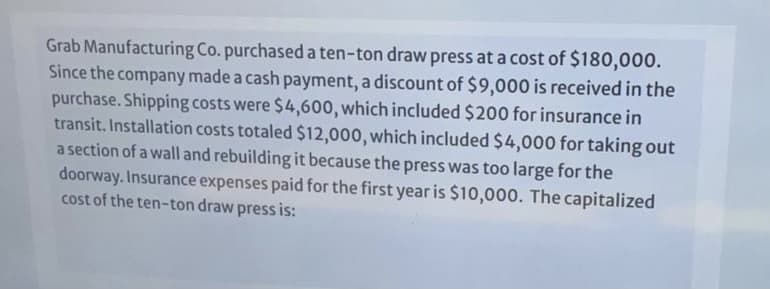

Grab Manufacturing Co. purchased a ten-ton draw press at a cost of $180,000. Since the company made a cash payment, a discount of $9,000 is received in the purchase. Shipping costs were $4,600, which included $200 for insurance in transit. Installation costs totaled $12,000, which included $4,000 for taking out a section of a wall and rebuilding it because the press was too large for the doorway. Insurance expenses paid for the first year is $10,000. The capitalized cost of the ten-ton draw press is:

Grab Manufacturing Co. purchased a ten-ton draw press at a cost of $180,000. Since the company made a cash payment, a discount of $9,000 is received in the purchase. Shipping costs were $4,600, which included $200 for insurance in transit. Installation costs totaled $12,000, which included $4,000 for taking out a section of a wall and rebuilding it because the press was too large for the doorway. Insurance expenses paid for the first year is $10,000. The capitalized cost of the ten-ton draw press is:

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 2EB: Johnson, Incorporated had the following transactions during the year: Purchased a building for...

Related questions

Question

Transcribed Image Text:Grab Manufacturing Co. purchased a ten-ton draw press at a cost of $180,000.

Since the company made a cash payment, a discount of $9,000 is received in the

purchase. Shipping costs were $4,600, which included $200 for insurance in

transit. Installation costs totaled $12,000, which included $4,000 for taking out

a section of a wall and rebuilding it because the press was too large for the

doorway. Insurance expenses paid for the first year is $10,000. The capitalized

cost of the ten-ton draw press is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning