s $17,000 non-el Canadian corpoi rate 41% (29% fec ederal and provir % of the gross-up deral and provin

s $17,000 non-el Canadian corpoi rate 41% (29% fec ederal and provir % of the gross-up deral and provin

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 48P

Related questions

Question

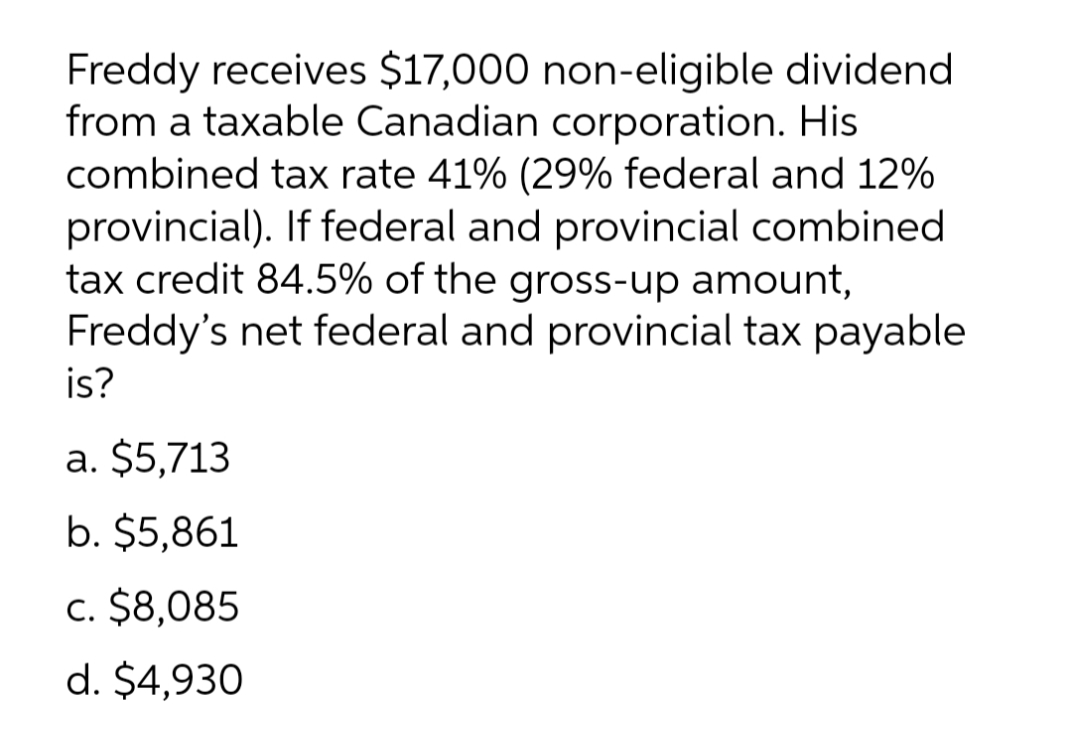

Transcribed Image Text:Freddy receives $17,000 non-eligible dividend

from a taxable Canadian corporation. His

combined tax rate 41% (29% federal and 12%

provincial). If federal and provincial combined

tax credit 84.5% of the gross-up amount,

Freddy's net federal and provincial tax payable

is?

a. $5,713

b. $5,861

c. $8,085

d. $4,930

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you