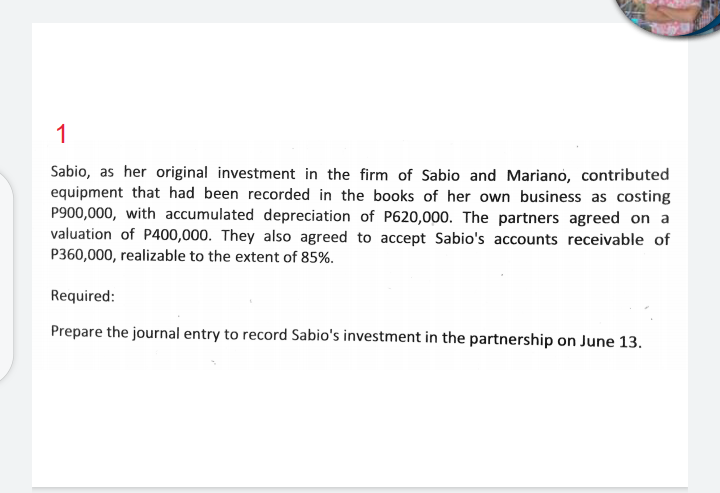

1 Sabio, as her original investment in the firm of Sabio and Mariano, contributed equipment that had been recorded in the books of her own business as costing P900,000, with accumulated depreciation of P620,000. The partners agreed on a valuation of P400,000. They also agreed to accept Sabio's accounts receivable of P360,000, realizable to the extent of 85%. Required: Prepare the journal entry to record Sabio's investment in the partnership on June 13.

1 Sabio, as her original investment in the firm of Sabio and Mariano, contributed equipment that had been recorded in the books of her own business as costing P900,000, with accumulated depreciation of P620,000. The partners agreed on a valuation of P400,000. They also agreed to accept Sabio's accounts receivable of P360,000, realizable to the extent of 85%. Required: Prepare the journal entry to record Sabio's investment in the partnership on June 13.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1PB: Consider the following situations and determine (1) which type of liability should be recognized...

Related questions

Question

100%

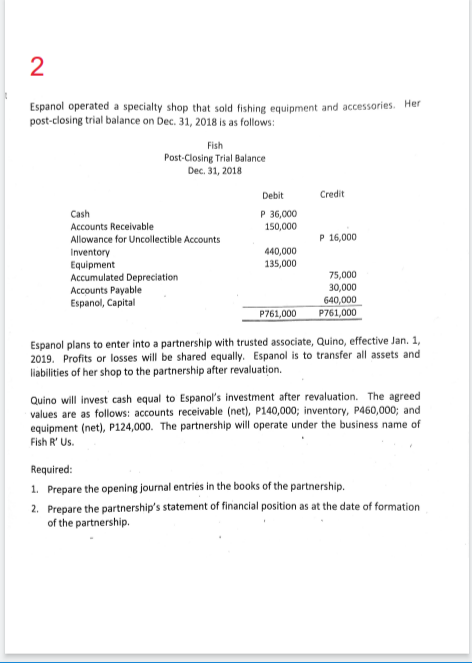

Transcribed Image Text:2

Espanol operated a specialty shop that sold fishing equipment and accessories. Her

post-closing trial balance on Dec. 31, 2018 is as follows:

Fish

Post-Closing Trial Balance

Dec. 31, 2018

Debit

Credit

Cash

P 36,000

Accounts Receivable

Allowance for Uncollectible Accounts

150,000

P 16,000

440,000

Inventory

Equipment

Accumulated Depreciation

135,000

75,000

30,000

Accounts Payable

Espanol, Capital

640,000

P761,000

P761,000

Espanol plans to enter into a partnership with trusted associate, Quino, effective Jan. 1,

2019. Profits or losses will be shared equally. Espanol is to transfer all assets and

liabilities of her shop to the partnership after revaluation.

Quino will invest cash equal to Espanol's investment after revaluation. The agreed

values are as follows: accounts receivable (net), P140,000; inventory, P460,000; and

equipment (net), P124,000. The partnership will operate under the business name of

Fish R' Us.

Required:

1. Prepare the opening journal entries in the books of the partnership.

2. Prepare the partnership's statement of financial position as at the date of formation

of the partnership.

Transcribed Image Text:1

Sabio, as her original investment in the firm of Sabio and Mariano, contributed

equipment that had been recorded in the books of her own business as costing

P900,000, with accumulated depreciation of P620,000. The partners agreed on a

valuation of P400,000. They also agreed to accept Sabio's accounts receivable of

P360,000, realizable to the extent of 85%.

Required:

Prepare the journal entry to record Sabio's investment in the partnership on June 13.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning