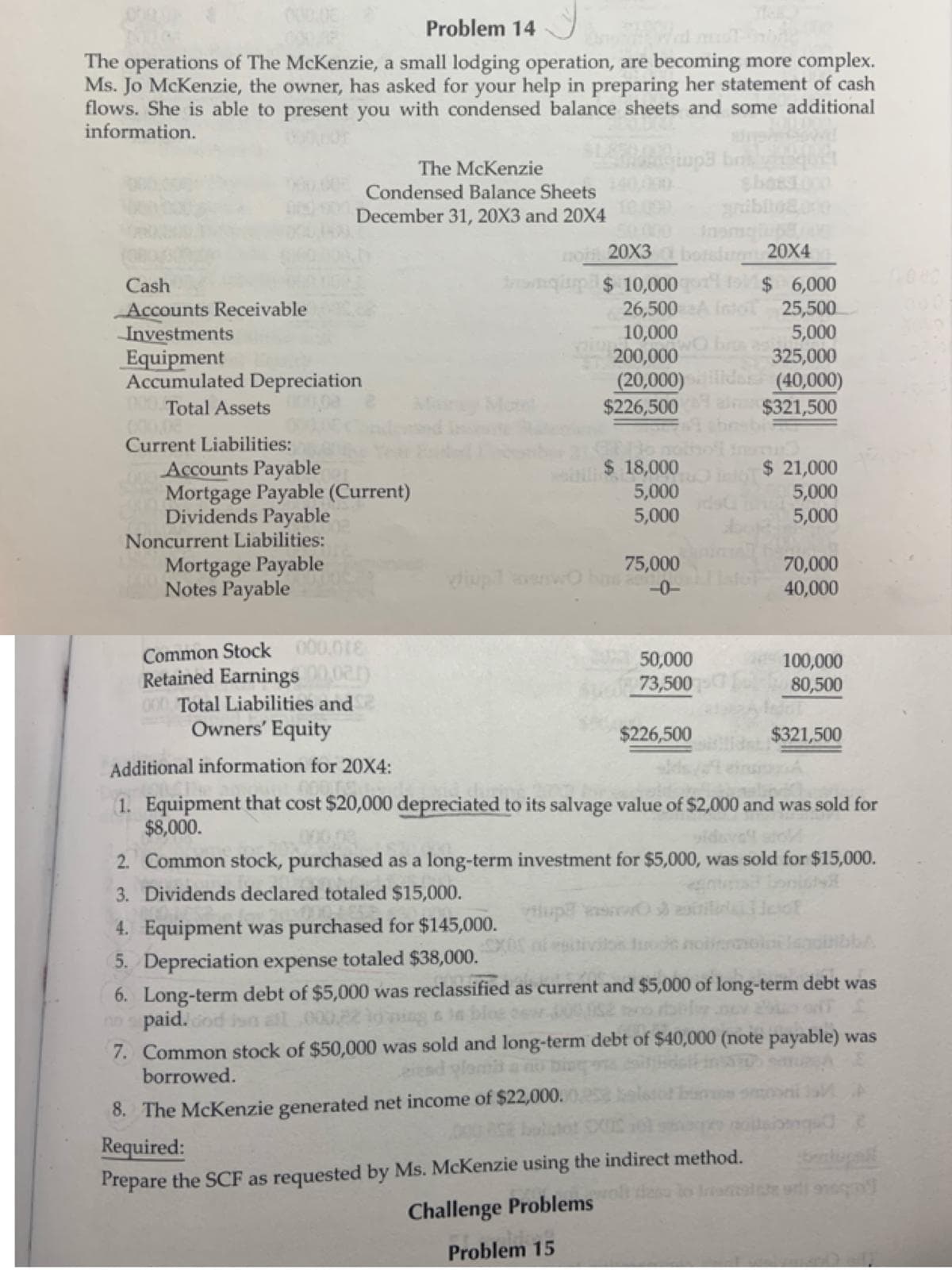

0008 Problem 14 The operations of The McKenzie, a small lodging operation, are becoming more complex. Ms. Jo McKenzie, the owner, has asked for your help in preparing her statement of cash flows. She is able to present you with condensed balance sheets and some additional information. The McKenzie Condensed Balance Sheets ibl m noin 20X3 bodn 20X4 December 31, 20X3 and 20X4 0000 $ 6,000 25,500 5,000 325,000 Cash 10,000 26,500 int 10,000 200,000 as (20,000) $226,500 Accounts Receivable Investments Equipment Accumulated Depreciation (40,000) $321,500 Ma Total Assets GO0.08 Current Liabilities: l$ 18,000 5,000 5,000 Accounts Payable Mortgage Payable (Current) Dividends Payable $21,000 5,000 5,000 Noncurrent Liabilities: Mortgage Payable Notes Payable 75,000 70,000 40,000 Common Stock 00.01 Retained Earnings0 Total Liabilities and Owners' Equity 50,000 100,000 73,500 80,500 $226,500 $321,500 Additional information for 20X4: 1. Equipment that cost $20,000 depreciated to its salvage value of $2,000 and was sold for $8,000. 2. Common stock, purchased as a long-term investment for $5,000, was sold for $15,000. 3. Dividends declared totaled $15,000. up 4. Equipment was purchased for $145,000. 5. Depreciation expense totaled $38,000. Long-term debt of $5,000 was reclassified as current and $5,000 of long-term debt was dod isa all 00022 6. 7. Common stock of $50,000 was sold and long-term debt of $40,000 (note payable) was borrowed. 8. The McKenzie generated net income of $22,000. Required: Prepare the SCF as requested by Ms. McKenzie using the indirect method. o Iatste s 9 Challenge Problems Problem 15

0008 Problem 14 The operations of The McKenzie, a small lodging operation, are becoming more complex. Ms. Jo McKenzie, the owner, has asked for your help in preparing her statement of cash flows. She is able to present you with condensed balance sheets and some additional information. The McKenzie Condensed Balance Sheets ibl m noin 20X3 bodn 20X4 December 31, 20X3 and 20X4 0000 $ 6,000 25,500 5,000 325,000 Cash 10,000 26,500 int 10,000 200,000 as (20,000) $226,500 Accounts Receivable Investments Equipment Accumulated Depreciation (40,000) $321,500 Ma Total Assets GO0.08 Current Liabilities: l$ 18,000 5,000 5,000 Accounts Payable Mortgage Payable (Current) Dividends Payable $21,000 5,000 5,000 Noncurrent Liabilities: Mortgage Payable Notes Payable 75,000 70,000 40,000 Common Stock 00.01 Retained Earnings0 Total Liabilities and Owners' Equity 50,000 100,000 73,500 80,500 $226,500 $321,500 Additional information for 20X4: 1. Equipment that cost $20,000 depreciated to its salvage value of $2,000 and was sold for $8,000. 2. Common stock, purchased as a long-term investment for $5,000, was sold for $15,000. 3. Dividends declared totaled $15,000. up 4. Equipment was purchased for $145,000. 5. Depreciation expense totaled $38,000. Long-term debt of $5,000 was reclassified as current and $5,000 of long-term debt was dod isa all 00022 6. 7. Common stock of $50,000 was sold and long-term debt of $40,000 (note payable) was borrowed. 8. The McKenzie generated net income of $22,000. Required: Prepare the SCF as requested by Ms. McKenzie using the indirect method. o Iatste s 9 Challenge Problems Problem 15

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter5: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 6CE

Related questions

Question

My text book is Hospitality Industry Financial Accounting (4th edition). I am in chapter 17 -- Statement of

Problem 14 asks me to prepare the SCF as requested by Ms. McKenzie using the indirect method.

The scenario will be show inthe image.

Transcribed Image Text:0008

Problem 14

The operations of The McKenzie, a small lodging operation, are becoming more complex.

Ms. Jo McKenzie, the owner, has asked for your help in preparing her statement of cash

flows. She is able to present you with condensed balance sheets and some additional

information.

The McKenzie

Condensed Balance Sheets

ibl

m

noin 20X3 bodn 20X4

December 31, 20X3 and 20X4

0000

$ 6,000

25,500

5,000

325,000

Cash

10,000

26,500 int

10,000

200,000 as

(20,000)

$226,500

Accounts Receivable

Investments

Equipment

Accumulated Depreciation

(40,000)

$321,500

Ma

Total Assets

GO0.08

Current Liabilities:

l$ 18,000

5,000

5,000

Accounts Payable

Mortgage Payable (Current)

Dividends Payable

$21,000

5,000

5,000

Noncurrent Liabilities:

Mortgage Payable

Notes Payable

75,000

70,000

40,000

Common Stock 00.01

Retained Earnings0

Total Liabilities and

Owners' Equity

50,000

100,000

73,500

80,500

$226,500

$321,500

Additional information for 20X4:

1. Equipment that cost $20,000 depreciated to its salvage value of $2,000 and was sold for

$8,000.

2. Common stock, purchased as a long-term investment for $5,000, was sold for $15,000.

3. Dividends declared totaled $15,000.

up

4. Equipment was purchased for $145,000.

5. Depreciation expense totaled $38,000.

Long-term debt of $5,000 was reclassified as current and $5,000 of long-term debt was

dod isa all 00022

6.

7. Common stock of $50,000 was sold and long-term debt of $40,000 (note payable) was

borrowed.

8. The McKenzie generated net income of $22,000.

Required:

Prepare the SCF as requested by Ms. McKenzie using the indirect method.

o Iatste s 9

Challenge Problems

Problem 15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning