Michael McNamee is the proprietor of a property management company, Apartment Exchange, near the campus of Penscola State College. The business has cash of $8,000 and furniture that cost $9,000 and has a market value of $13,000. The business debts include accounts payable of $6,000. Michael's personal home is valued at $400,000, and his personal bank account has a balance of $1,200. Identify the principle or assumption that best matches the situation: a. Michael's personal assets are not recorded on the Apartment Exchange's balance sheet. The Apartment Exchange records furniture at its cost of $9,000, not its market value of $13,000. The Apartment Exchange reports its financial statements in U.S. dollars. d. Michael expects the Apartment Exchange to remain in operations for the foreseeable future. . Michael's personal assets are not recorded on the company's balance sheet: p. The company records furniture at its cost of $9,000, not its market value of $13,000: . The company records its financial statements in U.S. dollars: 1. Michael expects the company to remain in operations for the foreseeable future:

Michael McNamee is the proprietor of a property management company, Apartment Exchange, near the campus of Penscola State College. The business has cash of $8,000 and furniture that cost $9,000 and has a market value of $13,000. The business debts include accounts payable of $6,000. Michael's personal home is valued at $400,000, and his personal bank account has a balance of $1,200. Identify the principle or assumption that best matches the situation: a. Michael's personal assets are not recorded on the Apartment Exchange's balance sheet. The Apartment Exchange records furniture at its cost of $9,000, not its market value of $13,000. The Apartment Exchange reports its financial statements in U.S. dollars. d. Michael expects the Apartment Exchange to remain in operations for the foreseeable future. . Michael's personal assets are not recorded on the company's balance sheet: p. The company records furniture at its cost of $9,000, not its market value of $13,000: . The company records its financial statements in U.S. dollars: 1. Michael expects the company to remain in operations for the foreseeable future:

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 25P

Related questions

Question

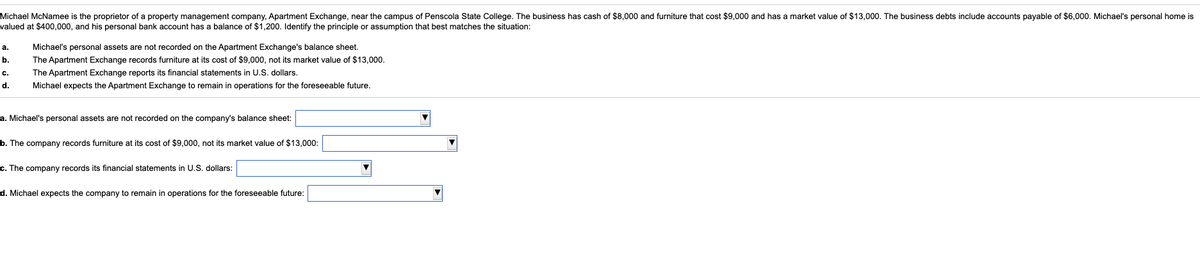

Transcribed Image Text:Michael McNamee is the proprietor of a property management company, Apartment Exchange, near the campus of Penscola State College. The business has cash of $8,000 and furniture that cost $9,000 and has a market value of $13,000. The business debts include accounts payable of $6,000. Michael's personal home is

valued at $400,000, and his personal bank account has a balance of $1,200. Identify the principle or assumption that best matches the situation:

а.

Michael's personal assets are not recorded on the Apartment Exchange's balance sheet.

b.

The Apartment Exchange records furniture at its cost of $9,000, not its market value of $13,000.

The Apartment Exchange reports its financial statements in U.S. dollars.

c.

d.

Michael expects the Apartment Exchange to remain in operations for the foreseeable future.

a. Michael's personal assets are not recorded on the company's balance sheet:

b. The company records furniture at its cost of $9,000, not its market value of $13.000:

c. The company records its financial statements in U.S. dollars:

d. Michael expects the company to remain in operations for the foreseeable future:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you