. Determine the capitalized cost of a small public market if the structure has a fir. ost of P20M, a life of 20 years and a salvage value of P750,000. The annual perating cost is P150,000. Taxes to be paid is P70,000 annually. Use an interest ate of 7.5%.

. Determine the capitalized cost of a small public market if the structure has a fir. ost of P20M, a life of 20 years and a salvage value of P750,000. The annual perating cost is P150,000. Taxes to be paid is P70,000 annually. Use an interest ate of 7.5%.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 5P

Related questions

Question

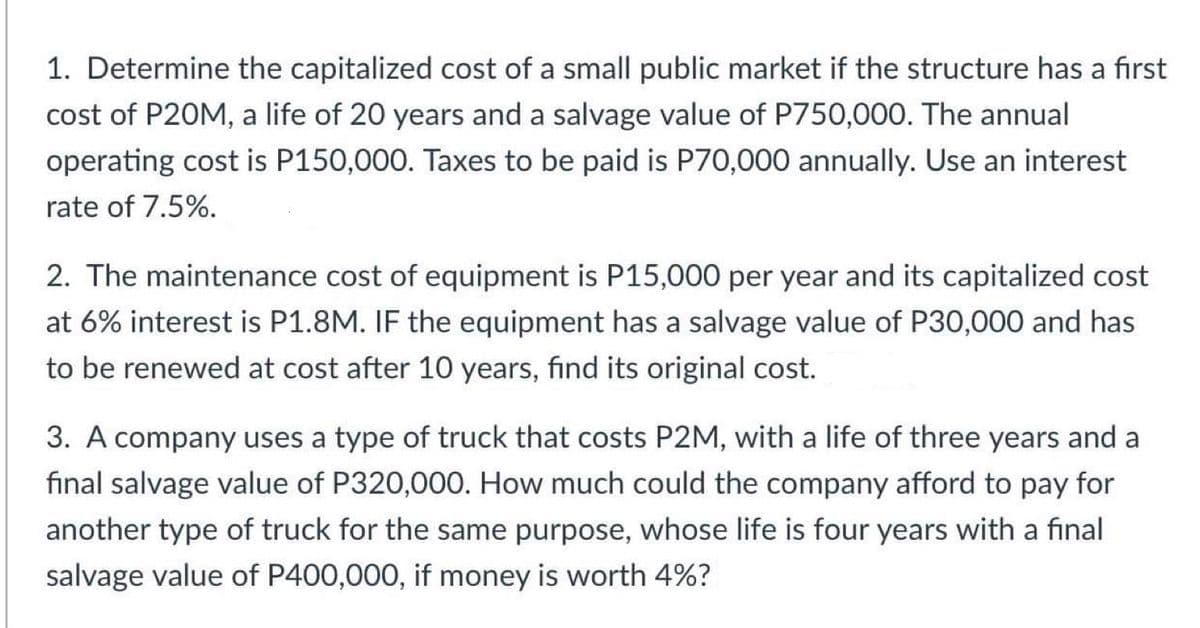

Transcribed Image Text:1. Determine the capitalized cost of a small public market if the structure has a first

cost of P20M, a life of 20 years and a salvage value of P750,000. The annual

operating cost is P150,000. Taxes to be paid is P70,000 annually. Use an interest

rate of 7.5%.

2. The maintenance cost of equipment is P15,000 per year and its capitalized cost

at 6% interest is P1.8M. IF the equipment has a salvage value of P30,000 and has

to be renewed at cost after 10 years, find its original cost.

3. A company uses a type of truck that costs P2M, with a life of three years and a

final salvage value of P320,000. How much could the company afford to pay for

another type of truck for the same purpose, whose life is four years with a final

salvage value of P400,000, if money is worth 4%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College