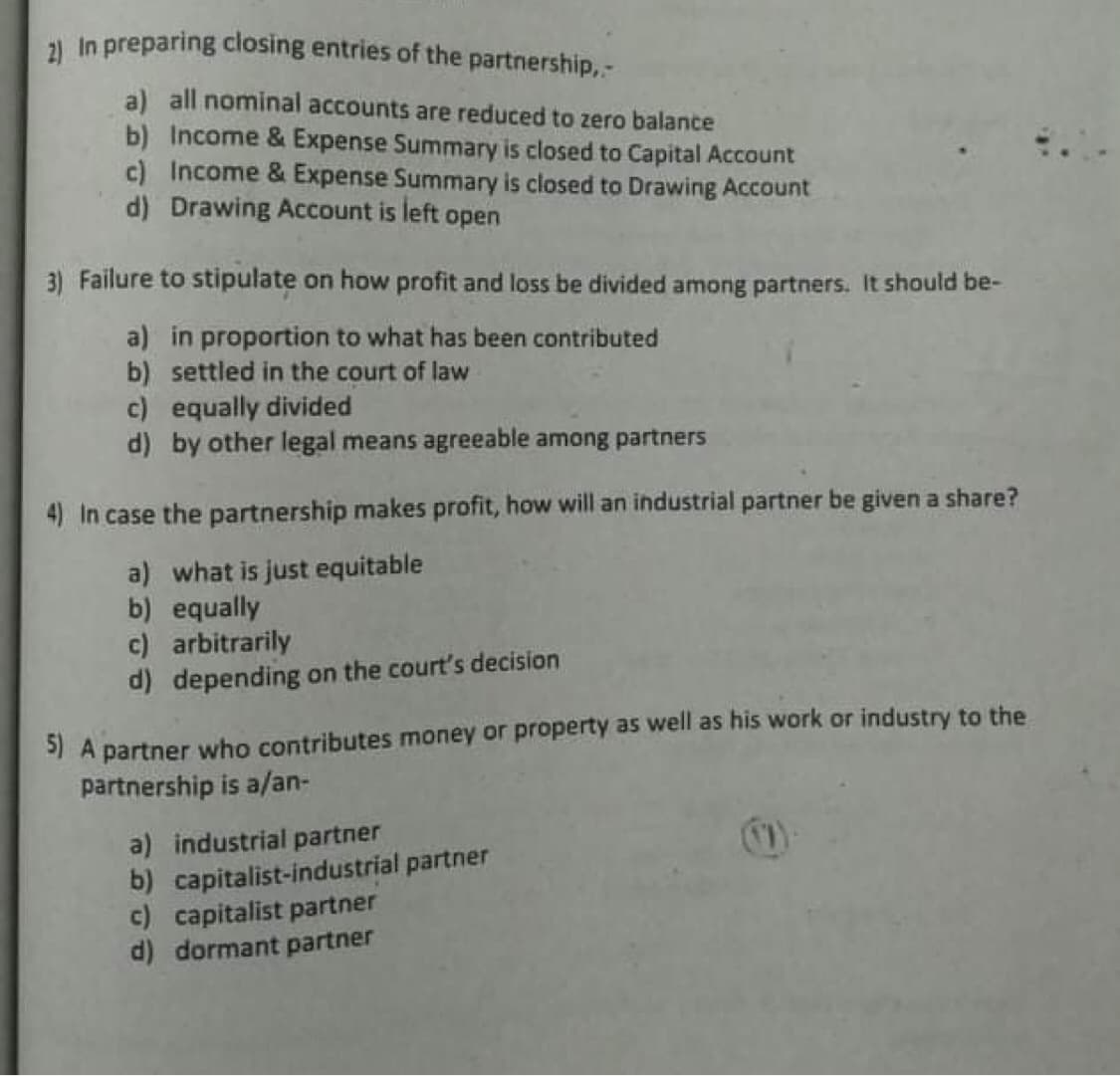

1 In preparing closing entries of the partnership,- a) all nominal accounts are reduced to zero balance b) Income & Expense Summary is closed to Capital Account c) Income & Expense Summary is closed to Drawing Account d) Drawing Account is left open 3) Failure to stipulate on how profit and loss be divided among partners. It should be- a) in proportion to what has been contributed b) settled in the court of law c) equally divided d) by other legal means agreeable among partners 4) In case the partnership makes profit, how will an industrial partner be given a share? a) what is just equitable b) equally c) arbitrarily d) depending on the court's decision 5) A partner who contributes money or property as well as his work or industry to the partnership is a/an- a) industrial partner b) capitalist-industrial partner c) capitalist partner d) dormant partner

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Step by step

Solved in 2 steps