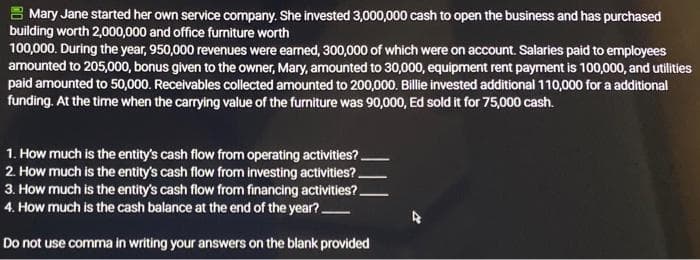

Mary Jane started her own service company. She invested 3,000,000 cash to open the business and has purchased building worth 2,000,000 and office furniture worth 100,000. During the year, 950,000 revenues were earned, 300,000 of which were on account. Salaries paid to employees amounted to 205,000, bonus given to the owner, Mary, amounted to 30,000, equipment rent payment is 100,000, and utilities paid amounted to 50,000. Receivables collected amounted to 200,000. Billie invested additional 110,000 for a additional funding. At the time when the carrying value of the furniture was 90,000, Ed sold it for 75,000 cash. 1. How much is the entity's cash flow from operating activities? 2. How much is the entity's cash flow from investing activities?. 3. How much is the entity's cash flow from financing activities?__ A

Mary Jane started her own service company. She invested 3,000,000 cash to open the business and has purchased building worth 2,000,000 and office furniture worth 100,000. During the year, 950,000 revenues were earned, 300,000 of which were on account. Salaries paid to employees amounted to 205,000, bonus given to the owner, Mary, amounted to 30,000, equipment rent payment is 100,000, and utilities paid amounted to 50,000. Receivables collected amounted to 200,000. Billie invested additional 110,000 for a additional funding. At the time when the carrying value of the furniture was 90,000, Ed sold it for 75,000 cash. 1. How much is the entity's cash flow from operating activities? 2. How much is the entity's cash flow from investing activities?. 3. How much is the entity's cash flow from financing activities?__ A

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 2MCQ

Related questions

Question

Transcribed Image Text:Mary Jane started her own service company. She invested 3,000,000 cash to open the business and has purchased

building worth 2,000,000 and office furniture worth

100,000. During the year, 950,000 revenues were earned, 300,000 of which were on account. Salaries paid to employees

amounted to 205,000, bonus given to the owner, Mary, amounted to 30,000, equipment rent payment is 100,000, and utilities

paid amounted to 50,000. Receivables collected amounted to 200,000. Billie invested additional 110,000 for a additional

funding. At the time when the carrying value of the furniture was 90,000, Ed sold it for 75,000 cash.

1. How much is the entity's cash flow from operating activities?

2. How much is the entity's cash flow from investing activities?

3. How much is the entity's cash flow from financing activities?

4. How much is the cash balance at the end of the year?

Do not use comma in writing your answers on the blank provided

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College