. Investment Problem Cost of bldg.. =5M Gross Revenue = 9.5 M Operating expense = 4M Nominal interest rate = 12% %3D Ongoing inflation rate = 8% a.) How much is the total profit? b.) Determine the expected rate of return (r) c.) Determine the real interest rate

. Investment Problem Cost of bldg.. =5M Gross Revenue = 9.5 M Operating expense = 4M Nominal interest rate = 12% %3D Ongoing inflation rate = 8% a.) How much is the total profit? b.) Determine the expected rate of return (r) c.) Determine the real interest rate

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 3P

Related questions

Question

please help me analyze and answer the following with formula and explanation please so that i can learn. thank you

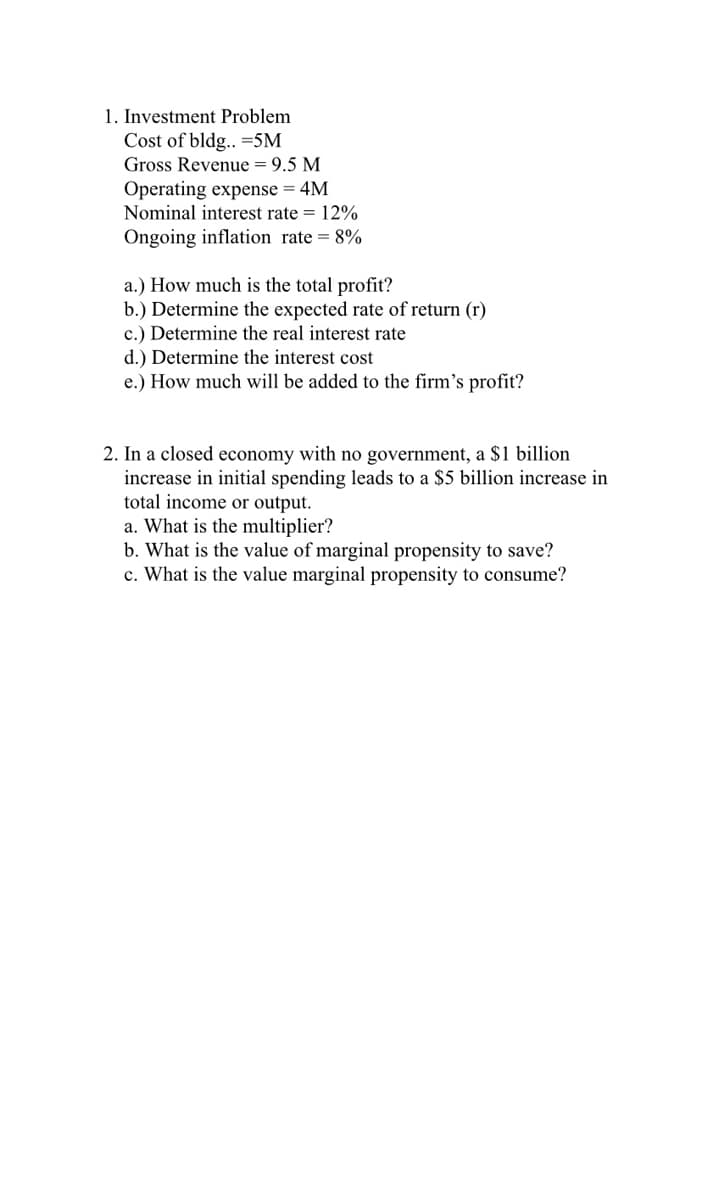

Transcribed Image Text:1. Investment Problem

Cost of bldg.. =5M

Gross Revenue = 9.5 M

Operating expense = 4M

Nominal interest rate = 12%

Ongoing inflation rate = 8%

a.) How much is the total profit?

b.) Determine the expected rate of return (r)

c.) Determine the real interest rate

d.) Determine the interest cost

e.) How much will be added to the firm's profit?

2. In a closed economy with no government, a $1 billion

increase in initial spending leads to a $5 billion increase in

total income or output.

a. What is the multiplier?

b. What is the value of marginal propensity to save?

c. What is the value marginal propensity to consume?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning