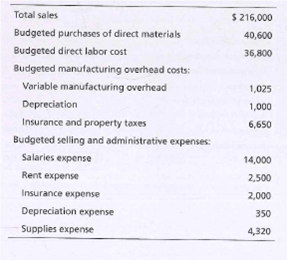

Total sales $ 216,000 Budgeted purchases of direct materials 40,600 Budgeted direct labor cost 36,800 Budgeted manufacturing overhead costs: Variable manufacturing overhead 1,025 Depreciation 1,000 Insurance and property taxes 6,650 Budgeted selling and administrative expenses: Salaries expense 14,000 Rent expense 2,500 Insurance expense 2,000 Depreciation expense 350 Supplies expense 4,320

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

A Preparing a financial budget—schedule of cash receipts, schedule of cash payments,

Puckett Company has provided the following budget information for the first quarter of 2018:

Additional data related to the first quarter of 2018 for Puckett Company:

- Capital expenditures include $41,000 for new manufacturing equipment to be purchased and paid in the first quarter.

- Cash receipts are 75% of sales in the quarter of the sale and 25% in the quarter following the sale.

- Direct materials purchases are paid 50% in the quarter purchased and 50% in the next quarter.

- Direct labor, manufacturing

overhead , and selling and administrative costs are paid in the quarter incurred. - Income tax expense for the first quarter is projected at $49,000 and is paid in the quarter incurred.

- Puckett Company expects to have adequate cash funds and does not anticipate borrowing in the first quarter.

- The December 31, 2017, balance in Cash is $25,000, in Accounts Receivable is $21,600, and in Accounts Payable is $16,500.

Requirements

- Prepare Puckett Company’s schedule of cash receipts from customers and schedule of cash payments for the first quarter of 2018.

- Prepare Puckett Company’s cash budget for the first quarter of 2018.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images