complete with respect to conversion. During October, it put 87.000 units into production and completed 89,000 gom ending work-in-process that were 70% complete with respect to conversion. Direct materials are added at the beg of the process, and normal spoilage is 6% of good output. Costs related to the beginning inventory were $36,800 f costs. During the month, the company issued $280,000 of direct materials and incurred $599,400 of conversion co Assume Eagles uses the weighted-average method of process costing. What are the normal and abnormal spollag

complete with respect to conversion. During October, it put 87.000 units into production and completed 89,000 gom ending work-in-process that were 70% complete with respect to conversion. Direct materials are added at the beg of the process, and normal spoilage is 6% of good output. Costs related to the beginning inventory were $36,800 f costs. During the month, the company issued $280,000 of direct materials and incurred $599,400 of conversion co Assume Eagles uses the weighted-average method of process costing. What are the normal and abnormal spollag

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 1CMA: During December, Krause Chemical Company had the following selected data concerning the manufacture...

Related questions

Question

Please help me with explanation thanku

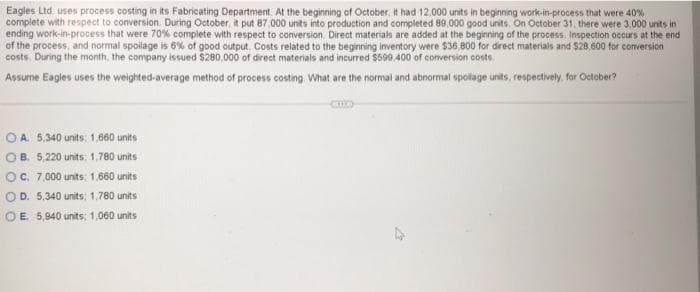

Transcribed Image Text:Eagles Ltd uses process costing in its Fabricating Department. At the beginning of October, it had 12,000 units in beginning work-in-process that were 40%

complete with respect to conversion. During October, it put 87.000 units into production and completed 89.000 good units. On October 31, there were 3.000 units in

ending work-in-process that were 70% complete with respect to conversion. Direct materials are added at the beginning of the process. Inspection occurs at the end

of the process, and normal spoilage is 6% of good output. Costs related to the beginning inventory were $36,800 for direct materials and $28,600 for conversion

costs. During the month, the company issued $280,000 of direct materials and incurred $599,400 of conversion costs

Assume Eagles uses the weighted-average method of process costing. What are the normal and abnormal spollage units, respectively for October?

OA. 5,340 units: 1,660 units

OB. 5,220 units; 1,780 units

OC. 7,000 units: 1,660 units

OD. 5,340 units: 1,780 units

OE. 5,940 units; 1,060 units

CERED

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College