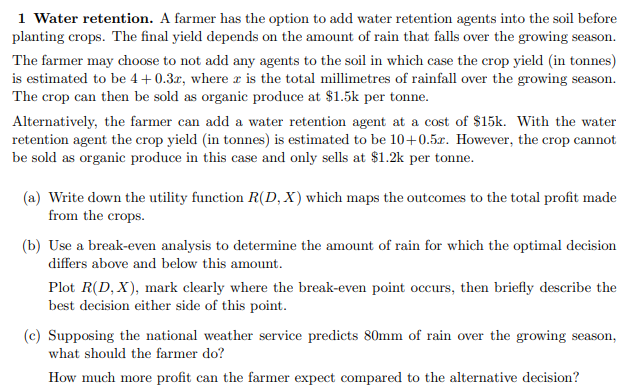

1 Water retention. A farmer has the option to add water retention agents into the soil before planting crops. The final yield depends on the amount of rain that falls over the growing season. The farmer may choose to not add any agents to the soil in which case the crop yield (in tonnes) is estimated to be 4+0.3.r, where r is the total millimetres of rainfall over the growing season. The crop can then be sold as organic produce at $1.5k per tonne. Alternatively, the farmer can add a water retention agent at a cost of $15k. With the water retention agent the crop yield (in tonnes) is estimated to be 10+0.5x. However, the crop cannot be sold as organic produce in this case and only sells at $1.2k per tonne. (a) Write down the utility function R(D, X) which maps the outcomes to the total profit made from the crops. (b) Use a break-even analysis to determine the amount of rain for which the optimal decision differs above and below this amount. Plot R(D, X), mark clearly where the break-even point occurs, then briefly describe the best decision either side of this point.

1 Water retention. A farmer has the option to add water retention agents into the soil before planting crops. The final yield depends on the amount of rain that falls over the growing season. The farmer may choose to not add any agents to the soil in which case the crop yield (in tonnes) is estimated to be 4+0.3.r, where r is the total millimetres of rainfall over the growing season. The crop can then be sold as organic produce at $1.5k per tonne. Alternatively, the farmer can add a water retention agent at a cost of $15k. With the water retention agent the crop yield (in tonnes) is estimated to be 10+0.5x. However, the crop cannot be sold as organic produce in this case and only sells at $1.2k per tonne. (a) Write down the utility function R(D, X) which maps the outcomes to the total profit made from the crops. (b) Use a break-even analysis to determine the amount of rain for which the optimal decision differs above and below this amount. Plot R(D, X), mark clearly where the break-even point occurs, then briefly describe the best decision either side of this point.

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 13CQ

Related questions

Question

Just a and b please

Transcribed Image Text:1 Water retention. A farmer has the option to add water retention agents into the soil before

planting crops. The final yield depends on the amount of rain that falls over the growing season.

The farmer may choose to not add any agents to the soil in which case the crop yield (in tonnes)

is estimated to be 4+0.3r, where r is the total millimetres of rainfall over the growing season.

The crop can then be sold as organic produce at $1.5k per tonne.

Alternatively, the farmer can add a water retention agent at a cost of $15k. With the water

retention agent the crop yield (in tonnes) is estimated to be 10+0.5x. However, the crop cannot

be sold as organic produce in this case and only sells at $1.2k per tonne.

(a) Write down the utility function R(D, X) which maps the outcomes to the total profit made

from the crops.

(b) Use a break-even analysis to determine the amount of rain for which the optimal decision

differs above and below this amount.

Plot R(D, X), mark clearly where the break-even point occurs, then briefly describe the

best decision either side of this point.

(c) Supposing the national weather service predicts 80mm of rain over the growing season,

what should the farmer do?

How much more profit can the farmer expect compared to the alternative decision?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning