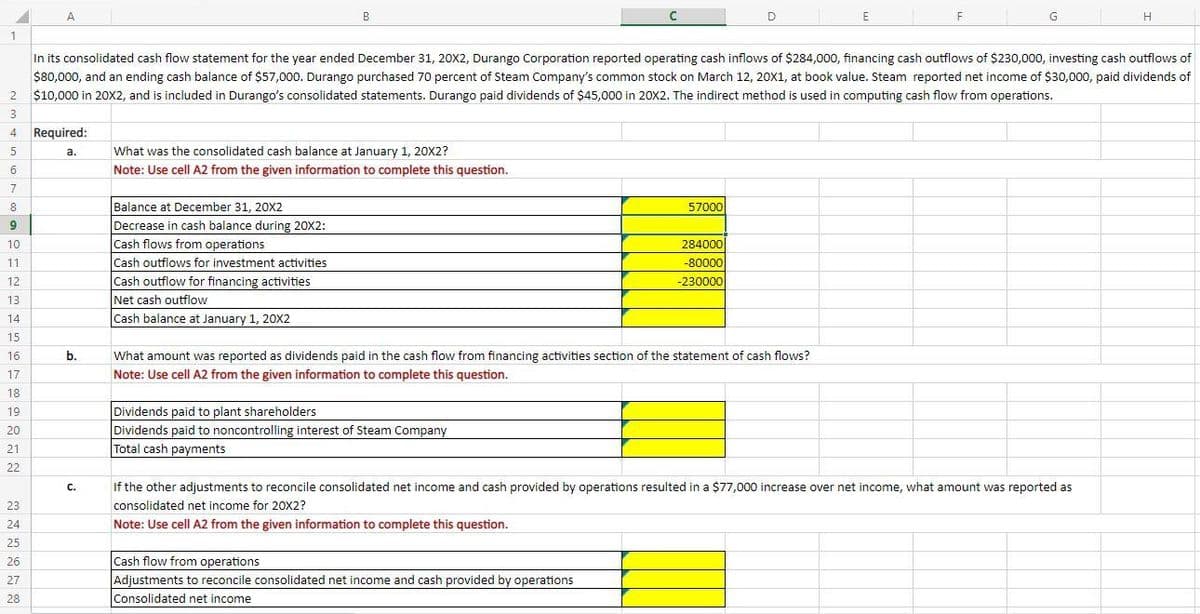

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 In its consolidated cash flow statement for the year ended December 31, 20X2, Durango Corporation reported operating cash inflows of $284,000, financing cash outflows of $230,000, investing cash $80,000, and an ending cash balance of $57,000. Durango purchased 70 percent of Steam Company's common stock on March 12, 20X1, at book value. Steam reported net income of $30,000, paid. $10,000 in 20X2, and is included in Durango's consolidated statements. Durango paid dividends of $45,000 in 20x2. The indirect method is used in computing cash flow from operations. Required: a. b. C. What was the consolidated cash balance at January 1, 20X2? Note: Use cell A2 from the given information to complete this question. Balance at December 31, 20X2 Decrease in cash balance during 20X2: Cash flows from operations Cash outflows for investment activities Cash outflow for financing activities Net cash outflow Cash balance at January 1, 20X2 57000 Dividends paid to plant shareholders Dividends paid to noncontrolling interest of Steam Company Total cash payments 284000 -80000 -230000 What amount was reported as dividends paid in the cash flow from financing activities section of the statement of cash flows? Note: Use cell A2 from the given information to complete this question. If the other adjustments to reconcile consolidated net income and cash provided by operations resulted in a $77,000 increase over net income, what amount was reported as consolidated net income for 20X2? Note: Use cell A2 from the given information to complete this question.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 In its consolidated cash flow statement for the year ended December 31, 20X2, Durango Corporation reported operating cash inflows of $284,000, financing cash outflows of $230,000, investing cash $80,000, and an ending cash balance of $57,000. Durango purchased 70 percent of Steam Company's common stock on March 12, 20X1, at book value. Steam reported net income of $30,000, paid. $10,000 in 20X2, and is included in Durango's consolidated statements. Durango paid dividends of $45,000 in 20x2. The indirect method is used in computing cash flow from operations. Required: a. b. C. What was the consolidated cash balance at January 1, 20X2? Note: Use cell A2 from the given information to complete this question. Balance at December 31, 20X2 Decrease in cash balance during 20X2: Cash flows from operations Cash outflows for investment activities Cash outflow for financing activities Net cash outflow Cash balance at January 1, 20X2 57000 Dividends paid to plant shareholders Dividends paid to noncontrolling interest of Steam Company Total cash payments 284000 -80000 -230000 What amount was reported as dividends paid in the cash flow from financing activities section of the statement of cash flows? Note: Use cell A2 from the given information to complete this question. If the other adjustments to reconcile consolidated net income and cash provided by operations resulted in a $77,000 increase over net income, what amount was reported as consolidated net income for 20X2? Note: Use cell A2 from the given information to complete this question.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 27BE

Related questions

Question

Transcribed Image Text:1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

A

Required:

a.

b.

C.

B

What was the consolidated cash balance at January 1, 20X2?

Note: Use cell A2 from the given information to complete this question.

Balance at December 31, 20X2

Decrease in cash balance during 20X2:

Cash flows from operations

Cash outflows for investment activities

In its consolidated cash flow statement for the year ended December 31, 20X2, Durango Corporation reported operating cash inflows of $284,000, financing cash outflows of $230,000, investing cash outflows of

$80,000, and an ending cash balance of $57,000. Durango purchased 70 percent of Steam Company's common stock on March 12, 20X1, at book value. Steam reported net income of $30,000, paid dividends of

$10,000 in 20X2, and is included in Durango's consolidated statements. Durango paid dividends of $45,000 in 20X2. The indirect method is used in computing cash flow from operations.

Cash outflow for financing activities

Net cash outflow

Cash balance at January 1, 20X2

Dividends paid to plant shareholders

Dividends paid to noncontrolling interest of Steam Company

Total cash payments

57000

D

284000

-80000

-230000

What amount was reported as dividends paid in the cash flow from financing activities section of the statement of cash flows?

Note: Use cell A2 from the given information to complete this question.

Cash flow from operations

Adjustments to reconcile consolidated net income and cash provided by operations

Consolidated net income

E

F

G

If the other adjustments to reconcile consolidated net income and cash provided by operations resulted in a $77,000 increase over net income, what amount was reported as

consolidated net income for 20X2?

Note: Use cell A2 from the given information to complete this question.

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning