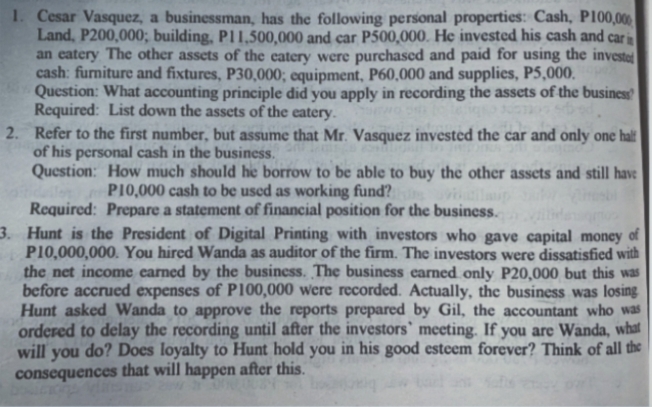

1. Cesar Vasquez, a businessman, has the following personal properties: Cash, P100,000 Land, P200,000; building, PI1,500,000 and car P500,000. He invested his cash and car i an eatery The other assets of the eatery were purchased and paid for using the investet cash: furniture and fixtures, P30,000; equipment, P60,000 and supplies, P5,000. Question: What accounting principle did you apply in recording the assets of the busines Required: List down the assets of the eatery.

1. Cesar Vasquez, a businessman, has the following personal properties: Cash, P100,000 Land, P200,000; building, PI1,500,000 and car P500,000. He invested his cash and car i an eatery The other assets of the eatery were purchased and paid for using the investet cash: furniture and fixtures, P30,000; equipment, P60,000 and supplies, P5,000. Question: What accounting principle did you apply in recording the assets of the busines Required: List down the assets of the eatery.

Chapter3: Computing The Tax

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:1. Cesar Vasquez, a businessman, has the following personal properties: Cash, P100,000

Land, P200,000; building, P11,500,000 and car P500,000. He invested his cash and car in

an eatery The other assets of the eatery were purchased and paid for using the investet

cash: furniture and fixtures, P30,000; equipment, P60,000 and supplies, P5,000.

Question: What accounting principle did you apply in recording the assets of the business

Required: List down the assets of the eatery.

2. Refer to the first number, but assume that Mr. Vasquez invested the car and only one hal!

of his personal cash in the business.

Question: How much should he borrow to be able to buy the other assets and still have

PI0,000 cash to be used as working fund?

Required: Prepare a statement of financial position for the business.

3. Hunt is the President of Digital Printing with investors who gave capital money of

P10,000,000. You hired Wanda as auditor of the firm. The investors were dissatisfied with

the net income carned by the business. The business earned only P20,000 but this was

before accrued expenses of P100,000 were recorded. Actually, the business was losing

Hunt asked Wanda to approve the reports prepared by Gil, the accountant who was

ordered to delay the recording until after the investors` meeting. If you are Wanda, what

will you do? Does loyalty to Hunt hold you in his good esteem forever? Think of all the

consequences that will happen after this.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT