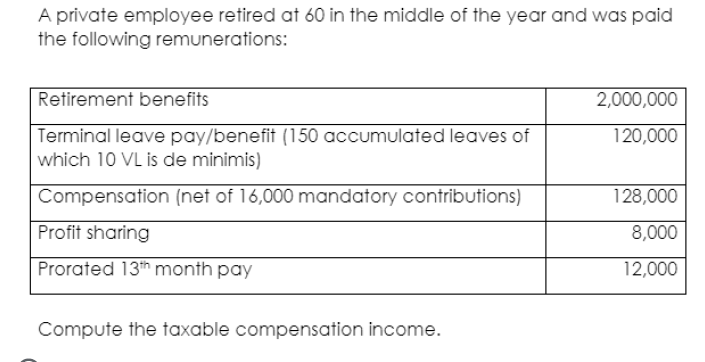

nal leave pa 10 VL is de IS

Q: During the first two years, the company drove the company truck 57S00 and 62.000 miles, respectively...

A: Activity based Method of Depreciation, also known as a unit of activity depreciation it is the depr...

Q: Krawl Company uses a job order cost system. The following data summarizes the operations related to ...

A: 1. Journal entries to record the summarized operations Date Account title and explanation Debit...

Q: Given the building layout for Store A, Store B, Store C, and Store D, what portion of the shared $75...

A: when the a person meant of cost is done then the distribution of cost items in proportion to the cos...

Q: PSc 2-2 (#1) Complete a Time Card Complete a time card for each employee below. Note that this emplo...

A: Comment - We’ll answer the first question since the exact one wasn’t specified. Please submit a new ...

Q: A supervisory employee is a recipient of a stock option which vested during the year. The following ...

A: ESOP Is employee benefits plan that gives to workers and employees for ownership interest in company...

Q: Crossfire Company segments its business into two regions-East and West. The company prepared a contr...

A: The question is based on the concept of Cost Accounting. As per the Bartleby guidelines we are allow...

Q: Bay Company holds 60,000 of Fay Company's 200,000 outstanding shares and 8,000 of Hay Company's 400,...

A: Dividend: It implies to the distribution of company's net earnings after paying out all the liabilit...

Q: *see attached What amount of interest income should be recognized by Ripple for the year ended Dece...

A: Lease means giving out the assets by lessor to lessee to use that assets in return of rent. Financia...

Q: Jefferson Inc. has the following information for the month of September. The company applies OH cost...

A: In this question, we will calculate the total manufacturing overhead is under applied or over applie...

Q: On January 1 of the current year, Yellow Company purchased 40% of the outstanding ordinary shares of...

A: Reported income: The investor's portion of the joint venture's earnings and losses is included in th...

Q: 30. A company uses the first-in-first-out (FIFO) method of valuing inventory and makes the followin...

A: FIFO METHOD :- it stands for first in first out that means good that is purchased first will be sold...

Q: da commercial building and lot for $190,000 0,000 when purchased. You sold the lot and B ACRS deprec...

A: The answer has been mentioned below.

Q: 22. SecuriPrint Ltd produces pre-printed cheques for customers to use in automated account payable d...

A: Selling Price=Cost+Profit

Q: B. Give the journal entry to be made in the books of the purchaser, if the account to be debited is ...

A: Accounting books: The various books drafted to carry out the accounting process are called as accoun...

Q: do family firms need audit ? explain what do we mean by auditors considering various risks related...

A: According to the size of company, volume of transactions and style of functioning the management can...

Q: Ada Company owns and manages apartments. On signing a lease, each tenant must pay the first month an...

A: Given, Cleaning costs of Php15,000 per apartment. About 30% of the time, the tenants are also charge...

Q: Which of the following subsequent expenditures would not be capitalized?

A: Ordinary repairs and maintenance expenditure would not be capitalized.

Q: SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $151,200, an v...

A: A break-even analysis seems to be a quantitative tool that assists a business in determining the sta...

Q: EXPLAIN THE MODE OF PAYMENT IN FOREIGN CONTRACTS.

A: A foreign exchange contract is a legal arrangement in which the parties agree to exchange a defined ...

Q: Draw a ( Ledgers ) for all transactions please. ASSIGNMENT PRINCIPLES OF ACCOUNTING (BAAC 1102) Give...

A: a) CASH Date Description Debit Credit Balance 1-Apr Hilal, Capit...

Q: Mr. Ron acquired machinery for use in his business. After a strong typhoon, the machinery suffered p...

A: Restoration cost shall be capitalized. And also depreciation shall be deductible on such cost. Resto...

Q: On January 1, 2021, Mirakulo Company acquired P4,000,000 of 12% face amount bonds for P3,767,000 to ...

A: Carrying amount of the bond = Present value of principal + Present value of interest payments where,...

Q: Fast Delivery is the world's largest express transportation company. In addition to the world's larg...

A: Gain (loss) on disposal of Truck = Sales value - Net book value of the Truck where, Net book value o...

Q: Item Nos. 17 and 18 are based on the following information: On December 31, 200C, the partnership of...

A: The partnership comes into existence when two or more persons agree to do the business and further s...

Q: 000, and the fair value of the asset on January 1, 2020, is $737,000. 3. At the end of the lease t...

A: The given lease is a finance lease because the equipment lease for most of its economic useful li...

Q: On November 1, 2016, Melissa Corp. issued P 800,000 of its 10- year,8% term bonds dated October 1, 2...

A: Bonds are units of corporate debt issued by companies and securitized as tradeable assets. Given...

Q: Allen Inc. took out a 1-year, 8%, $100,000 loan on March 31, 2018. Interest is due upon maturity of ...

A: Formula: Interest expense = Loan Amount x Interest rate x Time period

Q: Mountain Dirt Bikes Racing Bikes $ 256,000 159,000 97,000 Total Bikes $ 927,000 463,000 464,000 $ 26...

A: 1. Incremental Analysis - Regal Cycle - Racing Bikes Particulars Continue Racing Bikes (Alt 1) ...

Q: On January 5, 2021 Mr. Pacifico obtained a 4-year business loan from a bank for P200,000 at 6% inter...

A: Deductible interest expense is calculated by multiplying the loan amount by interest rate for the gi...

Q: Bay Company holds 60,000 of Fay Company's 200,000 outstanding shares and 8,000 of Hay Company's 400,...

A: Dividend: A dividend is a payment made by a firm to its shareholders in exchange for its earnings. D...

Q: Wages paid to a labourer who is engaged in production activities should be classified as: a) direct...

A: Cost refers to the amount incurred in return for goods or services.

Q: An insurance company pays its employees a commission of 6 percent on each sale. What is the proper c...

A: Introduction:- Fixed costs are remain constant irrespective production volume. Variable costs are v...

Q: Berkeley Inc. is engaged in manufacturing. For the procurement of machines, Berkeley Inc. uses the l...

A: When there is an option attached to the lease agreement then the lease is a sale-type lease. In sale...

Q: What is your opinion of the organization's financial strength Do you see any significant financial ...

A: Financial Strenght is the basic requirement for any business to flourish. Profit making business hav...

Q: 10 Which of the following requires that quality be manufactured rather than inspected into products?...

A: This statement is relevant for JIT i.e. Just in Time Process of production where production starts o...

Q: SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $151,200, and ...

A: Formula: Contribution margin per unit = Selling price per unit - Variable cost Per unit

Q: Budgets identify, gather, summarise, and communicate: a) Financial data only. b) Financial and n...

A: A budget is a prediction of taxes and expenditure for a certain future time period that is frequentl...

Q: SecuriPrint Ltd produces pre-printed cheques for customers to use in automated account payable depar...

A:

Q: s it true of false that stock sold for amounts in excess of par value results in a gain reported on ...

A: A company issues its common stock at par value or at an amount more than the par value. The amount i...

Q: st of P3,000,000 for trading, e at year end. 12/31/21 Trading 4.000.000

A: Trading investment refers to the process when one firm or entity holds stocks or shares of a company...

Q: On July 1, 2020, ABC Corporation invested in the stocks of XYZ foreign corporation, by acquiring 10,...

A: Capital Gain on Shares: It is possible to realise a capital gain on the appreciation of an asset or ...

Q: A combined set of operational budgets and a set of financial budgets for the entire organisation is ...

A: Lets understand the basics. Master budget is a budget which is combined budgets for whole of the org...

Q: 1. From the data above, calculate the Ending Inventory (quantity and cost), Cost of Goods Sold, and ...

A: Date Incoming goods Goods out Ending inventory Total units Cost / unit Total units Cost /...

Q: On January 1st, XYZ Co. prepays $1,500 for one year of prepaid insurance. What is the amount of insu...

A: Formula: Monthly insurance expense = Total prepaid insurance / 12 Months

Q: LoneStar Co. is a manufacturing company that produces only one product, cowboy boots, has provided t...

A: The question is based on the concept of Cost Accounting. As per the Bartleby guidelines we are allow...

Q: Flyers plc operates public transport services in major cities in the United Kingdom (UK). The compan...

A: Payback method is an often used capital budgeting tool. In this method we determine the time period ...

Q: The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a rac...

A:

Q: The following information applies to the questions displayed below.] Shares sold for consideration o...

A: Journal Entry The basic process of accounting is to journalize the required transaction into debit a...

Q: This project covers general partnership basis issues including computation of partners' adjusted bas...

A: The significant tax implication for the year are summarized by calculating the Adjusted tax basis of...

Q: PROBLEM 3–7 (LO1,2,3,4,5,6) Comprehensive Accounting Cycle Review Problem The unadjusted trial balan...

A: T-Account The purpose of preparing the T-Account is to know the actual balance which are incurred at...

Step by step

Solved in 2 steps with 1 images

- Lemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and the amount of federal income tax withholding are as follows. Lemurs payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax as previously shown, state income tax at 5% of gross pay, and 401(k) employee contributions at 2% of gross pay. Record the entry for the employee payroll on December 31.During the year, employee Sean Matthews earned wages in the amount of 250,000. Discuss how the employees HI tax will differ from the employers HI tax for this employee._____1. Employees FICA tax rates A. Severance pay _____2. Form SS-4 B. By the 15th day of the following month _____3. Semiweekly depositor C. Employers Quarterly Federal Tax Return _____4. Taxable for FICA D. Application for Employer Identification Number _____5. Nontaxable for FICA E. 6.2 percent and 1.45 percent _____6. Self-employeds FICA tax rates F. Employees application for social security card _____7. Form 941 G. Cumulative wages of 128,400 _____8. Monthly depositor H. More than 50,000 in employment taxes in the lookback period _____9. OASDI taxable wage base I. 12.4 percent and 2.9 percent _____10. Form SS-5 J. Employers matching contributions into employees deferred compensation arrangements