1. Future and present values Suppose a wealthy university booster has pledged a superstar high-school sophomore tennis recruit $1,000 as a gift the day they give a verbal commitment to play tennis at the booster's alma mater. Assuming a constant interest rate of 9%, consider the present and future values of this gift, depending on when the recruit announces their commitment. Complete the first row of the following table by determining the value of the gift in one and two years with interest if you become engaged today and save the money. Date Received Today In 1 year In 2 years Present Value (Dollars) 1,000.00 Value in One Year (Dollars) Value in Two Years (Dollars) 1,000.00 1,000.00 Now complete the first column of the previous table by computing the present value of the gift if the recruit commits in one year or two years. if the recruit commits in one year than it is if you get engaged in two years. The present value of the gift is Grade It Now Save & Continue Continue without saving

1. Future and present values Suppose a wealthy university booster has pledged a superstar high-school sophomore tennis recruit $1,000 as a gift the day they give a verbal commitment to play tennis at the booster's alma mater. Assuming a constant interest rate of 9%, consider the present and future values of this gift, depending on when the recruit announces their commitment. Complete the first row of the following table by determining the value of the gift in one and two years with interest if you become engaged today and save the money. Date Received Today In 1 year In 2 years Present Value (Dollars) 1,000.00 Value in One Year (Dollars) Value in Two Years (Dollars) 1,000.00 1,000.00 Now complete the first column of the previous table by computing the present value of the gift if the recruit commits in one year or two years. if the recruit commits in one year than it is if you get engaged in two years. The present value of the gift is Grade It Now Save & Continue Continue without saving

Chapter16: Interest, Rent, And Profit

Section: Chapter Questions

Problem 1WNG

Question

Transcribed Image Text:1. Future and present values

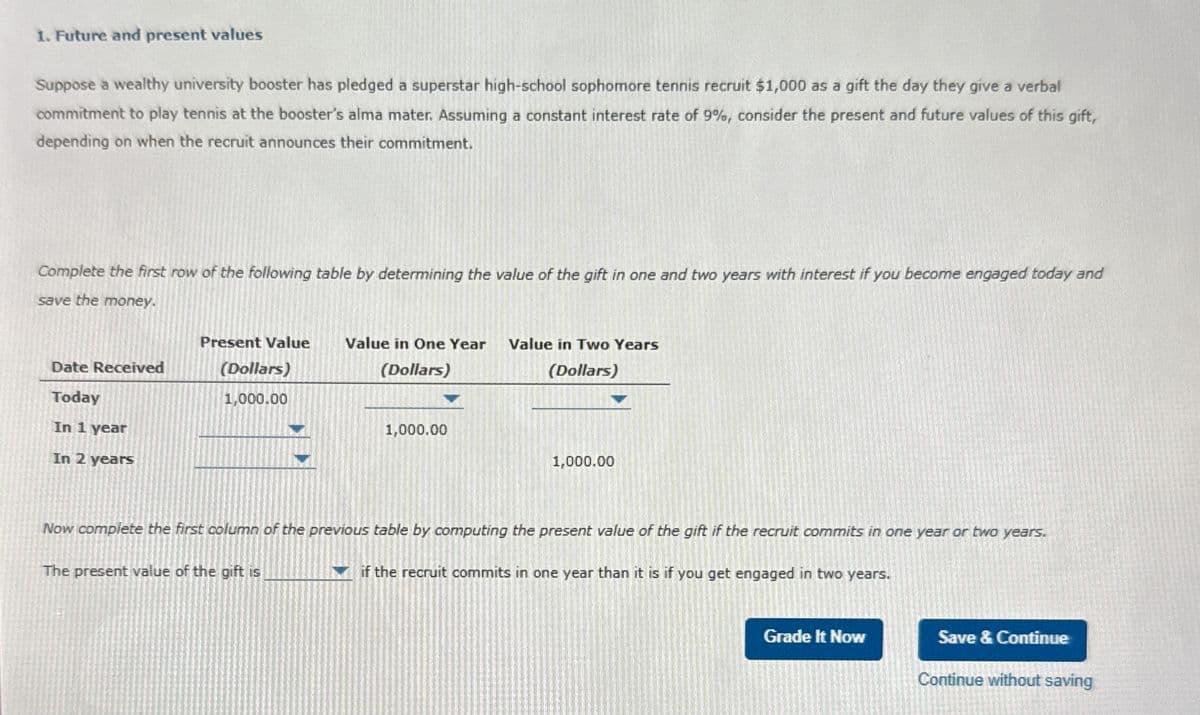

Suppose a wealthy university booster has pledged a superstar high-school sophomore tennis recruit $1,000 as a gift the day they give a verbal

commitment to play tennis at the booster's alma mater. Assuming a constant interest rate of 9%, consider the present and future values of this gift,

depending on when the recruit announces their commitment.

Complete the first row of the following table by determining the value of the gift in one and two years with interest if you become engaged today and

save the money.

Date Received

Today

In 1 year

In 2 years

Present Value

(Dollars)

1,000.00

Value in One Year

(Dollars)

Value in Two Years

(Dollars)

1,000.00

1,000.00

Now complete the first column of the previous table by computing the present value of the gift if the recruit commits in one year or two years.

if the recruit commits in one year than it is if you get engaged in two years.

The present value of the gift is

Grade It Now

Save & Continue

Continue without saving

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning