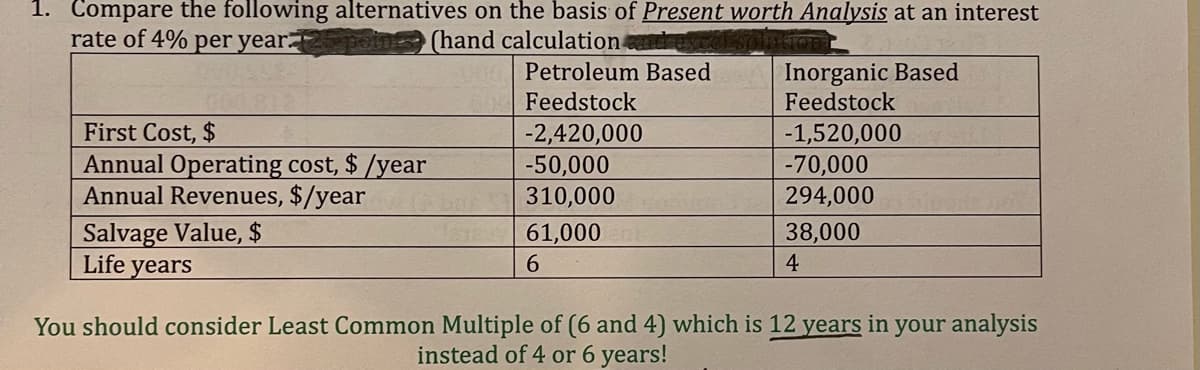

1. Compare the following alternatives on the basis of Present worth Analysis at an interest rate of 4% per year. (hand calculation Inorganic Based Feedstock Petroleum Based Feedstock First Cost, $ Annual Operating cost, $ /year Annual Revenues, $/year -2,420,000 -50,000 310,000 -1,520,000 -70,000 294,000 Salvage Value, $ Life years 61,000 38,000 6. 4. You should consider Least Common Multiple of (6 and 4) which is 12 years in your analysis instead of 4 or 6 years!

1. Compare the following alternatives on the basis of Present worth Analysis at an interest rate of 4% per year. (hand calculation Inorganic Based Feedstock Petroleum Based Feedstock First Cost, $ Annual Operating cost, $ /year Annual Revenues, $/year -2,420,000 -50,000 310,000 -1,520,000 -70,000 294,000 Salvage Value, $ Life years 61,000 38,000 6. 4. You should consider Least Common Multiple of (6 and 4) which is 12 years in your analysis instead of 4 or 6 years!

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.1.1MBA

Related questions

Question

Can someone please solve this question using hand calculations only? PLEASE AND THANK YOU!!!

Transcribed Image Text:1. Compare the following alternatives on the basis of Present worth Analysis at an interest

rate of 4% per year

(hand calculation

Inorganic Based

Feedstock

Petroleum Based

Feedstock

First Cost, $

Annual Operating cost, $ /year

Annual Revenues, $/year

-2,420,000

-50,000

310,000

-1,520,000

-70,000

294,000

Salvage Value, $

Life years

61,000

38,000

6.

4.

You should consider Least Common Multiple of (6 and 4) which is 12 years in your analysis

instead of 4 or 6 years!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT