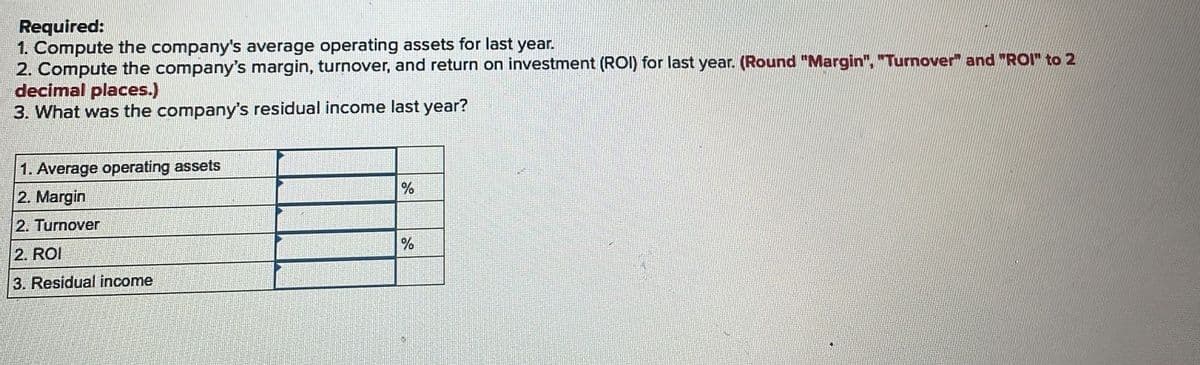

1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.) 3. What was the company's residual income last year? 1. Average operating assets 2. Margin 2. Turnover 2. ROI 3. Residual income % %

1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.) 3. What was the company's residual income last year? 1. Average operating assets 2. Margin 2. Turnover 2. ROI 3. Residual income % %

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 20BEA: The income statement, statement of retained earnings, and balance sheet for Somerville Company are...

Related questions

Question

Transcribed Image Text:Required:

1. Compute the company's average operating assets for last year.

2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2

decimal places.)

3. What was the company's residual income last year?

1. Average operating assets

2. Margin

2. Turnover

2. ROI

3. Residual income

%

%

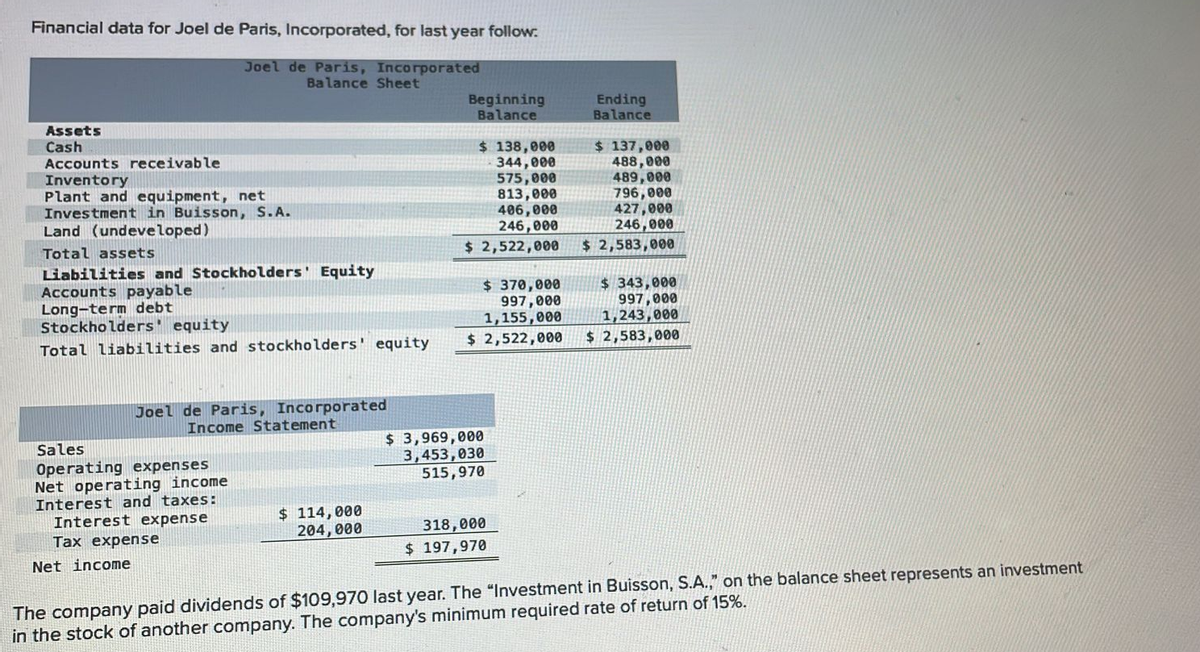

Transcribed Image Text:Financial data for Joel de Paris, Incorporated, for last year follow.

Joel de Paris, Incorporated

Balance Sheet

Assets

Cash

Accounts receivable

Inventory

Plant and equipment, net

Investment in Buisson, S.A.

Land (undeveloped)

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Long-term debt

Stockholders' equity

Total liabilities and stockholders' equity

Joel de Paris, Incorporated

Income Statement

Sales

Operating expenses

Net operating income

Interest and taxes:

Interest expense

Tax expense

Net income

$ 114,000

204,000

Beginning

Balance

$ 138,000

344,000

575,000

813,000

406,000

246,000

$ 2,522,000

$ 370,000

997,000

1,155,000

$ 2,522,000

$ 3,969,000

3,453,030

515,970

318,000

$ 197,970

Ending

Balance

$ 137,000

488,000

489,000

796,000

427,000

246,000

$ 2,583,000

$343,000

997,000

1,243,000

$2,583,000

The company paid dividends of $109,970 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment

in the stock of another company. The company's minimum required rate of return of 15%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning