash, it can be positive or negative. Positive cashflows means cash infl...

Q: estimated cash flows before tax (CFBT) are? 10,000; 11,000; 14,000; 15,000 and v machinery. The proj...

A: Tax rate is 55% Discount rate is 10% Depriciation Method is straight line To Find: Average rate o...

Q: Rank the following from highest present value to lowest present value. A payment of $5000 to be rece...

A: Option 1. Payment of 5000 N = 5 Option 2. Payment of 5000 N = 2 Option 3. Payment of 2000 in 1 y...

Q: ou found the following stock quote for DRK Enterprises, Inc., at your favorite website

A: a. Stock price = Dividend / Dividend yield = $0.83 / 0.0140 = $59.29

Q: The financial crisis had its roots in the easy-money policies that were pursued by the U.S. Federal ...

A: This refers to the 2008 global financial crisis. (GFC).

Q: Which of the following is correct about the security market line (SML)? Investment projects that plo...

A: Security market line is the graphical representation of the values of stock against the risk relativ...

Q: Jo sportswear company needs someone to supply it with 4,000 tons of cotton cloth per year to support...

A: The lowest bid: The lowest bid price is the selling price that will earn the lowest required rate of...

Q: T/F a. According to Expectation theory, long-term rates are geometric average of current and expecte...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: What is the importance of Foreign Exchange Market?

A: Foreign exchange markets commonly known as Forex markets are mainly concerned with purchasing and se...

Q: A contract requiring a specified future monetary payment at a specified future point in time in exch...

A: A derivative is a complicated financial security that is agreed upon by two or more parties. Traders...

Q: Boehm Incorporated is expected to pay a $1.50 per share dividend at the end of this year (i.e. D1 = ...

A: Data given: D1 = $1.50 Dividend growth rate per year= 6% Required Rate of return on the stock ...

Q: Why does business risk vary from industry to industry?

A: Business risk is an important parameter evaluated in the industry. Business risk can be defined as t...

Q: Which of the below best represents the idea that common stock investors generally earn higher reward...

A: Treasury bill are usually issued by the US government, So, this treasury bills are free from default...

Q: If average inventory is P80,000 and the inventory turnover ratio is 20, how much is the cost of good...

A: Calculate the costs of goods sold (COGS) by multiplying the average inventory which is P80,000 with ...

Q: Examples of Current liabilities includes accounts payable, accruals and other short-term liabilities...

A: Current Liabilities are the liabilities (payments) that the company has to pay within a year. These ...

Q: Question 2: Following is the Payoff table. Using the decision tree technique, choose the best option...

A: using the decision tree technique:

Q: Loans You have a $6,000 credit card debt, and you plan to pay it off through monthly payments of $15...

A: Loan amount (PV) = $6000 Monthly payment (P) = $150 Interest rate = 15% Monthly interest rate (r) = ...

Q: Use the following corn futures quotes: Corn 5,000 bushels Contract Month Open High Low Sett...

A: Future is the contract made between two persons for making delivery of asset in future by one person...

Q: The plan was to leave $8,000 on deposit in a savings account for 15 years at 7.5% interest compounde...

A: Deposit amount now (D) = $8000 Interest rate (r) = 7.5% Withdrawal after 5 years (W) = $2000 Period ...

Q: onsidering a merger, state

A: Introduction : In simple words, when two companies unites their operations to become one single comp...

Q: Question 1- Texas Instruments (TXN) (please include your Excel spreadsheet file!) Actual data for Te...

A: An Investment is an asset with the goal of generating Income. Investors get return from the Investme...

Q: pay off the loan earlier. If you are able to do this each month, by how many years will you shorten ...

A: Mortgage: It represents the loan taken by the borrower to purchase homes or other types of real esta...

Q: eter has saved $510 per month for the last years in savings account earning 4.2% ompounded semi-annu...

A: The future value of the money includes the deposit made and compound interest earned and this money ...

Q: his Ponzi scheme, what did Abraham Kennard use to lure his victims? Group of answer choices A. Loans...

A: Ponzi schemes are run by the many peoples to make frauds and cheat the investors by making impossibl...

Q: The Hohner Marine Band harmonica retailed for €30 in Germany (see Exhibit 2). German retailers gener...

A: Contribution per unit is the difference between the selling per unit and the variable cost per unit....

Q: The stock price of Heavy Metal (HM) changes only once a month: either it goes up by 26% or it falls ...

A: Particulars Amount Stock price 43 Increase % 26% Interest rate 0.50% Decrease % 19.30% Exe...

Q: de during a 25-year period, at annually compounded rate of return must it eam? (Do not round Interme...

A: Future value of money grow with increase in compounding due to increased effective interest rate.

Q: discussion on six assets included in a decedent’s gross estate. List and discuss three valuation dis...

A: Decedent’s gross estate is the gross value of all the assets owned by an Individual at the time of h...

Q: What is the effective interest rate corresponding to a nominal annual rate of. (Round your percentag...

A: Whenever the impacts of compounding over time are considered, the effective annual interest rate is ...

Q: A trader creates a bear spread by selling a six-month put option with a $25 strike price for $2.15 a...

A: Strike Price of Short Put Option is $25 Strike Price of Long Put Option is $29 Premium received on s...

Q: b) Aida Kamilia won RM1,000,000 in a contest, to be paid in twenty RM50,000 payments at yearly inter...

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first...

Step by step

Solved in 2 steps with 2 images

- KK Corporation is analyzing its option to restrict its credit terms. Current sales level is P6,000,000, average receivables balance is P500,000, bad debts on sales is 10%. With the new policy, sales will be P5,000,000, average receivables balance will be P200,000, and bad debts on sales will be 2%. The variable cost rate is 60% and the effective cost of capital is 18%. Based on these available information, what is the net benefit/(cost) of this change in policy?JJ Corporation is analyzing its option to restrict its credit terms. Current sales level is P6,000,000, average receivables balance is P500,000, bad debts on sales is 10%. With the new policy, sales will be P5,000,000, average receivables balance will be P200,000, and bad debts on sales will be 2% The variable cost rate is 60% and the effective cost of capital is 13%. Based on these available information, what is the net benefit/(cost) of ihis change in policy?Tara’s Textiles currently has credit sales of $360 million per year and an average collection period of 60 days. Assume that the price of Tara’s products is $60 per unit and that the variable costs are $55 per unit. The firm is considering an accounts receivable change that will result in a 20% increase in sales and a 20% increase in the average collection period. No change in bad debts is expected. The firm’s equal-risk opportunity cost on its investment in accounts receivable is 14%. (Note: Use a 365-day year.) Calculate the additional profit contribution from sales that the firm will realize if it makes the proposed change. What marginal investment in accounts receivable will result? Calculate the cost of the marginal investment in accounts receivable. Should the firm implement the proposed change? What other information would be helpful in your analysis?

- Lewis Enterprises is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed relaxation, sales are expected to increase by 5% from 10,000 to 10,500 units during the coming year; the average collection period is expected to increase from 40 to 55 days; and bad debts are expected to increase from 2% to 4% of sales. The sale price per unit is $39, and the variable cost per unit is $29. The firm's required return on equal-risk investments is 9.4%. Evaluate the proposed relaxation, and make a recommendation to the firm. (Note:Assume a 365-day year.) a. the cost from the increased marginal investment in A/R is? (round to nearest dollar) b. the cost from an increase in bad debts.? (round to nearest dollar) c. compute the net profit from the proposed plan.Serfd Limited is considering a change in credit policy which is expected to increase sales revenue from $240,000 to $356,000 and increase accounts receivable from $20,000 to $89,000 with all other working capital items unaffected. The contribution margin ratio is 30% and Serfd Limited requires a return of 13% on all investments in working capital. What is the minimum expected increase in profit necessary to justify the change in credit policy?Zed’s Textiles currently has Credit Sales of $360 million per year and an Average Collection Period of 60 days. Assume that the price of Zed’s products is $60 per unit and that the Variable Costs are $55 per unit. The firm is considering accounts receivable changes that will result in a 20% increase in sales and a 20% increase in the Average Collection Period. No change in Bad Debts is expected. The firm’s equal-risk Opportunity Cost on its investment in Accounts Receivable is 14%. (Note: Use a 365-day year) A. Calculate the Additional Profit Contribution from sales that the firm will realize if it makes the proposed change. (Format: 1,111,111) B. What Marginal Investment in Accounts Receivable will result? (Format: 1,111,111) C. Calculate the Cost of the Marginal Investment in Accounts Receivable. (Format: 1,111,111)

- ABC Corporation is deciding whether to change the credit term from 1/15, n/60 to 2/10, n/40 to speed up cash collections. Its original forecasted sales and average age of receivables are P7,000,000 and 63 days. With the new credit term, sales would decrease by 5% but the average age of receivables will be 42 days. ABC's variable cost rate is 55% while its weighted average cost of capital is 17%. How much is the benefit from the change in average receivable balance?Lewis Enterprises is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed relaxation, sales are expected to increase by 10% from 12,000 to 13,200 units during the coming year; the average collection period is expected to increase from 50 to 70 days; and bad debts are expected to increase from 1% to 2.5% of sales. The sale price per unit is $41, and the variable cost per unit is $29. The firm's required return on equal-risk investments is 9%. Evaluate the proposed relaxation, and make a recommendation to the firm. (Note: Assume a 365-day year.) The additional profit contrbution from an increase in sales is $ ? (round to the nearest dollar) The cost from the increased marginal investment in A/R is $ ? (round to the nearest dollar)Kelly expects its sales to be $20 million this year under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 65 days; and the bad debt loss percentage is 4%. Also, Kelly’s cost of capital is 14%, and its variable costs total 62% of sales. Since Kelly wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. It is predicted that sales would increase by $600,000, and that 55 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 2 percent. (Hint, use incremental approach table) What are the incremental pre-tax profits from this proposal?

- Kelly expects its sales to be $20 million this year under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 65 days; and the bad debt loss percentage is 4%. Also, Kelly’s cost of capital is 14%, and its variable costs total 62% of sales. Since Kelly wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. It is predicted that sales would increase by $600,000, and that 55 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 2 percent. (Hint, use incremental approach table) What would be the incremental bad debt losses if the change were made? What would be the incremental cost of carrying receivables if the change were made? What are the incremental pre-tax profits from this proposal?A firm is considering relaxing credit standards, which will result in annual sales increasing from P1.5 million to P1.75 million, the cost of annual sales increasing from P1,000,000 to P1,125,000, and the average collection period increasing from 40 to 55 days. The bad debt loss is expected to increase from 1 percent of sales to 1.5 percent of sales. The firm's required return on investments is 20 percent. The firm's cost of marginal investment in accounts receivable is? Format: 11,111.11Edward Enterprises is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed relaxation, sales are expected to increase by 10% from 10,000 to 11,000 units during the coming year, the Average Collection Period is expected increase from 45 to 60 days; and Bad Debts are expected to increase from 1% to 3% of sales. The Sale Price per unit is $40, and the Variable Cost per unit is $31. The firm’s required on equal-risk investment is 25%. A. What is the Net Gain or Los from implementing the Proposed Plan? (Format: 1,111 G or 1,111 L) B. Would you recommend the Proposed Relaxation? (Format: Yes or No)