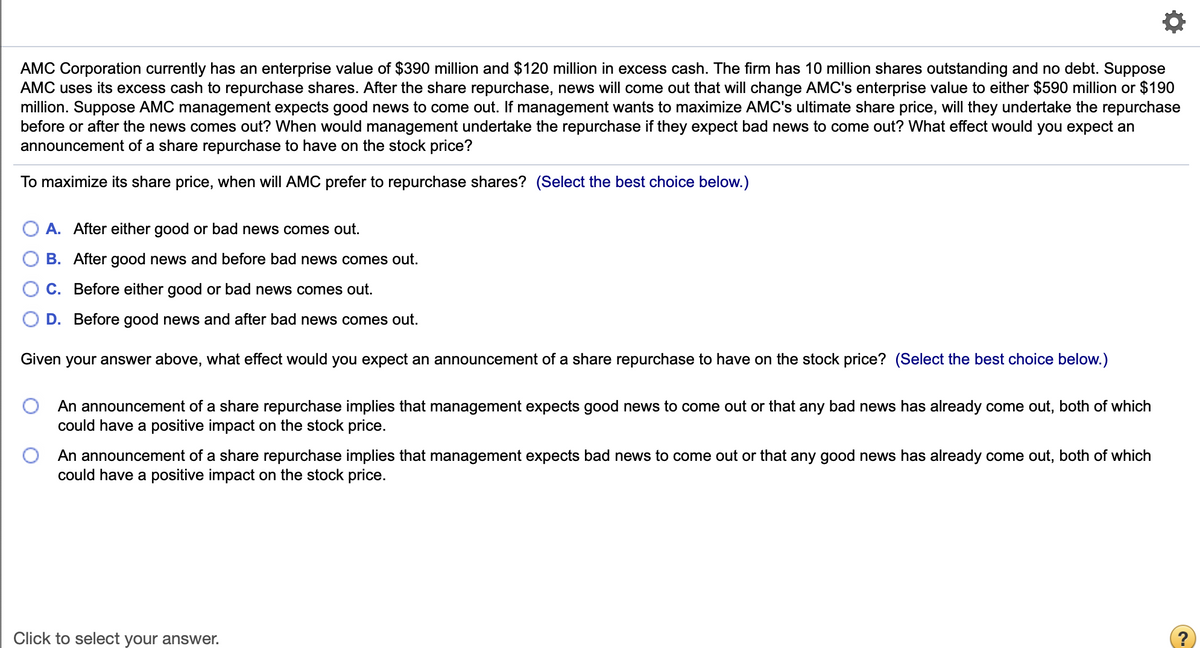

AMC Corporation currently has an enterprise value of $390 million and $120 million in excess cash. The firm has 10 million shares outstanding and no debt. Suppose AMC uses its excess cash to repurchase shares. After the share repurchase, news will come out that will change AMC's enterprise value to either $590 million or $190 million. Suppose AMC management expects good news to come out. If management wants to maximize AMC's ultimate share price, will they undertake the repurchase before or after the news comes out? When would management undertake the repurchase if they expect bad news to come out? What effect would you expect an announcement of a share repurchase to have on the stock price? To maximize its share price, when will AMC prefer to repurchase shares? (Select the best choice below.) O A. After either good or bad news comes out. O B. After good news and before bad news comes out. O C. Before either good or bad news comes out. O D. Before good news and after bad news comes out. Given your answer above, what effect would you expect an announcement of a share repurchase to have on the stock price? (Select the best choice below.) An announcement of a share repurchase implies that management expects good news to come out or that any bad news has already come out, both of which could have a positive impact on the stock price. O An announcement of a share repurchase implies that management expects bad news to come out or that any good news has already come out, both of which could have a positive impact on the stock price.

AMC Corporation currently has an enterprise value of $390 million and $120 million in excess cash. The firm has 10 million shares outstanding and no debt. Suppose AMC uses its excess cash to repurchase shares. After the share repurchase, news will come out that will change AMC's enterprise value to either $590 million or $190 million. Suppose AMC management expects good news to come out. If management wants to maximize AMC's ultimate share price, will they undertake the repurchase before or after the news comes out? When would management undertake the repurchase if they expect bad news to come out? What effect would you expect an announcement of a share repurchase to have on the stock price? To maximize its share price, when will AMC prefer to repurchase shares? (Select the best choice below.) O A. After either good or bad news comes out. O B. After good news and before bad news comes out. O C. Before either good or bad news comes out. O D. Before good news and after bad news comes out. Given your answer above, what effect would you expect an announcement of a share repurchase to have on the stock price? (Select the best choice below.) An announcement of a share repurchase implies that management expects good news to come out or that any bad news has already come out, both of which could have a positive impact on the stock price. O An announcement of a share repurchase implies that management expects bad news to come out or that any good news has already come out, both of which could have a positive impact on the stock price.

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 1lM

Related questions

Question

Transcribed Image Text:AMC Corporation currently has an enterprise value of $390 million and $120 million in excess cash. The firm has 10 million shares outstanding and no debt. Suppose

AMC uses its excess cash to repurchase shares. After the share repurchase, news will come out that will change AMC's enterprise value to either $590 million or $190

million. Suppose AMC management expects good news to come out. If management wants to maximize AMC's ultimate share price, will they undertake the repurchase

before or after the news comes out? When would management undertake the repurchase if they expect bad news to come out? What effect would you expect an

announcement of a share repurchase to have on the stock price?

To maximize its share price, when will AMC prefer to repurchase shares? (Select the best choice below.)

O A. After either good or bad news comes out.

B. After good news and before bad news comes out.

C. Before either good or bad news comes out.

D. Before good news and after bad news comes out.

Given your answer above, what effect would you expect an announcement of a share repurchase to have on the stock price? (Select the best choice below.)

An announcement of a share repurchase implies that management expects good news to come out or that any bad news has already come out, both of which

could have a positive impact on the stock price.

An announcement of a share repurchase implies that management expects bad news to come out or that any good news has already come out, both of which

could have a positive impact on the stock price.

Click to select your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning