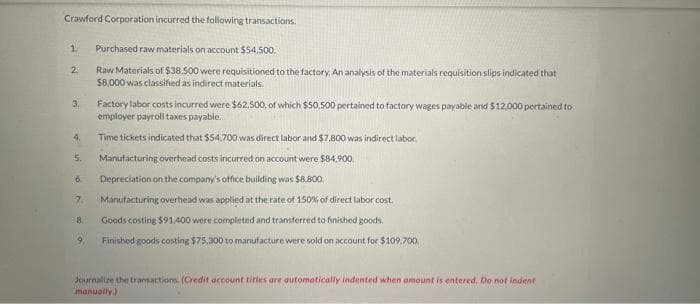

1. 2 3. 4 5. 6 7. 8 9. rd Corporation incurred the following transactions. Purchased raw materials on account $54,500. Raw Materials of $38.500 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $8,000 was classified as indirect materials. Factory labor costs incurred were $62.500, of which $50.500 pertained to factory wages payable and $12,000 pertained to employer payroll taxes payable. Time tickets indicated that $54,700 was direct labor and $7,800 was indirect labor Manufacturing overhead costs incurred on account were $84,900 Depreciation on the company's office building was $8.800. Manufacturing overhead was applied at the rate of 150% of direct labor cost. Goods costing $91,400 were completed and transferred to finished goods. Finished goods costing $75,300 to manufacture were sold on account for $109,700, Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

1. 2 3. 4 5. 6 7. 8 9. rd Corporation incurred the following transactions. Purchased raw materials on account $54,500. Raw Materials of $38.500 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $8,000 was classified as indirect materials. Factory labor costs incurred were $62.500, of which $50.500 pertained to factory wages payable and $12,000 pertained to employer payroll taxes payable. Time tickets indicated that $54,700 was direct labor and $7,800 was indirect labor Manufacturing overhead costs incurred on account were $84,900 Depreciation on the company's office building was $8.800. Manufacturing overhead was applied at the rate of 150% of direct labor cost. Goods costing $91,400 were completed and transferred to finished goods. Finished goods costing $75,300 to manufacture were sold on account for $109,700, Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter1: Introduction To Cost Accounting

Section: Chapter Questions

Problem 9P: Glasson Manufacturing Co. produces only one product. You have obtained the following information...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Crawford Corporation incurred the following transactions.

1.

2

3.

4.

5.

6

7.

8

9.

Purchased raw materials on account $54,500.

Raw Materials of $38.500 were requisitioned to the factory. An analysis of the materials requisition slips indicated that

$8,000 was classified as indirect materials.

Factory labor costs incurred were $62,500, of which $50,500 pertained to factory wages payable and $12,000 pertained to

employer payroll taxes payable.

Time tickets indicated that $54,700 was direct labor and $7,800 was indirect labor.

Manufacturing overhead costs incurred on account were $84,900.

Depreciation on the company's office building was $8,800.

Manufacturing overhead was applied at the rate of 150% of direct labor cost.

Goods costing $91,400 were completed and transferred to finished goods.

Finished goods costing $75,300 to manufacture were sold on account for $109,700,

Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent

manually.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College