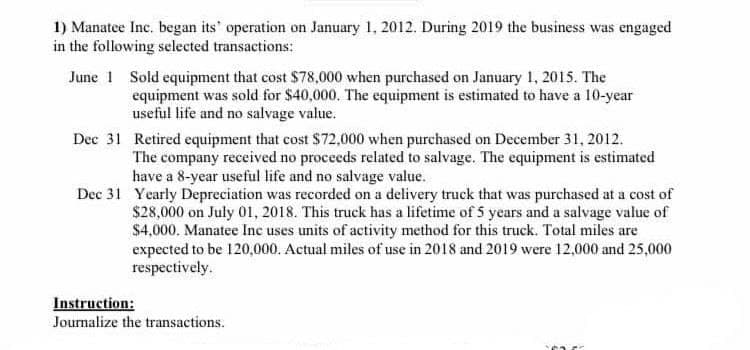

1) Manatee Inc. began its' operation on January 1, 2012. During 2019 the business was engaged in the following selected transactions: June 1 Sold equipment that cost $78,000 when purchased on January 1, 2015. The equipment was sold for $40,000. The equipment is estimated to have a 10-year useful life and no salvage value. Dec 31 Retired equipment that cost $72,000 when purchased on December 31, 2012. The company received no procceds related to salvage. The equipment is estimated have a 8-year useful life and no salvage value. Dec 31 Yearly Depreciation was recorded on a delivery truck that was purchased at a cost of $28,000 on July 01, 2018. This truck has a lifetime of 5 years and a salvage value of $4,000, Manatee Inc uses units of activity method for this truck. Total miles are expected to be 120,000. Actual miles of use in 2018 and 2019 were 12,000 and 25,000 respectively. Instruction: Journalize the transactions.

1) Manatee Inc. began its' operation on January 1, 2012. During 2019 the business was engaged in the following selected transactions: June 1 Sold equipment that cost $78,000 when purchased on January 1, 2015. The equipment was sold for $40,000. The equipment is estimated to have a 10-year useful life and no salvage value. Dec 31 Retired equipment that cost $72,000 when purchased on December 31, 2012. The company received no procceds related to salvage. The equipment is estimated have a 8-year useful life and no salvage value. Dec 31 Yearly Depreciation was recorded on a delivery truck that was purchased at a cost of $28,000 on July 01, 2018. This truck has a lifetime of 5 years and a salvage value of $4,000, Manatee Inc uses units of activity method for this truck. Total miles are expected to be 120,000. Actual miles of use in 2018 and 2019 were 12,000 and 25,000 respectively. Instruction: Journalize the transactions.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 8P: At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the...

Related questions

Question

Transcribed Image Text:1) Manatee Inc. began its" operation on January 1, 2012. During 2019 the business was engaged

in the following selected transactions:

June 1 Sold equipment that cost $78,000 when purchased on January 1, 2015. The

equipment was sold for $40,000. The equipment is estimated to have a 10-year

useful life and no salvage value.

Dec 31 Retired equipment that cost $72,000 when purchased on December 31, 2012.

The company received no proceeds related to salvage. The equipment is estimated

have a 8-year useful life and no salvage value.

Dec 31 Yearly Depreciation was recorded on a delivery truck that was purchased at a cost of

$28,000 on July 01, 2018. This truck has a lifetime of 5 years and a salvage value of

$4,000. Manatee Inc uses units of activity method for this truck. Total miles are

expected to be 120,000. Actual miles of use in 2018 and 2019 were 12,000 and 25,000

respectively.

Instruction:

Journalize the transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning