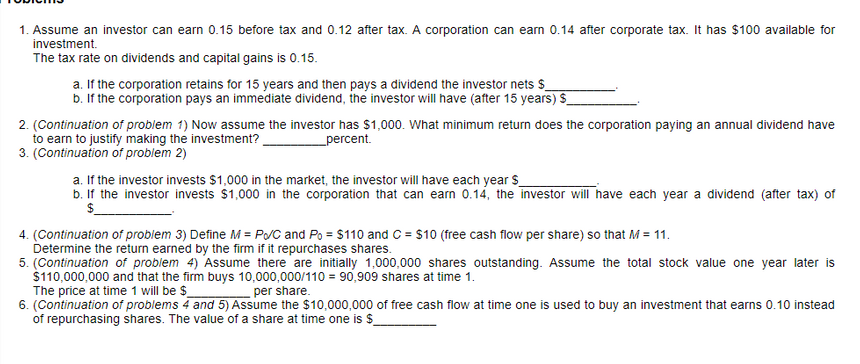

1. Assume an investor can earn 0.15 before tax and 0.12 after tax. A corporation can earn 0.14 after corporate tax. It has $100 available for investment. The tax rate on dividends and capital gains is 0.15. a. If the corporation retains for 15 years and then pays a dividend the investor nets s b. If the corporation pays an immediate dividend, the investor will have (after 15 years) S 2. (Continuation of problem 1) Now assume the investor has $1,000. What minimum return does the corporation paying an annual dividend have to earn to justify making the investment? 3. (Continuation of problem 2) percent. a. If the investor invests $1,000 in the market, the investor will have each year $ b. If the investor invests $1,000 in the corporation that can earn 0.14, the investor will have each year a dividend (after tax) of $. 4. (Continuation of problem 3) Define M = P/C and Po = $110 and C = $10 (free cash flow per share) so that M= 11. Determine the return earned by the firm if it repurchases shares. 5. (Continuation of problem 4) Assume there are initially 1,000,000 shares outstanding. Assume the total stock value one year later is $110,000,000 and that the firm buys 10,000,000/110 = 90,909 shares at time 1. The price at time 1 will be $ 6. (Continuation of problems 4 and 5) Assume the $10,000,000 of free cash flow at time one is used to buy an investment that earns 0.10 instead of repurchasing shares. The value of a share at time one is $_ per share.

1. Assume an investor can earn 0.15 before tax and 0.12 after tax. A corporation can earn 0.14 after corporate tax. It has $100 available for investment. The tax rate on dividends and capital gains is 0.15. a. If the corporation retains for 15 years and then pays a dividend the investor nets s b. If the corporation pays an immediate dividend, the investor will have (after 15 years) S 2. (Continuation of problem 1) Now assume the investor has $1,000. What minimum return does the corporation paying an annual dividend have to earn to justify making the investment? 3. (Continuation of problem 2) percent. a. If the investor invests $1,000 in the market, the investor will have each year $ b. If the investor invests $1,000 in the corporation that can earn 0.14, the investor will have each year a dividend (after tax) of $. 4. (Continuation of problem 3) Define M = P/C and Po = $110 and C = $10 (free cash flow per share) so that M= 11. Determine the return earned by the firm if it repurchases shares. 5. (Continuation of problem 4) Assume there are initially 1,000,000 shares outstanding. Assume the total stock value one year later is $110,000,000 and that the firm buys 10,000,000/110 = 90,909 shares at time 1. The price at time 1 will be $ 6. (Continuation of problems 4 and 5) Assume the $10,000,000 of free cash flow at time one is used to buy an investment that earns 0.10 instead of repurchasing shares. The value of a share at time one is $_ per share.

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 50P

Related questions

Question

Transcribed Image Text:1. Assume an investor can earn 0.15 before tax and 0.12 after tax. A corporation can earn 0.14 after corporate tax. It has $100 available for

investment.

The tax rate on dividends and capital gains is 0.15.

a. If the corporation retains for 15 years and then pays a dividend the investor nets s

b. If the corporation pays an immediate dividend, the investor will have (after 15 years) S

2. (Continuation of problem 1) Now assume the investor has $1,000. What minimum return does the corporation paying an annual dividend have

to earn to justify making the investment?

3. (Continuation of problem 2)

percent.

a. If the investor invests $1,000 in the market, the investor will have each year $

b. If the investor invests $1,000 in the corporation that can earn 0.14, the investor will have each year a dividend (after tax) of

$.

4. (Continuation of problem 3) Define M = P/C and Po = $110 and C = $10 (free cash flow per share) so that M= 11.

Determine the return earned by the firm if it repurchases shares.

5. (Continuation of problem 4) Assume there are initially 1,000,000 shares outstanding. Assume the total stock value one year later is

$110,000,000 and that the firm buys 10,000,000/110 = 90,909 shares at time 1.

The price at time 1 will be $

6. (Continuation of problems 4 and 5) Assume the $10,000,000 of free cash flow at time one is used to buy an investment that earns 0.10 instead

of repurchasing shares. The value of a share at time one is $_

per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT