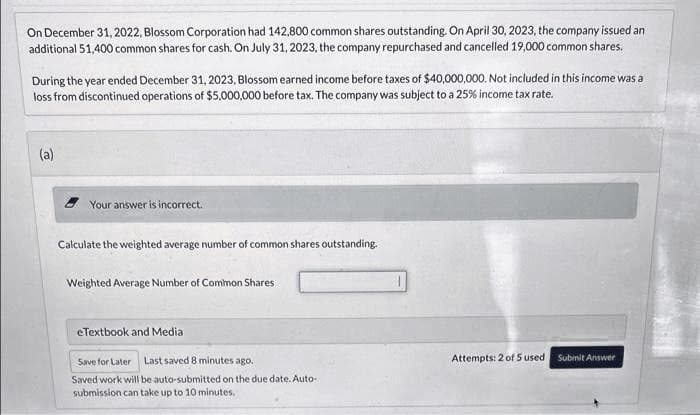

On December 31, 2022, Blossom Corporation had 142,800 common shares outstanding. On April 30, 2023, the company issued an additional 51,400 common shares for cash. On July 31, 2023, the company repurchased and cancelled 19,000 common shares. During the year ended December 31, 2023, Blossom earned income before taxes of $40,000,000. Not included in this income was a loss from discontinued operations of $5,000,000 before tax. The company was subject to a 25% income tax rate. (a) Your answer is incorrect. Calculate the weighted average number of common shares outstanding. Weighted Average Number of Common Shares eTextbook and Media Save for Later Last saved 8 minutes ago. Saved work will be auto-submitted on the due date. Auto- submission can take up to 10 minutes. Attempts: 2 of 5 used Submit Answer

On December 31, 2022, Blossom Corporation had 142,800 common shares outstanding. On April 30, 2023, the company issued an additional 51,400 common shares for cash. On July 31, 2023, the company repurchased and cancelled 19,000 common shares. During the year ended December 31, 2023, Blossom earned income before taxes of $40,000,000. Not included in this income was a loss from discontinued operations of $5,000,000 before tax. The company was subject to a 25% income tax rate. (a) Your answer is incorrect. Calculate the weighted average number of common shares outstanding. Weighted Average Number of Common Shares eTextbook and Media Save for Later Last saved 8 minutes ago. Saved work will be auto-submitted on the due date. Auto- submission can take up to 10 minutes. Attempts: 2 of 5 used Submit Answer

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

100%

Sh6

Transcribed Image Text:On December 31, 2022, Blossom Corporation had 142,800 common shares outstanding. On April 30, 2023, the company issued an

additional 51,400 common shares for cash. On July 31, 2023, the company repurchased and cancelled 19,000 common shares.

During the year ended December 31, 2023, Blossom earned income before taxes of $40,000,000. Not included in this income was a

loss from discontinued operations of $5,000,000 before tax. The company was subject to a 25% income tax rate.

(a)

Your answer is incorrect.

Calculate the weighted average number of common shares outstanding.

Weighted Average Number of Common Shares

eTextbook and Media

Save for Later Last saved 8 minutes ago.

Saved work will be auto-submitted on the due date. Auto-

submission can take up to 10 minutes.

Attempts: 2 of 5 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning