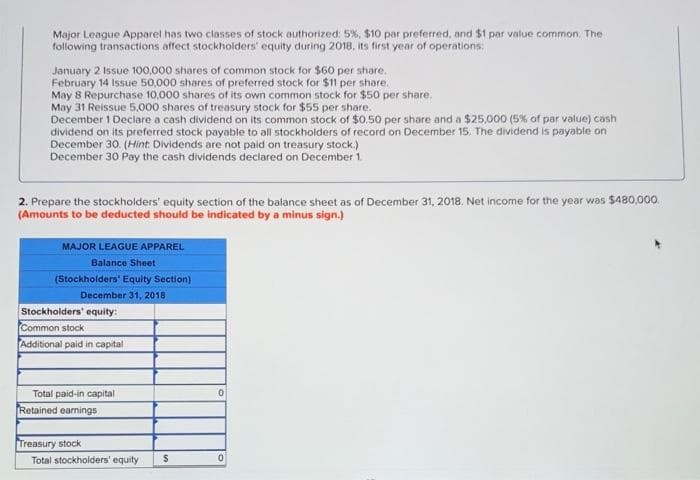

Major League Apparel has two classes of stock authorized: 5%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2018, its first year of operations: January 2 Issue 100,000 shares of common stock for $60 per share. February 14 Issue 50,000 shares of preferred stock for $11 per share. May 8 Repurchase 10,000 shares of its own common stock for $50 per share. May 31 Reissue 5,000 shares of treasury stock for $55 per share. December 1 Declare a cash dividend on its common stock of $0.50 per share and a $25,000 (5% of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2018. Net income for the year was $480,000 (Amounts to be deducted should be indicated by a minus sign.) MAJOR LEAGUE APPAREL Balance Sheet (Stockholders' Equity Section) December 31, 2018 Stockholders' equity: Common stock Additional paid in capital Total paid-in capital Retained earnings Treasury stock Total stockholders' equity s 0 0

Major League Apparel has two classes of stock authorized: 5%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2018, its first year of operations: January 2 Issue 100,000 shares of common stock for $60 per share. February 14 Issue 50,000 shares of preferred stock for $11 per share. May 8 Repurchase 10,000 shares of its own common stock for $50 per share. May 31 Reissue 5,000 shares of treasury stock for $55 per share. December 1 Declare a cash dividend on its common stock of $0.50 per share and a $25,000 (5% of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2018. Net income for the year was $480,000 (Amounts to be deducted should be indicated by a minus sign.) MAJOR LEAGUE APPAREL Balance Sheet (Stockholders' Equity Section) December 31, 2018 Stockholders' equity: Common stock Additional paid in capital Total paid-in capital Retained earnings Treasury stock Total stockholders' equity s 0 0

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.6E

Related questions

Question

Transcribed Image Text:Major League Apparel has two classes of stock authorized: 5%, $10 par preferred, and $1 par value common. The

following transactions affect stockholders' equity during 2018, its first year of operations:

January 2 Issue 100,000 shares of common stock for $60 per share.

February 14 Issue 50,000 shares of preferred stock for $11 per share..

May 8 Repurchase 10,000 shares of its own common stock for $50 per share.

May 31 Reissue 5,000 shares of treasury stock for $55 per share.

December 1 Declare a cash dividend on its common stock of $0.50 per share and a $25,000 (5% of par value) cash

dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on

December 30. (Hint: Dividends are not paid on treasury stock.)

December 30 Pay the cash dividends declared on December 1.

2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2018. Net income for the year was $480,000.

(Amounts to be deducted should be indicated by a minus sign.)

MAJOR LEAGUE APPAREL

Balance Sheet

(Stockholders' Equity Section)

December 31, 2018

Stockholders' equity:

Common stock

Additional paid in capital

Total paid-in capital

Retained earnings

Treasury stock

Total stockholders' equity

$

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning