1. The velocity of money represents: (a) Whether individuals are increasing or decreasing the quantity of money spent in an economy (b) The quantity of money available in an economy (c) The level of prices determined by the equation of exchange (d) How often money is used in a specific period of time (e) Whether currency is accepted as a medium of exchange in an economy

1. The velocity of money represents: (a) Whether individuals are increasing or decreasing the quantity of money spent in an economy (b) The quantity of money available in an economy (c) The level of prices determined by the equation of exchange (d) How often money is used in a specific period of time (e) Whether currency is accepted as a medium of exchange in an economy

Chapter15: Monetary Theory And Policy

Section: Chapter Questions

Problem 3.7P

Related questions

Question

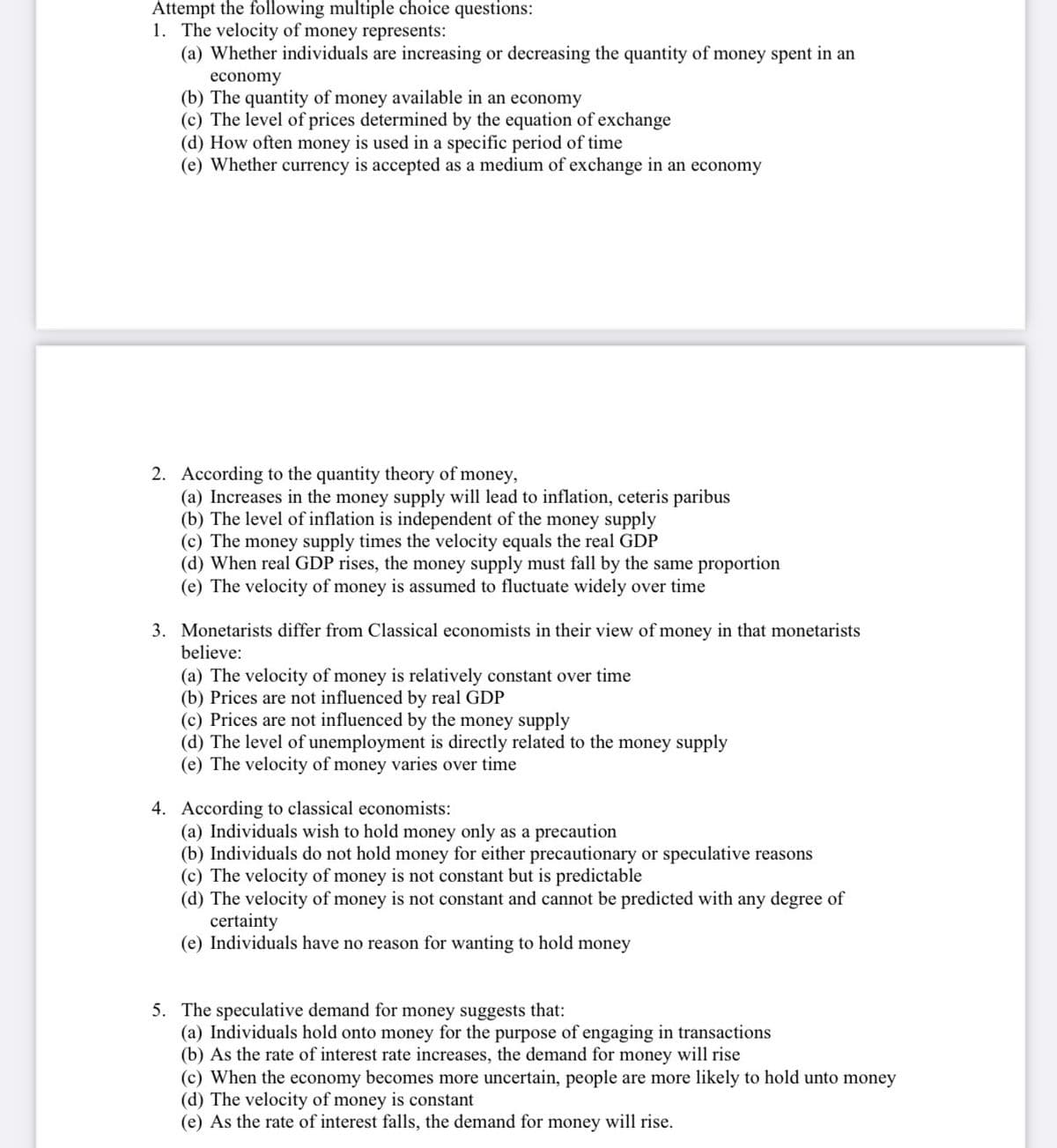

Transcribed Image Text:Attempt the following multiple choice questions:

1. The velocity of money represents:

(a) Whether individuals are increasing or decreasing the quantity of money spent in an

economy

(b) The quantity of money available in an economy

(c) The level of prices determined by the equation of exchange

(d) How often money is used in a specific period of time

(e) Whether currency is accepted as a medium of exchange in an economy

2. According to the quantity theory of money,

(a) Increases in the money supply will lead to inflation, ceteris paribus

(b) The level of inflation is independent of the money supply

(c) The money supply times the velocity equals the real GDP

(d) When real GDP rises, the money supply must fall by the same proportion

(e) The velocity of money is assumed to fluctuate widely over time

3. Monetarists differ from Classical economists in their view of money in that monetarists

believe:

(a) The velocity of money is relatively constant over time

(b) Prices are not influenced by real GDP

(c) Prices are not influenced by the money supply

(d) The level of unemployment is directly related to the money supply

(e) The velocity of money varies over time

4. According to classical economists:

(a) Individuals wish to hold money only as a precaution

(b) Individuals do not hold money for either precautionary or speculative reasons

(c) The velocity of money is not constant but is predictable

(d) The velocity of money is not constant and cannot be predicted with any degree of

certainty

(e) Individuals have no reason for wanting to hold money

5. The speculative demand for money suggests that:

(a) Individuals hold onto money for the purpose of engaging in transactions

(b) As the rate of interest rate increases, the demand for money will rise

(c) When the economy becomes more uncertain, people are more likely to hold unto money

(d) The velocity of money is constant

(e) As the rate of interest falls, the demand for money will rise.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc