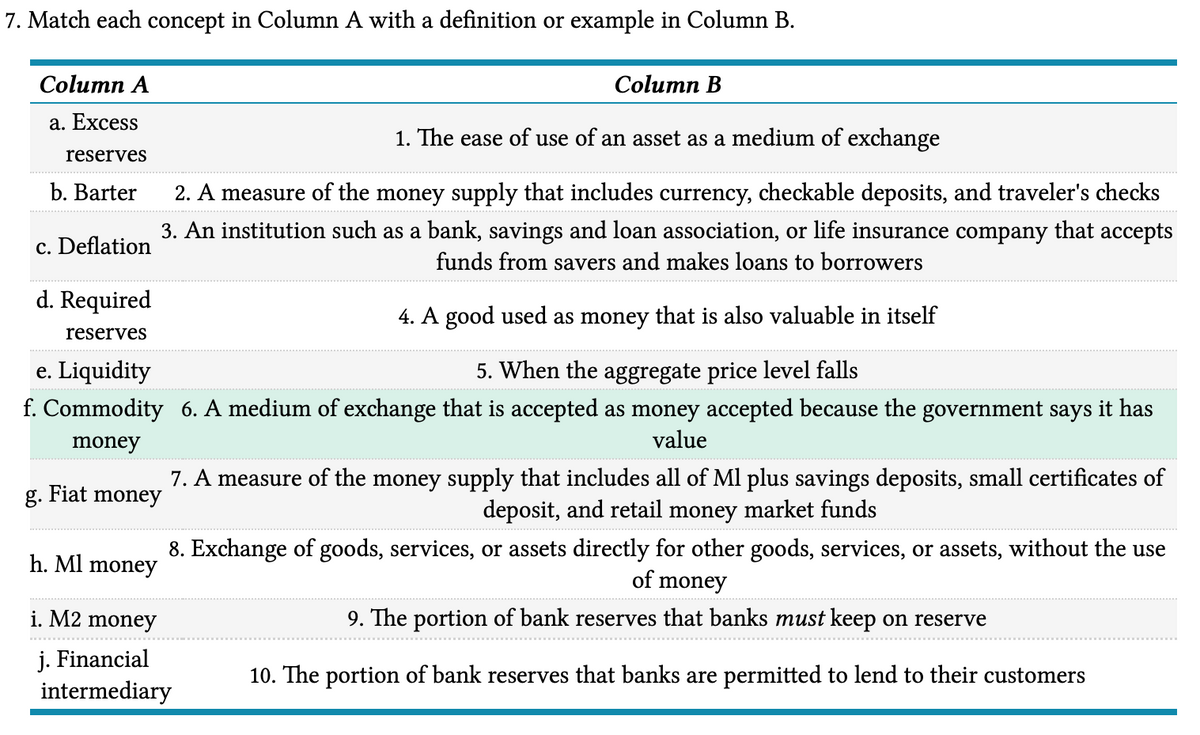

. Match each concept in Column A with a definition or example in Column B. Column A Column B а. Еxcess 1. The ease of use of an asset as a medium of exchange reserves b. Barter 2. A measure of the money supply that includes currency, checkable deposits, and traveler's checks 3. An institution such as a bank, savings and loan association, or life insurance company that accepts funds from savers and makes loans to borrowers c. Deflation d. Required 4. A good used as money that is also valuable in itself reserves e. Liquidity 5. When the aggregate price level falls f. Commodity 6. A medium of exchange that is accepted as money accepted because the government says it has money value 7. A measure of the money supply that includes all of Ml plus savings deposits, small certificates of deposit, and retail money market funds g. Fiat money 8. Exchange of goods, services, or assets directly for other goods, services, or assets, without the use of money h. Ml money i. M2 money 9. The portion of bank reserves that banks must keep on reserve j. Financial intermediary 10. The portion of bank reserves that banks are permitted to lend to their customers

. Match each concept in Column A with a definition or example in Column B. Column A Column B а. Еxcess 1. The ease of use of an asset as a medium of exchange reserves b. Barter 2. A measure of the money supply that includes currency, checkable deposits, and traveler's checks 3. An institution such as a bank, savings and loan association, or life insurance company that accepts funds from savers and makes loans to borrowers c. Deflation d. Required 4. A good used as money that is also valuable in itself reserves e. Liquidity 5. When the aggregate price level falls f. Commodity 6. A medium of exchange that is accepted as money accepted because the government says it has money value 7. A measure of the money supply that includes all of Ml plus savings deposits, small certificates of deposit, and retail money market funds g. Fiat money 8. Exchange of goods, services, or assets directly for other goods, services, or assets, without the use of money h. Ml money i. M2 money 9. The portion of bank reserves that banks must keep on reserve j. Financial intermediary 10. The portion of bank reserves that banks are permitted to lend to their customers

Chapter13: Money And The Financial System

Section: Chapter Questions

Problem 1.4P

Related questions

Question

Please answer fully

Transcribed Image Text:7. Match each concept in Column A with a definition or example in Column B.

Column A

Column B

а. Еxcess

1. The ease of use of an asset as a medium of exchange

reserves

b. Barter

2. A measure of the money supply that includes currency, checkable deposits, and traveler's checks

3. An institution such as a bank, savings and loan association, or life insurance company that accepts

c. Deflation

funds from savers and makes loans to borrowers

d. Required

4. A good used as money that is also valuable in itself

reserves

e. Liquidity

f. Commodity 6. A medium of exchange that is accepted as money accepted because the government says it has

5. When the aggregate price level falls

money

value

7. A measure of the money supply that includes all of Ml plus savings deposits, small certificates of

deposit, and retail money market funds

8. Exchange of goods, services, or assets directly for other goods, services, or assets, without the use

g. Fiat money

h. Ml money

of money

i. M2 money

9. The portion of bank reserves that banks must keep on reserve

j. Financial

intermediary

10. The portion of bank reserves that banks are permitted to lend to their customers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning