1. Discretionary fiscal policy is the direct result of deliberate actions by policy makers rather than an automatic adjustment. A. True B. False 2. Discretionary government spending is an automatic stabilizer. A. True B. False 3. Fiscal policy refers to the: A. changing the money supply to impact the economy. B. policies to positively impact the environment. C. policies design to achieve a balanced budget. D. manipulation of government spending and taxes to stabilize domestic output, employment, and the price level. E. manipulation of government spending and taxes to achieve greater equality in the distribution of income.

1. Discretionary fiscal policy is the direct result of deliberate actions by policy makers rather than an automatic adjustment. A. True B. False 2. Discretionary government spending is an automatic stabilizer. A. True B. False 3. Fiscal policy refers to the: A. changing the money supply to impact the economy. B. policies to positively impact the environment. C. policies design to achieve a balanced budget. D. manipulation of government spending and taxes to stabilize domestic output, employment, and the price level. E. manipulation of government spending and taxes to achieve greater equality in the distribution of income.

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter12: Fiscal Policy, Incentives, And Secondary Effects

Section: Chapter Questions

Problem 1CQ

Related questions

Question

100%

Please answer the following questions:

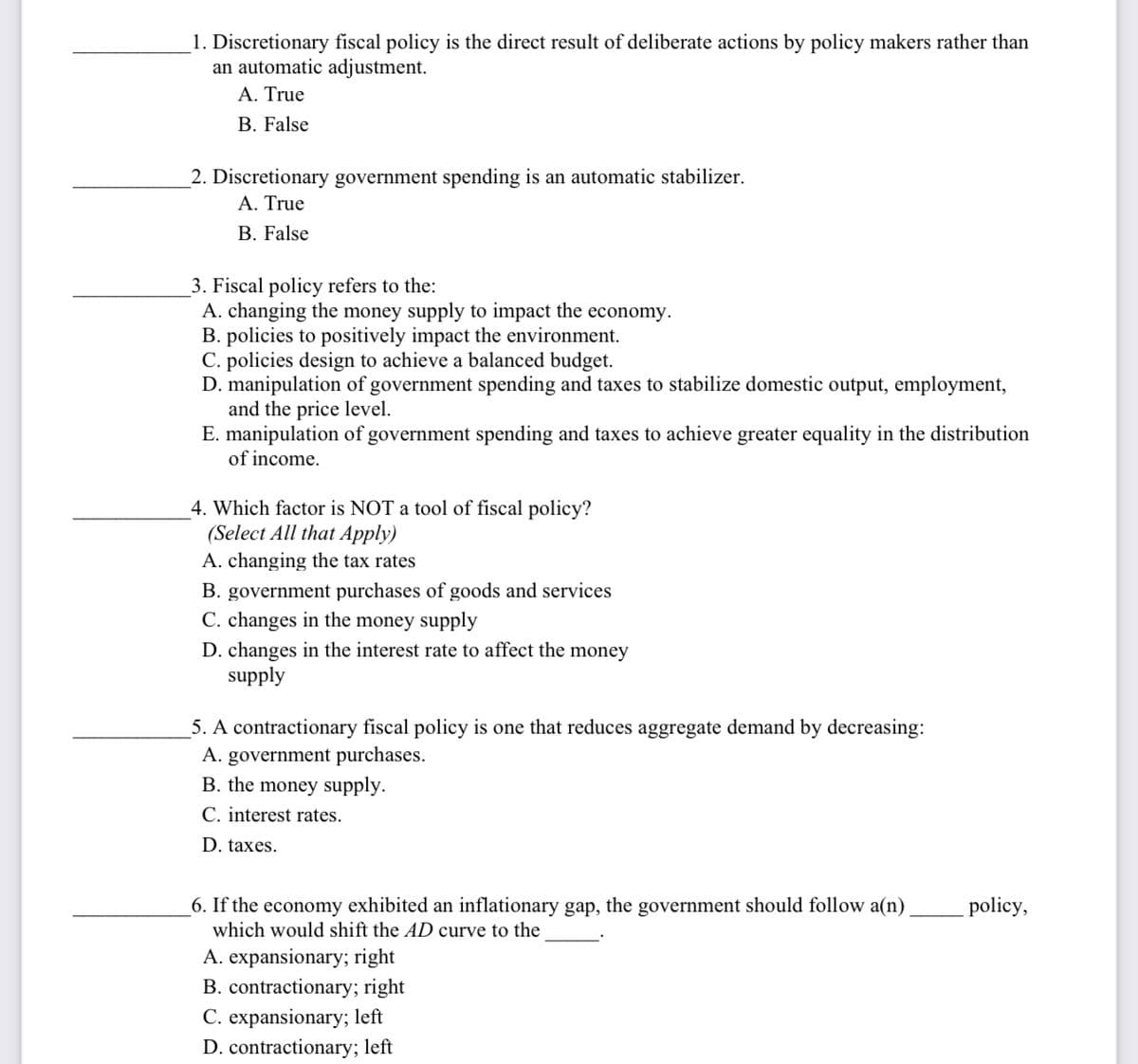

Transcribed Image Text:1. Discretionary fiscal policy is the direct result of deliberate actions by policy makers rather than

an automatic adjustment.

A. True

B. False

2. Discretionary government spending is an automatic stabilizer.

A. True

B. False

3. Fiscal policy refers to the:

A. changing the money supply to impact the economy.

B. policies to positively impact the environment.

C. policies design to achieve a balanced budget.

D. manipulation of government spending and taxes to stabilize domestic output, employment,

and the price level.

E. manipulation of government spending and taxes to achieve greater equality in the distribution

of income.

4. Which factor is NOT a tool of fiscal policy?

(Select All that Apply)

A. changing the tax rates

B. government purchases of goods and services

C. changes in the money supply

D. changes in the interest rate to affect the money

supply

5. A contractionary fiscal policy is one that reduces aggregate demand by decreasing:

A. government purchases.

B. the money supply.

C. interest rates.

D. taxes.

6. If the economy exhibited an inflationary gap, the government should follow a(n)

which would shift the AD curve to the

A. expansionary; right

B. contractionary; right

C. expansionary; left

D. contractionary; left

policy,

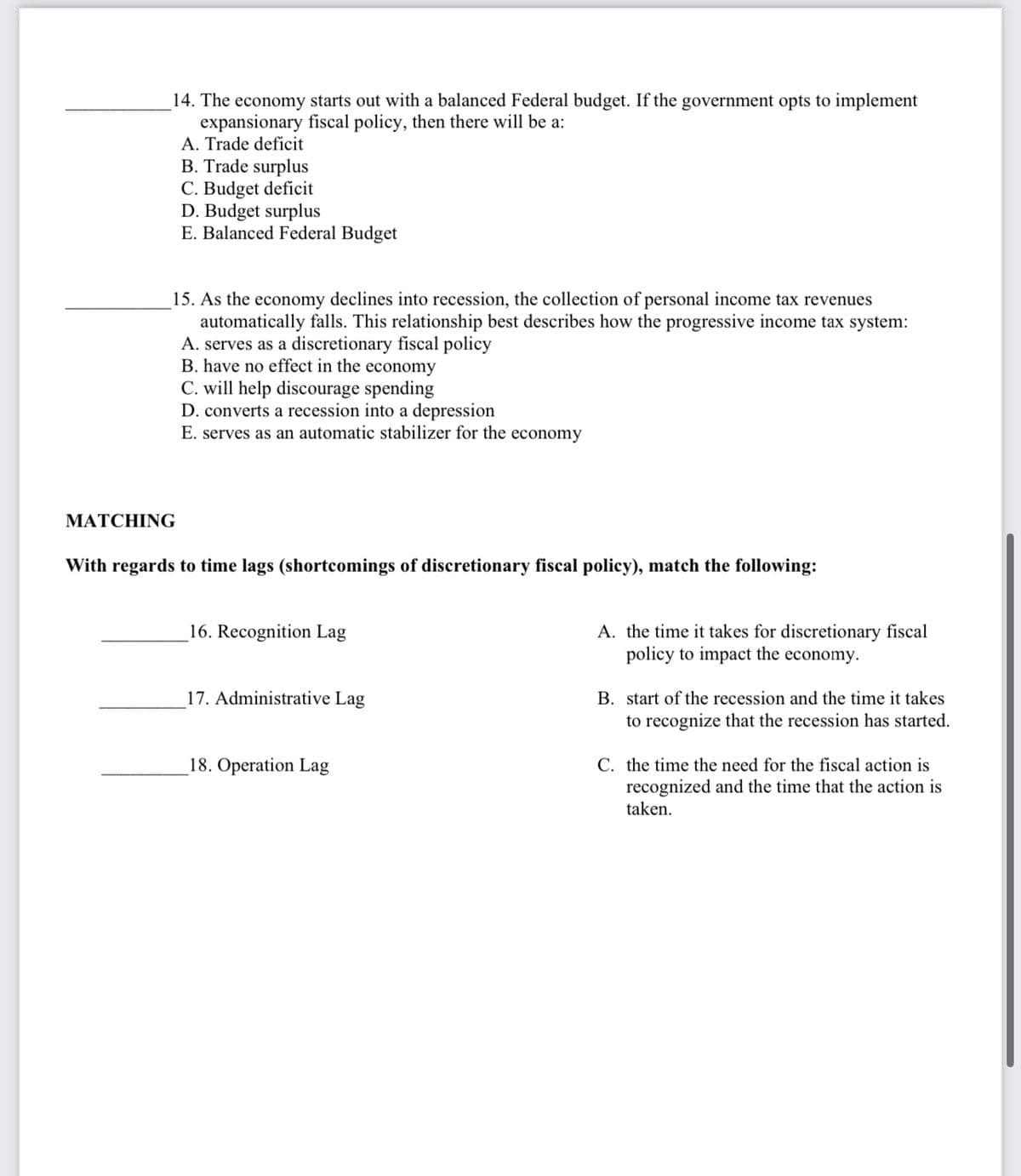

Transcribed Image Text:14. The economy starts out with a balanced Federal budget. If the government opts to implement

expansionary fiscal policy, then there will be a:

A. Trade deficit

B. Trade surplus

C. Budget deficit

D. Budget surplus

E. Balanced Federal Budget

15. As the economy declines into recession, the collection of personal income tax revenues

automatically falls. This relationship best describes how the progressive income tax system:

A. serves as a discretionary fiscal policy

B. have no effect in the economy

C. will help discourage spending

D. converts a recession into a depression

E. serves as an automatic stabilizer for the economy

MATCHING

With regards to time lags (shortcomings of discretionary fiscal policy), match the following:

16. Recognition Lag

17. Administrative Lag

18. Operation Lag

A. the time it takes for discretionary fiscal

policy to impact the economy.

B. start of the recession and the time it takes

to recognize that the recession has started.

C. the time the need for the fiscal action is

recognized and the time that the action is

taken.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning