1) The type of the risk that can be eliminated by diversification is called A) market risk. B) unique risk. C) interest rate risk. D) default risk. 2) Learn and Earn Company is financed entirely by common stock that is priced to offer a 2 percent expected rate of return. The stock price is $60 and the earnings per share are $12. TH company wishes to repurchase 50 percent of the stock and substitutes an equal value of del yielding 8 percent. Suppose that before refinancing, an investor owned 100 shares of Learn ar Earn common stock. What should he do if he wishes to ensure that risk and expected return c his investment are unaffected by this refinancing? A) Borrow $3,000 and buy 50 more shares. B) Continue to hold 100 shares. C) Sell 50 shares and purchase $3,000 of 8 percent debt (bonds). D) Sell 8 percent of his stock and invest in bonds. 3) A stock return's beta measures A) the stock's covariance with the risk-free asset. B) the change in the stock's return for a given change in the market return. C) the return on the stock. D) the standard deviation on the stock's return.

1) The type of the risk that can be eliminated by diversification is called A) market risk. B) unique risk. C) interest rate risk. D) default risk. 2) Learn and Earn Company is financed entirely by common stock that is priced to offer a 2 percent expected rate of return. The stock price is $60 and the earnings per share are $12. TH company wishes to repurchase 50 percent of the stock and substitutes an equal value of del yielding 8 percent. Suppose that before refinancing, an investor owned 100 shares of Learn ar Earn common stock. What should he do if he wishes to ensure that risk and expected return c his investment are unaffected by this refinancing? A) Borrow $3,000 and buy 50 more shares. B) Continue to hold 100 shares. C) Sell 50 shares and purchase $3,000 of 8 percent debt (bonds). D) Sell 8 percent of his stock and invest in bonds. 3) A stock return's beta measures A) the stock's covariance with the risk-free asset. B) the change in the stock's return for a given change in the market return. C) the return on the stock. D) the standard deviation on the stock's return.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter15: Capital Structure Decisions

Section: Chapter Questions

Problem 11P: The Rivoli Company has no debt outstanding, and its financial position is given by the following...

Related questions

Question

Question 2

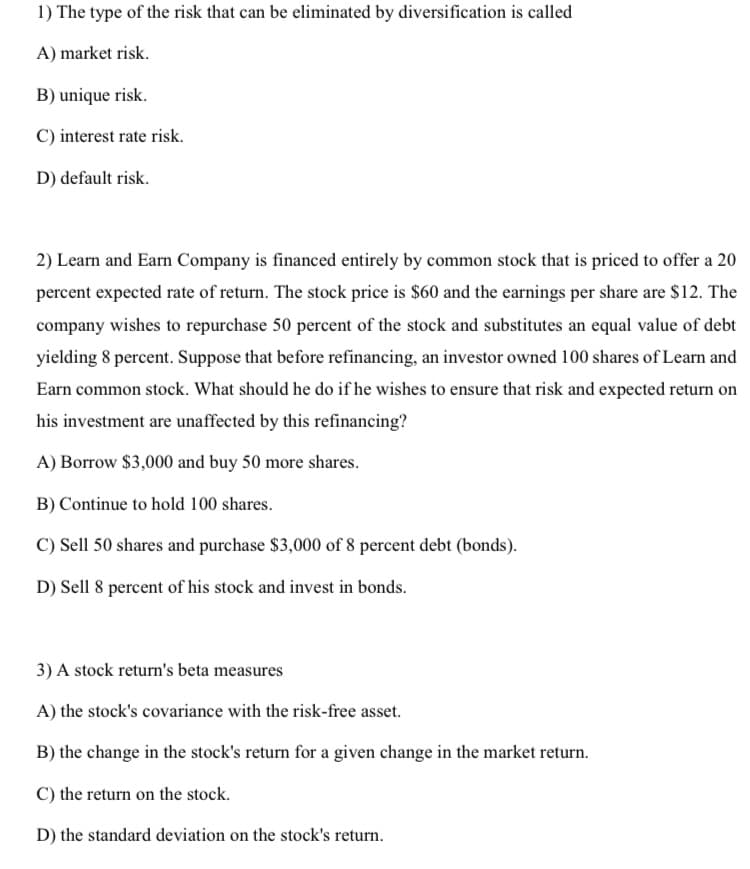

Transcribed Image Text:1) The type of the risk that can be eliminated by diversification is called

A) market risk.

B) unique risk.

C) interest rate risk.

D) default risk.

2) Learn and Earn Company is financed entirely by common stock that is priced to offer a 20

percent expected rate of return. The stock price is $60 and the earnings per share are $12. The

company wishes to repurchase 50 percent of the stock and substitutes an equal value of debt

yielding 8 percent. Suppose that before refinancing, an investor owned 100 shares of Learn and

Earn common stock. What should he do if he wishes to ensure that risk and expected return on

his investment are unaffected by this refinancing?

A) Borrow $3,000 and buy 50 more shares.

B) Continue to hold 100 shares.

C) Sell 50 shares and purchase $3,000 of 8 percent debt (bonds).

D) Sell 8 percent of his stock and invest in bonds.

3) A stock return's beta measures

A) the stock's covariance with the risk-free asset.

B) the change in the stock's return for a given change in the market return.

C) the return on the stock.

D) the standard deviation on the stock's return.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you