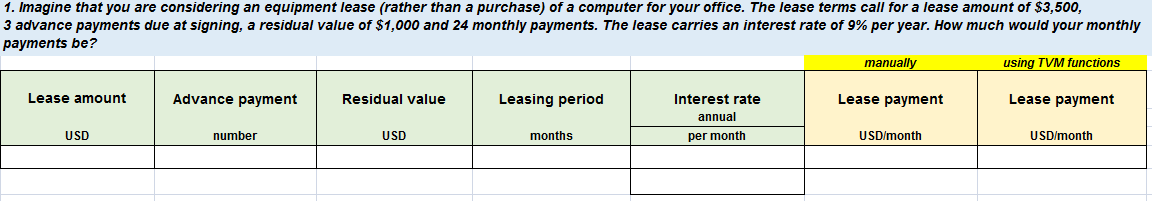

1. Imagine that you are considering an equipment lease (rather than a purchase) of a computer for your office. The lease terms call for a lease amount of $3,500, 3 advance payments due at signing, a residual value of $1,000 and 24 monthly payments. The lease carries an interest rate of 9% per year. How much would your monthly payments be? manually using TVM functions Lease amount Advance payment Residual value Leasing period Interest rate Lease payment Lease payment annual USD number USD months per month USD/month USD/month

1. Imagine that you are considering an equipment lease (rather than a purchase) of a computer for your office. The lease terms call for a lease amount of $3,500, 3 advance payments due at signing, a residual value of $1,000 and 24 monthly payments. The lease carries an interest rate of 9% per year. How much would your monthly payments be? manually using TVM functions Lease amount Advance payment Residual value Leasing period Interest rate Lease payment Lease payment annual USD number USD months per month USD/month USD/month

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 9E: Lessor Accounting with Guaranteed Residual Value Use the information for Edom Company in E20-8,...

Related questions

Question

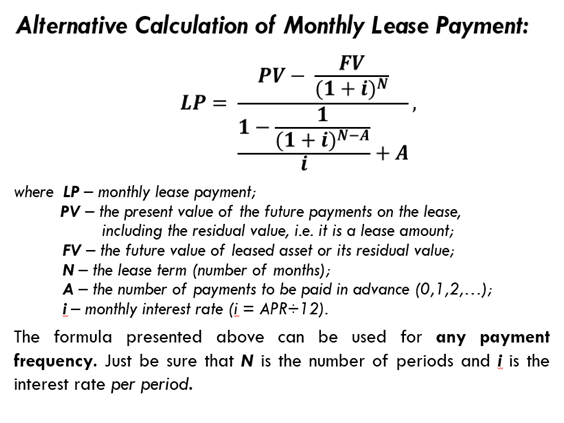

Transcribed Image Text:Alternative Calculation of Monthly Lease Payment:

FV

PV

(1+ i)N

1

LP =

1

(1+i)N-A

i

+ A

where LP – monthly lease payment;

PV – the present value of the future payments on the lease,

including the residual value, i.e. it is a lease amount;

FV – the future value of leased asset or its residual value;

N- the lease term (number of months);

A - the number of payments to be paid in advance (0,1,2,...);

i- monthly interest rate (i = APR÷12).

The formula presented above can be used for any payment

frequency. Just be sure that N is the number of periods and į is the

interest rate per period.

Transcribed Image Text:1. Imagine that you are considering an equipment lease (rather than a purchase) of a computer for your office. The lease terms call for a lease amount of $3,500,

3 advance payments due at signing, a residual value of $1,000 and 24 monthly payments. The lease carries an interest rate of 9% per year. How much would your monthly

payments be?

manually

using TVM functions

Lease amount

Advance payment

Residual value

Leasing period

Interest rate

Lease payment

Lease payment

annual

USD

number

USD

months

per month

USD/month

USD/month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning