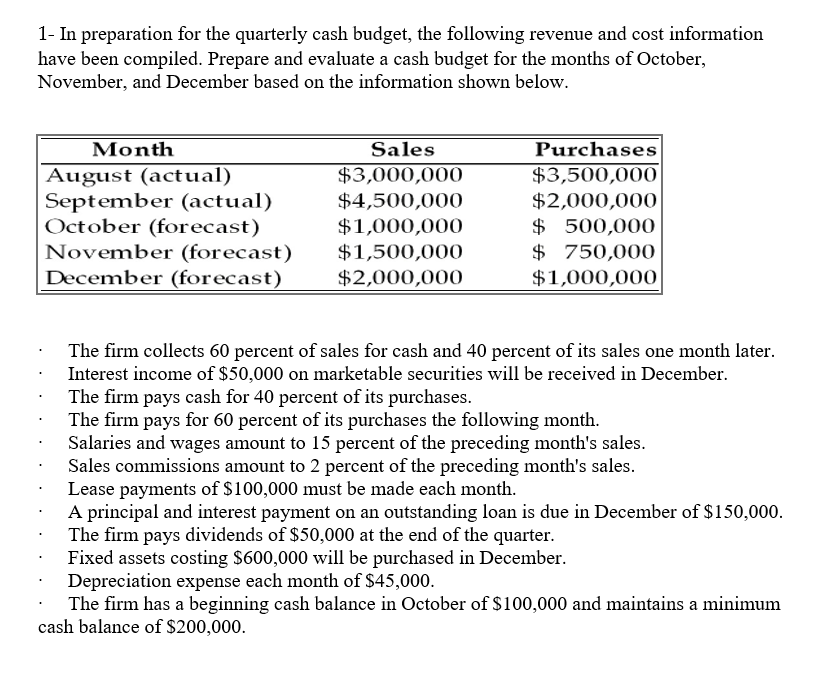

1- In preparation for the quarterly cash budget, the following revenue and cost information have been compiled. Prepare and evaluate a cash budget for the months of October, November, and December based on the information shown below. Month Sales Purchases August (actual) September (actual) October (forecast) November (forecast) December (forecast) $3,500,000 $2,000,000 $ 500,000 $ 750,000 $1,000,000| $3,000,000 $4,500,000 $1,000,000 $1,500,000 $2,000,000 The firm collects 60 percent of sales for cash and 40 percent of its sales one month later. Interest income of $50,000 on marketable securities will be received in December. The firm pays cash for 40 percent of its purchases. The firm pays for 60 percent of its purchases the following month. Salaries and wages amount to 15 percent of the preceding month's sales. Sales commissions amount to 2 percent of the preceding month's sales. Lease payments of $100,000 must be made each month. A principal and interest payment on an outstanding loan is due in December of $150,000. The firm pays dividends of $50,000 at the end of the quarter. Fixed assets costing $600,000 will be purchased in December. Depreciation expense each month of $45,000. The firm has a beginning cash balance in October of $100,000 and maintains a minimum cash balance of $200,000.

1- In preparation for the quarterly cash budget, the following revenue and cost information have been compiled. Prepare and evaluate a cash budget for the months of October, November, and December based on the information shown below. Month Sales Purchases August (actual) September (actual) October (forecast) November (forecast) December (forecast) $3,500,000 $2,000,000 $ 500,000 $ 750,000 $1,000,000| $3,000,000 $4,500,000 $1,000,000 $1,500,000 $2,000,000 The firm collects 60 percent of sales for cash and 40 percent of its sales one month later. Interest income of $50,000 on marketable securities will be received in December. The firm pays cash for 40 percent of its purchases. The firm pays for 60 percent of its purchases the following month. Salaries and wages amount to 15 percent of the preceding month's sales. Sales commissions amount to 2 percent of the preceding month's sales. Lease payments of $100,000 must be made each month. A principal and interest payment on an outstanding loan is due in December of $150,000. The firm pays dividends of $50,000 at the end of the quarter. Fixed assets costing $600,000 will be purchased in December. Depreciation expense each month of $45,000. The firm has a beginning cash balance in October of $100,000 and maintains a minimum cash balance of $200,000.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 5PB: Cash budget The controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for...

Related questions

Question

Can you solve question that is in the picture, thanks

Transcribed Image Text:1- In preparation for the quarterly cash budget, the following revenue and cost information

have been compiled. Prepare and evaluate a cash budget for the months of October,

November, and December based on the information shown below.

Month

Sales

Purchases

August (actual)

September (actual)

October (forecast)

November (forecast)

December (forecast)

$3,000,000

$4,500,000

$1,000,000

$1,500,000

$2,000,000

$3,500,000

$2,000,000

$ 500,000

$ 750,000

$1,000,000

The firm collects 60 percent of sales for cash and 40 percent of its sales one month later.

Interest income of $50,000 on marketable securities will be received in December.

The firm pays cash for 40 percent of its purchases.

The firm pays for 60 percent of its purchases the following month.

Salaries and wages amount to 15 percent of the preceding month's sales.

Sales commissions amount to 2 percent of the preceding month's sales.

Lease payments of $100,000 must be made each month.

A principal and interest payment on an outstanding loan is due in December of $150,000.

The firm pays dividends of $50,000 at the end of the quarter.

Fixed assets costing $600,000 will be purchased in December.

Depreciation expense each month of $45,000.

The firm has a beginning cash balance in October of $100,000 and maintains a minimum

cash balance of $200,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning