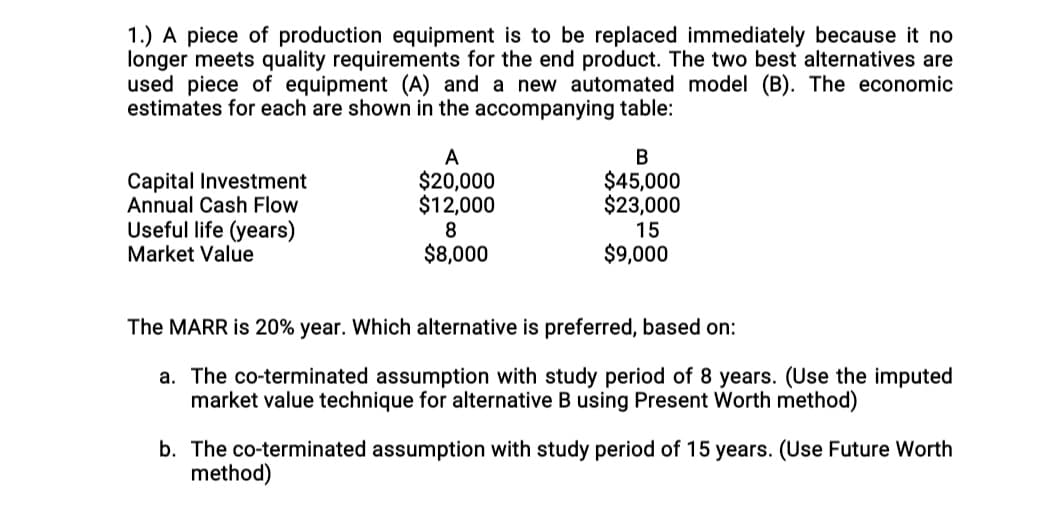

1.) A piece of production equipment is to be replaced immediately because it no longer meets quality requirements for the end product. The two best alternatives are used piece of equipment (A) and a new automated model (B). The economic estimates for each are shown in the accompanying table: A $20,000 $12,000 B $45,000 $23,000 Capital Investment Annual Cash Flow Useful life (years) Market Value 15 $8,000 $9,000 The MARR is 20% year. Which alternative is preferred, based on: a. The co-terminated assumption with study period of 8 years. (Use the imputed market value technique for alternative B using Present Worth method) b. The co-terminated assumption with study period of 15 years. (Use Future Worth method)

1.) A piece of production equipment is to be replaced immediately because it no longer meets quality requirements for the end product. The two best alternatives are used piece of equipment (A) and a new automated model (B). The economic estimates for each are shown in the accompanying table: A $20,000 $12,000 B $45,000 $23,000 Capital Investment Annual Cash Flow Useful life (years) Market Value 15 $8,000 $9,000 The MARR is 20% year. Which alternative is preferred, based on: a. The co-terminated assumption with study period of 8 years. (Use the imputed market value technique for alternative B using Present Worth method) b. The co-terminated assumption with study period of 15 years. (Use Future Worth method)

Elements Of Electromagnetics

7th Edition

ISBN:9780190698614

Author:Sadiku, Matthew N. O.

Publisher:Sadiku, Matthew N. O.

ChapterMA: Math Assessment

Section: Chapter Questions

Problem 1.1MA

Related questions

Question

Solve manually, excel is not accepted.

Transcribed Image Text:1.) A piece of production equipment is to be replaced immediately because it no

longer meets quality requirements for the end product. The two best alternatives are

used piece of equipment (A) and a new automated model (B). The economic

estimates for each are shown in the accompanying table:

A

$20,000

$12,000

$45,000

$23,000

Capital Investment

Annual Cash Flow

Useful life (years)

Market Value

8

15

$8,000

$9,000

The MARR is 20% year. Which alternative is preferred, based on:

a. The co-terminated assumption with study period of 8 years. (Use the imputed

market value technique for alternative B using Present Worth method)

b. The co-terminated assumption with study period of 15 years. (Use Future Worth

method)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, mechanical-engineering and related others by exploring similar questions and additional content below.Recommended textbooks for you

Elements Of Electromagnetics

Mechanical Engineering

ISBN:

9780190698614

Author:

Sadiku, Matthew N. O.

Publisher:

Oxford University Press

Mechanics of Materials (10th Edition)

Mechanical Engineering

ISBN:

9780134319650

Author:

Russell C. Hibbeler

Publisher:

PEARSON

Thermodynamics: An Engineering Approach

Mechanical Engineering

ISBN:

9781259822674

Author:

Yunus A. Cengel Dr., Michael A. Boles

Publisher:

McGraw-Hill Education

Elements Of Electromagnetics

Mechanical Engineering

ISBN:

9780190698614

Author:

Sadiku, Matthew N. O.

Publisher:

Oxford University Press

Mechanics of Materials (10th Edition)

Mechanical Engineering

ISBN:

9780134319650

Author:

Russell C. Hibbeler

Publisher:

PEARSON

Thermodynamics: An Engineering Approach

Mechanical Engineering

ISBN:

9781259822674

Author:

Yunus A. Cengel Dr., Michael A. Boles

Publisher:

McGraw-Hill Education

Control Systems Engineering

Mechanical Engineering

ISBN:

9781118170519

Author:

Norman S. Nise

Publisher:

WILEY

Mechanics of Materials (MindTap Course List)

Mechanical Engineering

ISBN:

9781337093347

Author:

Barry J. Goodno, James M. Gere

Publisher:

Cengage Learning

Engineering Mechanics: Statics

Mechanical Engineering

ISBN:

9781118807330

Author:

James L. Meriam, L. G. Kraige, J. N. Bolton

Publisher:

WILEY