1) Provide the necessary consolidation journal entries for the year ended 30 June 2000 are not required. (ii) Post your journal entries to the consolidation worksheet on 30 June 2000 a consolidated amounts for Share capital, Retained earnings and Revaluation Surplus. K Ltd Y I td Cr Consolidated

1) Provide the necessary consolidation journal entries for the year ended 30 June 2000 are not required. (ii) Post your journal entries to the consolidation worksheet on 30 June 2000 a consolidated amounts for Share capital, Retained earnings and Revaluation Surplus. K Ltd Y I td Cr Consolidated

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 24E

Related questions

Question

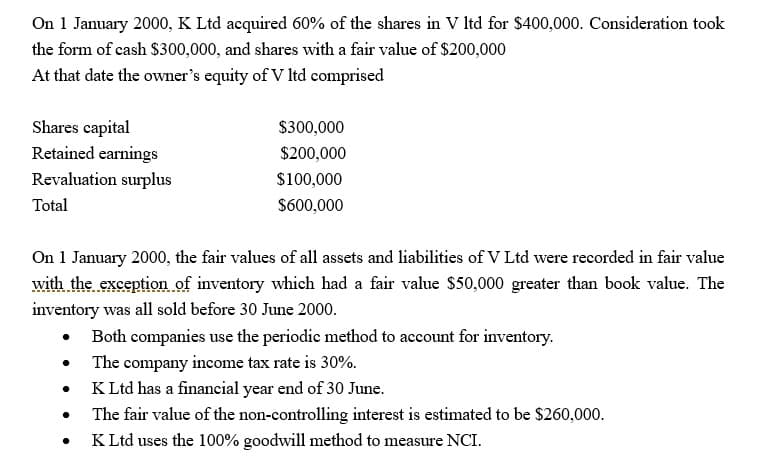

Transcribed Image Text:On 1 January 2000, K Ltd acquired 60% of the shares in V ltd for $400,000. Consideration took

the form of cash $300,000, and shares with a fair value of $200,000

At that date the owner's equity of V ltd comprised

Shares capital

$300,000

Retained earnings

$200,000

$100,000

Revaluation surplus

Total

$600,000

On 1 January 2000, the fair values of all assets and liabilities of V Ltd were recorded in fair value

with the exception of inventory which had a fair value $50,000 greater than book value. The

inventory was all sold before 30 June 2000.

• Both companies use the periodic method to account for inventory.

●

The company income tax rate is 30%.

K Ltd has a financial year end of 30 June.

●

The fair value of the non-controlling interest is estimated to be $260,000.

K Ltd uses the 100% goodwill method to measure NCI.

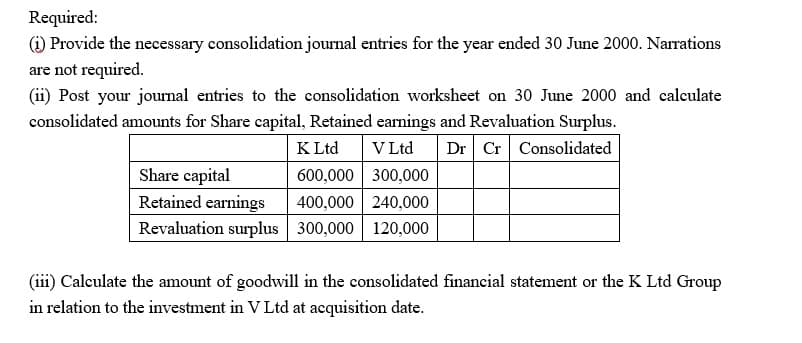

Transcribed Image Text:Required:

(1) Provide the necessary consolidation journal entries for the year ended 30 June 2000. Narrations

are not required.

(ii) Post your journal entries to the consolidation worksheet on 30 June 2000 and calculate

consolidated amounts for Share capital, Retained earnings and Revaluation Surplus.

K Ltd V Ltd Dr Cr Consolidated

Share capital

600,000

300,000

Retained earnings

400,000 240,000

Revaluation surplus 300,000 120,000

(iii) Calculate the amount of goodwill in the consolidated financial statement or the K Ltd Group

in relation to the investment in V Ltd at acquisition date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning