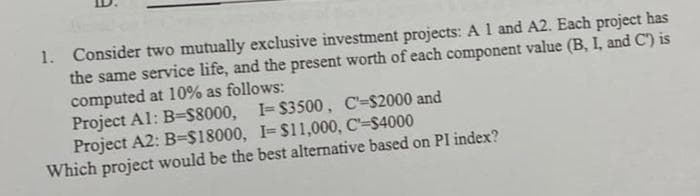

1. Consider two mutually exclusive investment projects: A 1 and A2. Each project has the same service life, and the present worth of each component value (B, I, and C) is computed at 10% as follows: Project Al: B=$8000, I-$3500, C-$2000 and Project A2: B-$18000, I-$11,000, C-$4000 Which project would be the best alternative based on PI index?

Q: Assume that the gross domestic product is $6,000, personal disposal income is $5,100, the government…

A: Disclaimer- “Since you have asked multiple questions, we will solve the first three questions for…

Q: Refer to the table below. Note that the first column shows variable costs. Quantity Cost 0 1 2 3 5 6…

A: The firm will produce where the marginal revenue is equal to marginal cost to maximize its profit.…

Q: Fill in the missing values in the table of data collected in the household survey. The working- age…

A: A person is considered unemployed if he is of legal age and is able and willing to work but unable…

Q: 1. Suppose that the reserve requirement for chequing deposits is 15 % and the banks do not hold any…

A: A central bank, also known as a reserve bank or monetary authority, is an institution that manages…

Q: Partnership Game Lee (Player 1), and Julie (Player 2), are business partners. Each of them has to…

A: The level of effort is given as The cost of putting the effort is given as The profit for both the…

Q: Calculate the missing information in the table below taking into consideration that the base year is…

A: Nominal GDP (Gross Domestic Product) is a measure of the total value of all final goods and services…

Q: 1. Explain briefly what the consumer price index tries to measure?

A: Since you have posted multiple questions, we will solve the first one for you. If you want any…

Q: 1. Consider a consumer with the utility function u(x, y) = 2x¹/2 + y, an income of I = Rs100, and…

A: A utility function is a concept in economics that represents an individual's preferences or…

Q: Consider a lake found in the village of Sturbridge, and then answer the questions that follow. The…

A: Economic ProfitsEconomic profits are the revenue created minus explicit and implicit costs. Explicit…

Q: (a) Explain the effects on the equilibruim if Total Factor Productivity decreases temporarily. (b)…

A: a) Problem Statement: The core problem is understanding how changes in Total Factor Productivity…

Q: The first table describes an economy's labor market in 2014 and the second table describes its…

A: Labor productivity is a measure of how efficiently labor is being used to produce goods and…

Q: The figure on the right shows a pair of budget deficit functions for a country (G+iD-T), denotes the…

A: The budget deficit function, which expresses the difference between government expenditures (G) and…

Q: Calculate the chain-weighted Real GDP for Year 3, using Year 1 as the base year. Here are all the…

A: Chain-weighted method of GDP is a new approach to calculating GDP. It depicts a more accurate…

Q: If firms in the market are producing output but are currently making economic losses, illustrates…

A: The perfectly competitive market is a market type which is characterized by a large number of buyers…

Q: Refer to Figure 9-4. What price would a monopolist charge when maximizing profits? a. P₁ b. P4 OC.…

A: The Monopoly refers to market where only single firm exists in the market. Monopoly firm can earn…

Q: Suppose a small country has the following monies in circulation: Cash/currency: $5…

A: The supply of money includes the circulation of currency, demand deposits and other deposits of…

Q: The following information relates to a project Year Cash flow Sh. 'Millions' (16) 8 10 1 2 3 4 6 15…

A: To advise management on the optimum time to abandon the project, we need to calculate the Net…

Q: c. Given your observations in 1)c., consider an economy that converges towards .. When and why would…

A: a) Derive the desired number of children under the assumption that education is provided by public…

Q: What causes the economy to move from its short-run equilibrium to its long-run equilibrium? The…

A: The aggregate demand (AD) shows the total demand for goods and services in the economy. The AD…

Q: Consider a competitive firm that produces two specific goods. The firm's cost function for the two…

A: The cost function of a firm producing two commodities is given byThe price of first commodity is…

Q: Please continue the search, I require a news article from belize showing the contractionary monetary…

A: Monetary policy plays a crucial role in shaping a country's economic landscape, influencing factors…

Q: Think a price making firm (monopolist) with a downward-sloping demand curve is one with a price…

A: Price elasticity of demand is a measure of how sensitive the quantity demanded of a good or service…

Q: Pharmaceutical Benefits Managers (PBMs) are intermediaries between upstream drug manufacturers and…

A: The process through which an employer and a group of employees negotiate the terms of their…

Q: Figure 9.1 shows the cost structure of a firm in a perfectly competitive market. If the market price…

A: The perfectly competitive market refers to market where large number of buyers and sellers exist in…

Q: edmund works as a waiter on the weekends at a fancy resturant. he occasionally makes an enormous…

A: In order to avoid having taxes assessed or paid, people who engage in tax evasion utilise unlawful…

Q: Consider the following information regarding PriorityShoes, the athletic shoe company that has…

A: Profit maximization refers to the methodology or objective of a firm to accomplish the most…

Q: Suppose that a firm in a competitive market faces the following revenues and costs: Quantity…

A: A competitive market is one where there are numerous producers that compete with one another in…

Q: Discuss in detail the law of diminishing returns and how it explains the shape of the short-run…

A: The objective of this question is to understand the law of diminishing returns and how it influences…

Q: What does the Canadian poverty rate measure? the number of people whose annual household income is…

A: The problem is to determine what the Canadian poverty rate measures

Q: (Scenario: Monopoly in Stand-Up Paddle Rentals) Use Scenario: Monopoly in Stand Up Paddle Rentals.…

A: Demand function: Marginal cost function: ATC at the profit-maximizing output is $12.50We need to…

Q: If the Bank of Canada were to conduct an open market sale, it would Select one: a. decrease the…

A: Open market operation is a monetary policy tool. Open market operation is the sale and purchase of…

Q: n some circumstances, individuals reproduce better when the population size is large, and fail to…

A: The Allee effect is a phenomenon in the population study where individuals have difficulty…

Q: The graph illustrates the market for pulp and paper with no government intervention. The pulp and…

A: The overall price society pays for the creation of an additional unit or for engaging in additional…

Q: Use the AD/AS model to illustrate the following. Draw 6 graphs by hand. Show how the AD or the AS…

A: Aggregate demand refers to the total amount of goods and services that households, businesses,…

Q: 1. LO 2 In the Malthusian model, suppose that the quantity of land increases. Using diagrams, deter-…

A: The basic exponential growth model is the Malthusian model. It states that the rate of expansion of…

Q: The market price of laptops in a certain city is determined by P = 1,400 – Q where Q represents the…

A: A monopoly is a market structure where a single seller or producer assumes a dominant position in an…

Q: 1.. Consider the following GDP data (IMF, WEO Database) China U.S.A. Nominal Real | Nominal Real…

A: Nominal GDP more is the total value of all goods and services that are produced inside its…

Q: Nominal GDP for the Bahamas for 2020 and 2021 Year 2020 2021 Nominal GDP for the Bahamas (B$ Mil)…

A: The real GDP is price-adjusted nominal GDP, it portrays the real economic growth in the economy.

Q: 1. Assume that the gross domestic product is $6,000, personal disposal income is $5,100, the…

A: Disclaimer- “Since you have asked multiple questions, we will solve the first three questions for…

Q: The following table contains data for country A for the year 2019. In Billions of Dollars $1,293…

A: Gross domestic product is the summation of a country's final goods and services. The increase in GDP…

Q: The graph to the right represents the situation of Marguerite's Caps, a firm selling caps in the…

A: A perfect market, also known as an atomistic market, is defined by several idealized conditions,…

Q: This exercise points to a clear policy dilemma. A fiscal contraction may have desirable long-run…

A: Contractionary fiscal policy is a type of economic policy that is used to slow down an economy that…

Q: Consider an AD-AS model with AD curve Y - Y* = −ay(n − ñ*) + €d π = π² + ß(Y - Y*) + €s with…

A: Aggregate supply refers to the cumulative quantity of a firm's production and selling, or the real…

Q: There are 1000 competitive firms of the size represented by AC1, and AC2 represents the only firm if…

A: A perfectly competitive firm produces at the intersection of MC and AC in the long run. A monopoly…

Q: Price 65 60 55 50 45 40 35 30 25 20 15 10 5 CUT 0 0 50 100 Type your answers in all of the blanks…

A: The demand curve is represented by curve D1 and the supply curve before tax is represented by curve…

Q: The normal life cycle pattern of income reflects differences in earnings based on: a. age and…

A: This can be defined as a concept that shows a given nominal amount refers to how many units of…

Q: "no shirking constraint" (NSC) curve never crosses the supply of labor curve, so: Question 15…

A: The equilibrium wage rates in a competitive labor market represent the marginal productivity of…

Q: You are considering a luxury apartment building project that requires an investment of $14,500,000.…

A: Divide the total profit by the total cost to find ROI, a profitability metric. Effective investment…

Q: An industry consists of three firms with sales of $225,000, $45,000, and $315,000. a. Calculate the…

A: The HHI is a statistic that's employed in some industries to evaluate market concentration. It is…

Q: Suppose that the reserve requirement for chequing deposits is 15 % and the banks do not hold any…

A: The Reserve Ratio refers to the percentage of deposits a bank must keep in the bank for liquidity…

Step by step

Solved in 3 steps with 5 images

- 6 The economic analysis of a project foresees annual investments equal to R$300,000,000.00, over three years of construction, followed by a very long period, which can be considered infinite, with an annual revenue of R$300,000,000.00 and annual operating costs (including taxes) of BRL 120,000,000.00. Obtain the net present value (NPV) of this project, in the year of the first investment, considering the minimum rate of attractiveness equal to 12% per year.Answer the given question with a proper explanation and step-by-step solution. 6. Raytheon Corp. is building a munitions facility that requires a $100 million up-front investment. The plant will generate after-tax profits of $50 million per year for 3 years, and will require a $40 million clean-up cost at the end of the fourth year. Calculate the Net Present Value (NPV) of the investment project assuming a 10% (annual) discount rate.A stock currently sells for 11 TL per share and pays 0.16 TL per year in dividends. What is an investor's valuation of this stock if she expects it to be selling for 14 TL in one year and requires a 10 % return on equity investments? a. 12,89% b. 12,73% c. 12,87% d. 10%

- Calculation question: Suppose the following data accurately estimates the costs and benefits you outlined in #1. Calculate NPV assuming a discount rate of 4%. Should ISU invest in this project? Year Costs Benefits 0 1000 400 1 200 500 2 200 500 3 200 500Horizon value question A project involved initial construction costs of $1.75 million. After 15 years, the useful life of that construction will be over and the facility will be demolished, involving sensitive environmental protections and cleanup. You estimate that 25% of the cost of the facility represents items that could be sold for scrap at 30% of their initial construction cost. You estimate the proper demolition cost of such a facility to be $0.9M. a. What is the NPV of the horizon value if the real discount rate is 0.035? b. If the expected annual rate of inflation is 0.02, what is the nominal horizon value in 15 years?A stock now trades for 11 TL per share and distributes 0.16 TL in dividends annually. What is the stock worth to an investor if she anticipates selling it for 14 TL in a year and demands a 10% return on equity investments? a. 12,89%b. 12,73%c. 12,87%d. 10%

- You have been asked by the chief financial officer of your company to estimate what thecompany’s share price will be at the end of four years from today. Your company has recentlypaid a dividend of $1.00 which is expected to grow at 5% p.a. over the foreseeable future. Ifthe company’s required rate of return on equity is 10% your price estimate at the end of year 4will be closest to: A. $20.00.B. $21.00.C. $24.30.D. $25.50.You've estimated the following cash flows (in $ million) for two mutually exclusive projects: Year Project A Project B 0 -27 -43 1 30 45 2 40 50 What is the crossover rate, i.e., the discount rate at which both projects have the same NPV? What is project A's NPV at the crossover rate? What is project B's NPV at the crossover rate?A firm is considering purchasing equipment to manufacture a new product. The equipment will cost $3M, and expected net cash inflowsare $0.35M indefinitely. If market demand for theproduct is low, then over the next five years thefirm will have the option of discarding the equipment on a secondary market for $2.2M. Assume thatMARR = 12%, s = 50%, and r = 6%. What isthe value of this investment opportunity for the firm?

- You purchased a stamping machine for $100,000 to produce a new line of products. The stamping machine will be used for five years, and the expected salvage value of the machine is 20% of the initial cost. The annual operating and maintenance costs amount to $30,000. If each part stamped generates $12 revenue, how many parts should be stamped each year just to break even? Assume that you require a 15% return on your investment.(a) 5,000(b)4,739(c) 4,488(d)2,238Suppose that the cost of an investment is €12000 and its return is €5000 per year for three years. At the end of the three years, the value of the equipment is zero. Calculate the net present value (NPV) if the discount rate is 5%. Give only a numerical answer with no symbols. Use a point (.) as a decimal separator and nothing as a thousand separator (e.g., 2325.37 and not 2.325, 37).Assuming monetary benefits of an information system at $85,000 per year, one-time costs of $75,000, recurring costs of $35,000 per year, a discount rate of 12 percent, and a 5-year time horizon, calculate the net present value (NPV) of the system’s costs and benefits. Also calculate the overall return on investment (ROI) of the project and then present a break-even analysis (BEA). At what point does break-even occur?